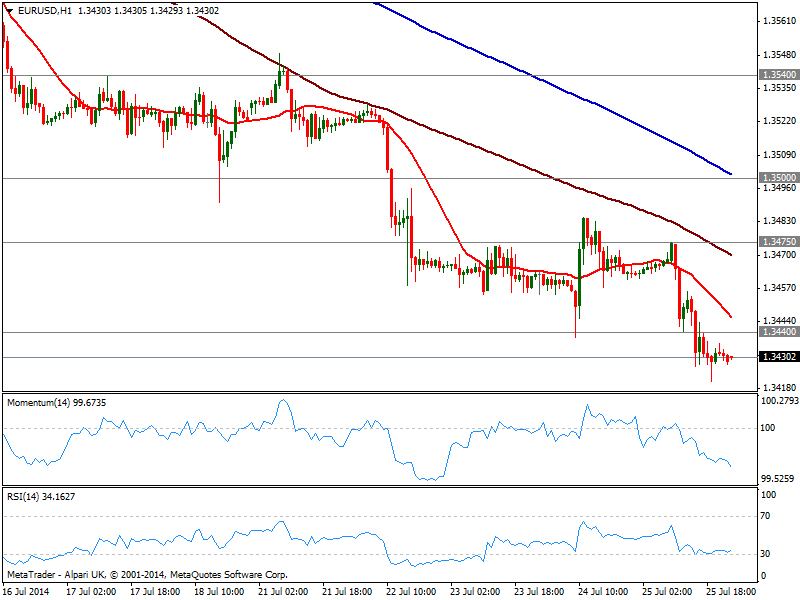

EUR/USD Current price: 1.3430

View Live Chart for the EUR/USD

The EUR/USD stands steady around the year low of 1.3320 reached last Friday, with a quiet calendar for the Asian session pointing for another dull Monday. The week however, will be fulfilled with US data, starting with GDP and FOMC meeting on Wednesday, and NFP figures on Friday, which may turn market even thinner ahead of the events.

Technically, the hourly chart maintains a clear bearish tone, with price developing below its moving averages, all heading lower, and momentum still heading south despite near oversold levels. In the 4 hours chart indicators seem slightly exhausted to the downside, suggesting a probable upward correction: above 1.3440, the pair mat extend up to 1.3475, yet gains beyond this last are not likely. A break below 1.3410 on the other hand, should only accelerate the slide.

Support levels: 1.3410 1.3380 1.3335

Resistance levels: 1.3440 1.3475 1.3500

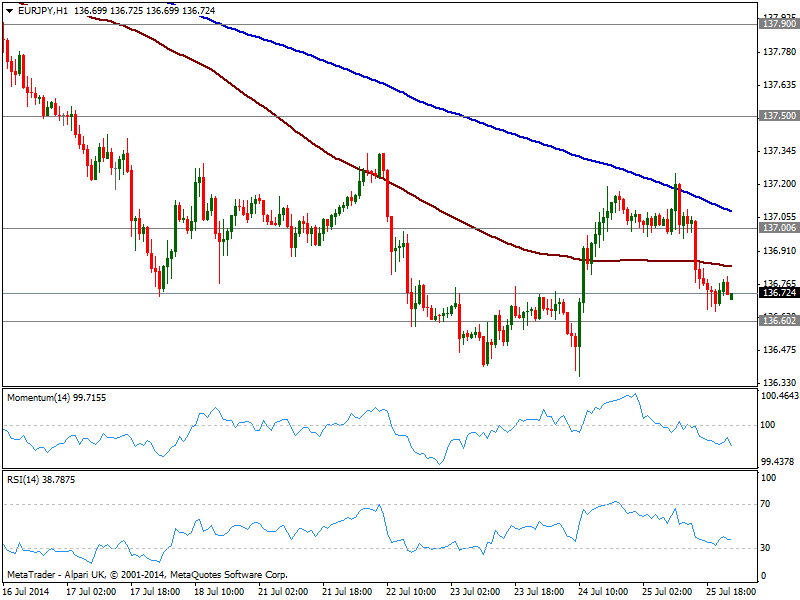

EUR/JPY Current price: 136.72

View Live Chart for the EUR/JPY

The EUR/JPY maintains a weak stance, according to the hourly chart that shows price was unable to advance beyond its 200 SMA and slipped below 100 one, as momentum continues heading south in negative territory. In the 4 hours chart technical readings are also bearish supportive, as per price well below its moving averages and indicators losing upward potential and turning flat in neutral territory. Renewed selling pressure below 136.60 should keep the risk to the downside, while only above 137.90 an interim bottom may be underway.

