EUR/USD Current price: 1.3466

View Live Chart for the EUR/USD

The EUR/USD trades a couple pips above a fresh year low posted early US session, at 1.3458. The movement came after the release of US CPI, mostly in line with expectation except from core readings that grew less than expected: dollar lost some ground against most rivals after the news, albeit the EUR was unable to regain the 1.3500 level and remained under pressure.

The lack of follow through is quite notorious, but the bearish pressure undeniable: the hourly chart shows indicators turning flat in extreme oversold readings, far from suggesting an upward correction, while moving averages stand well above current price, with 20 SMA presenting a strong bearish slope and acting as dynamic resistance around 1.3500. In the 4 hours chart technical readings present a strong bearish momentum, with immediate support now at 1.3440: further declines below this last should lead to a continued slide towards the 1.3280/1.3300 area for the upcoming days.

Support levels: 1.3440 1.3410 1.3380

Resistance levels: 1.3500 1.3535 1.3570

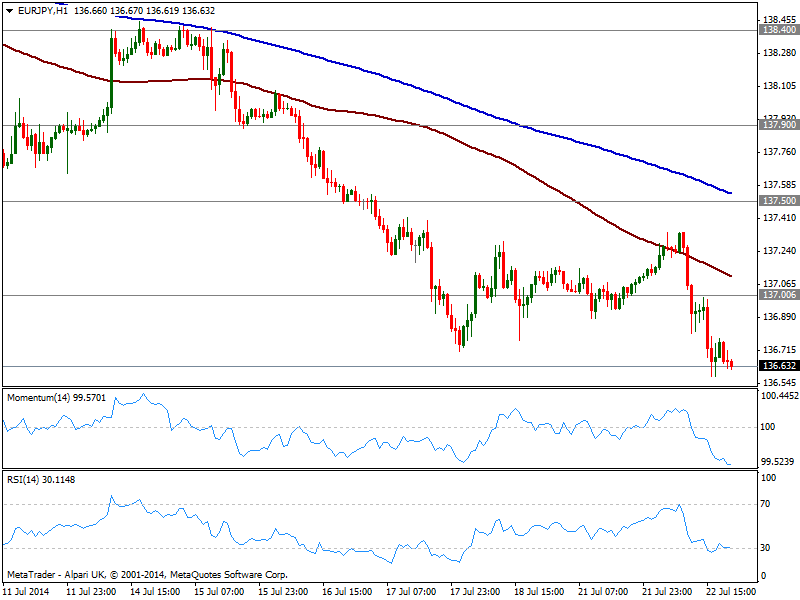

EUR/JPY Current price: 136.63

View Live Chart for the EUR/JPY

US stocks edged higher this Tuesday, with S&P reaching a new all time high before pulling back some on the back of healthy company earnings giving yen some intraday support: the EUR/JPY drifted lower, posting a daily low of 136.58 where it stands as a new day starts. The hourly chart shows price failed to overcome its 100 SMA on an early attempt of recovery, while indicators maintain a clear bearish momentum that supports the downside. In the 4 hours chart indicators head south below their midlines, also keeping the risk to the downside in the pair: further slides point to a probable test of 136.20 in the short term, in route to fresh year lows.

Support levels: 136.60 136.20 135.75

Resistance levels: 137.00 137.50 137.90

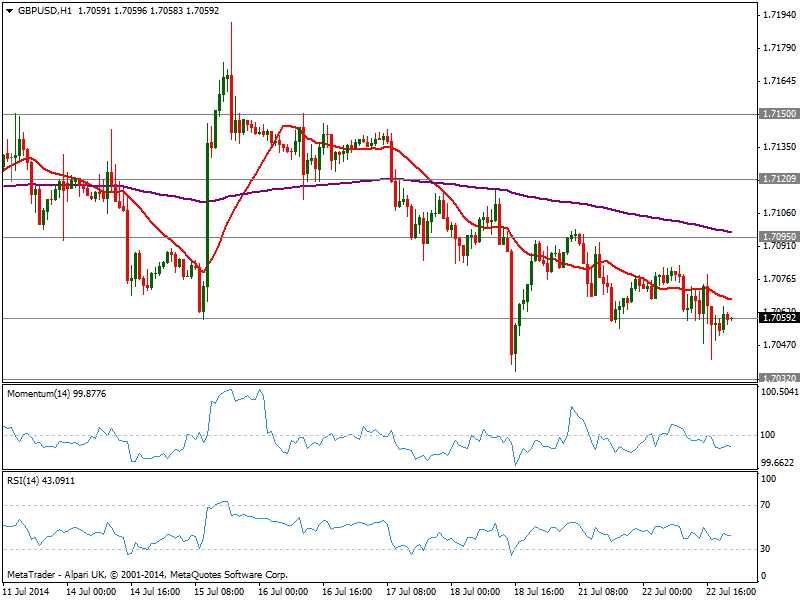

GBP/USD Current price: 1.7059

View Live Chart for the GBP/USD

The GBP/USD traded lower in range, contained ahead of Wednesday UK data including BOE Minutes and a Carney speech. Nevertheless, the pair has extended its weekly decline to a low of 1.7040, and spikes were short of 1.7100, while the hourly chart presents a bearish bias, all of which supports some upcoming declines. In the 4 hours chart technical indicators present a mild bearish tone, as per heading lower below their midlines, with 200 EMA and last week low around 1.7030 acting as critical support for the upcoming hours.

