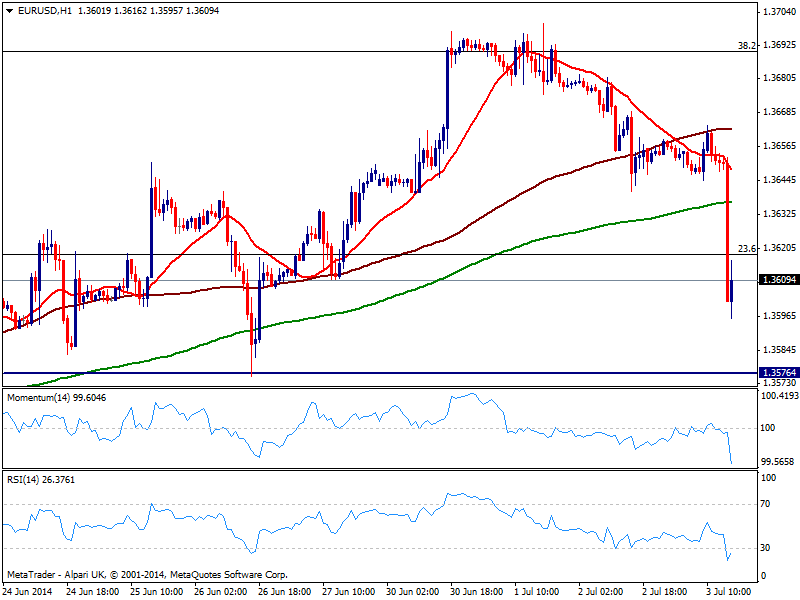

EUR/USD Current price: 1.3610

View Live Chart for the EUR/USD

The EUR/USD fell down to 1.3595 on the back of strong US employment figures and a mild dovish ECB that anyway brought nothing new. Dollar gathered some pace with the news, albeit the greenback strength is not enough as several majors had already reversed course. Technically, the hourly chart shows price capped now below the 23.6% retracement of the 1.40/1.35 daily fall, but recovering from the mentioned low. Indicators maintain a strong bearish tone both in 1 and 4 hours charts yet the downside seems limited to the strong support zone around 1.3570/80. A recovery above 1.3645 on the other hand, should see the pair extending its recovery back where it started.

Support levels: 1.3600 1.3570 1.3530

Resistance levels: 1.3645 1.3675 1.3700

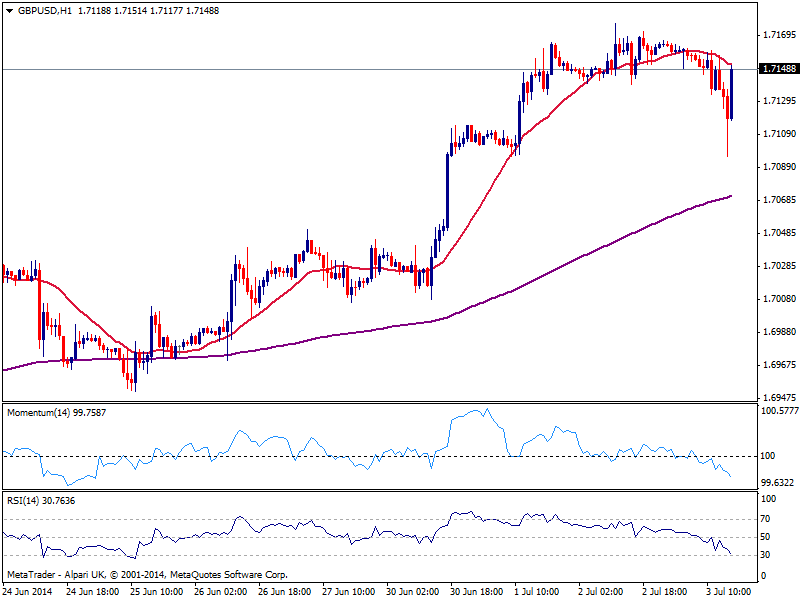

GBP/USD Current price: 1.7148

View Live Chart for the GBP/USD

After a kneejerk to 1.7095, the GBP/USD recovered the ground lost with the news and even extended near the daily high of 1.7166 immediate resistance. The hourly chart shows indicators heading lower below their midlines, still not reflecting the latest recovery, while 20 SMA caps the upside. In the 4 hours chart indicators continue heading lower from overbought readings, but hold above their midlines, as price recovers above its 20 SMA. Pound self strength is even more clear now, and fresh high should not be discarded.