Support levels: 136.90 136.60 136.20

Resistance levels: 137.50 137.90 138.40

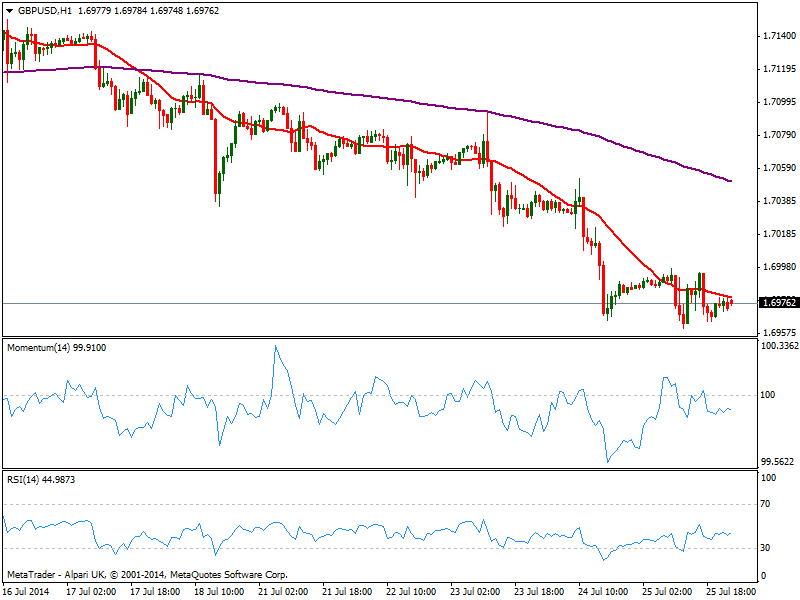

GBP/USD Current price: 1.6976

View Live Chart for the GBP/USD

Pound stands below the 1.7000 figure against the greenback, presenting a mild bearish tone in the short term, as the hourly chart shows price contained below a flat 20 SMA and indicators also directionless although in negative territory. In the 4 hours chart indicators aim higher from oversold levels, while 20 SMA maintains a strong bearish slope, currently around 1.7010 acting as dynamic resistance for the day: a recovery above the level should see GBP/USD extending its recovery up to 1.7050/60 price zone, while stops stand below 1.6950 and if triggered, may push the pair down to 1.6910/20 price zone.

Support levels: 1.6950 1.6920 1.6870

Resistance levels: 1.7010 1.7055 1.7095

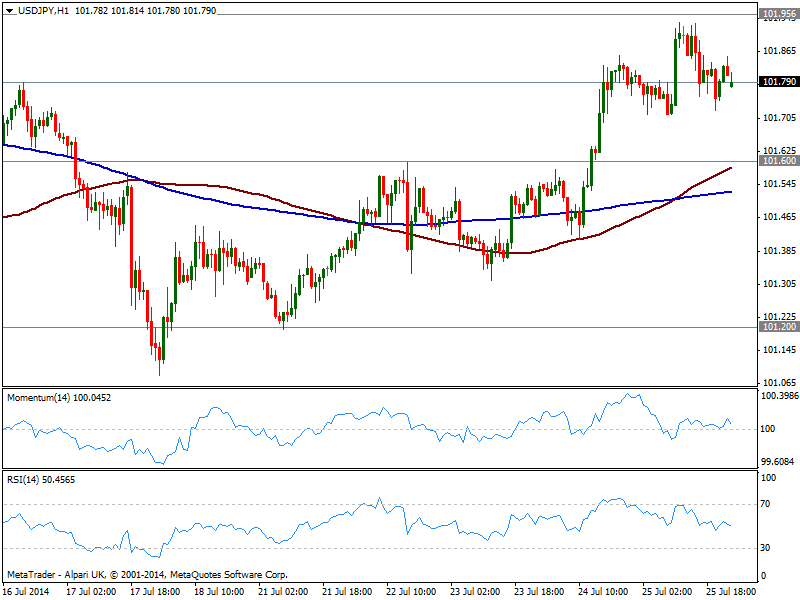

USD/JPY Current price: 101.79

View Live Chart for the USD/JPY

The USD/JPY saw some strength late last week, advancing up to 101.92 where 200 DMA halted the run. Nevertheless, the pair regained a mild positive tone firm above 101.60 and with the hourly chart showing 100 SMA crossing above 200 one both below current price and indicators mostly neutral right above their midlines. In the 4 hours chart however, the upward potential eases, with indicators turning lower from overbought levels, still well above their midlines.

Support levels: 101.60 101.20 101.05

Resistance levels: 101.95 102.35 102.80

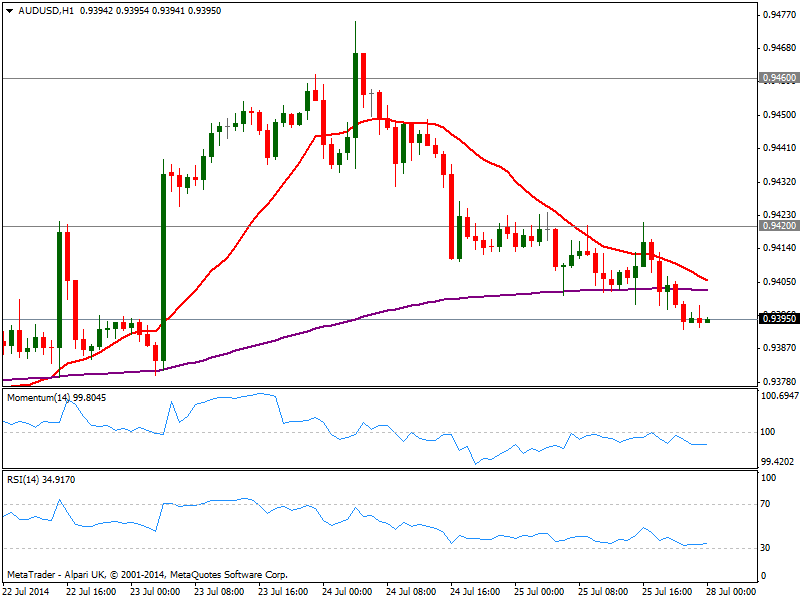

AUD/USD Current price: 0.9395

View Live Chart for the AUD/USD

Australian dollar finally gave up all of it latest gains against the greenback, consolidating now around the 0.9400 figure and looking short term bearish, with price below its 20 SMA in the hourly chart, and indicators below their midlines, albeit showing no actual strength at the time being. In the 4 hours chart the bearish tone coming from technical readings is stronger, eyeing now 0.9370 immediate support as a break below it exposes the pair to a test of critical 0.9330 price zone.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.