Support levels: 1.7030 1.6985 1.6950

Resistance levels: 1.7095 1.7120 1.7150

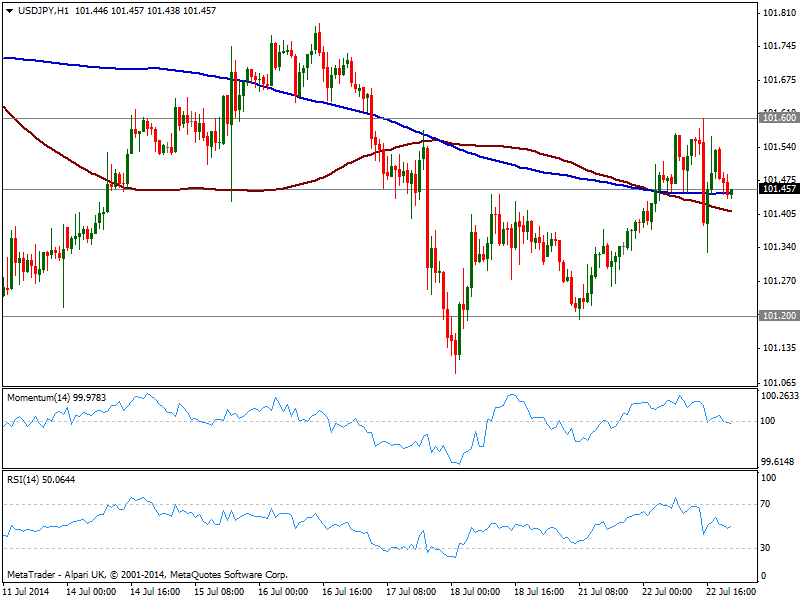

USD/JPY Current price: 101.46

View Live Chart for the USD/JPY

USD/JPY recovery stalled at critical 101.60 static resistance level, but the pair managed anyway to close the day with some mild gains. The hourly chart shows price right above its moving averages, but indicators turning lower around their midlines, still quite neutral. In the 4 hours chart price remained capped by its 100 SMA while indicators stand also in neutral territory, flat around their midlines.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.60 101.95 102.35

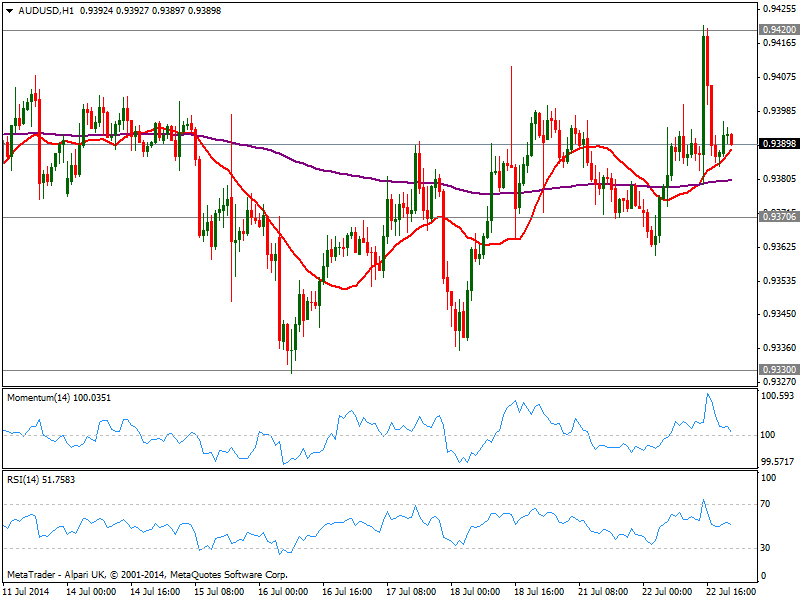

AUD/USD Current price: 0.9389

View Live Chart for the AUD/USD

The AUD/USD surged up to 0.9421 before selling interest pushed price back below the 0.9400 mark. Slightly higher, the pair trades still within range and far from establishing a clear direction. With Australian inflation readings ahead, the pair however may become more interesting in Asian hours, as CPI divergences should trigger some action either side of the board: below 0.9370, the pair may extend its decline down to 0.9330 critical midterm support, while above 0.9420, immediate target stands at 0.9460. Technically, the 1 hour chart shows price holding above a bullish 20 SMA as indicators erased all of its overbought conditions and stand right above their midlines, while the 4 hours chart shows a similar picture.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.