Support levels: 1.7130 1.7095 1.7060

Resistance levels: 1.7180 1.7220 1.7250

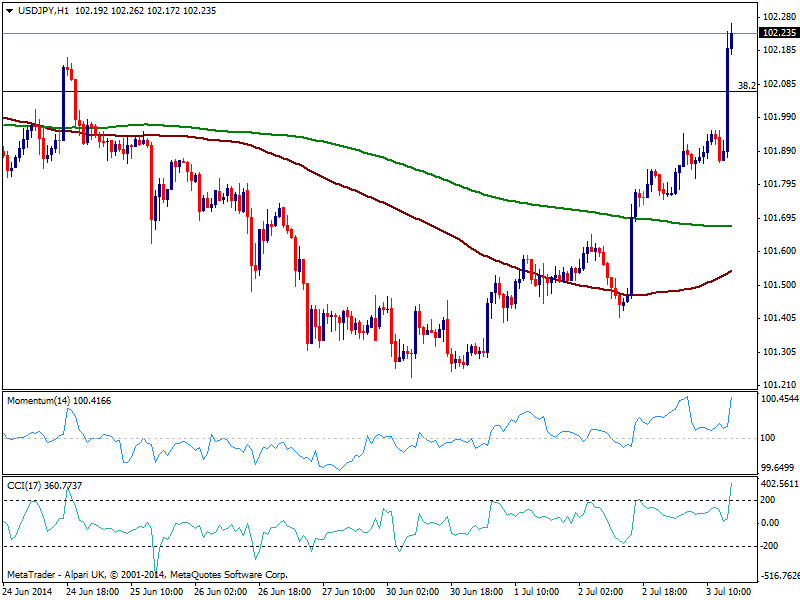

USD/JPY Current price: 102.24

View Live Chart for the USD/JPY

The USD/JPY advances beyond the 102.00 mark as strong employment figures combine with US indexes soaring to record highs: DJIA stands above 17,000 first time ever. Technically, the bullish momentum remains strong in the short term, while price stands above its 100 DMA around 102.20, first time in over 2 weeks. If the level holds, there’s scope for a continuation up to 102.80, where the pair will have to face a descendant trend line and a congestion zone of intraday highs.

Support levels: 102.20 101.90 101.60

Resistance levels: 102.35 102.80 103.10

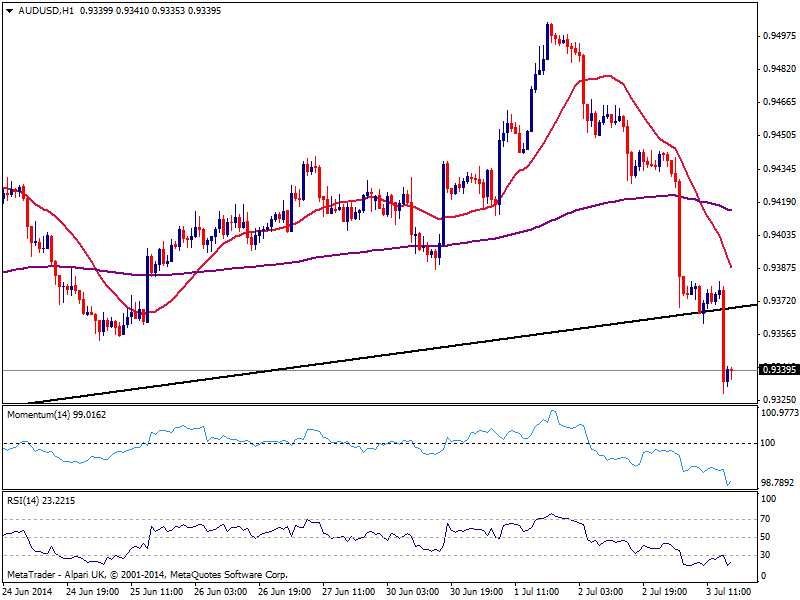

AUD/USD Current price: 0.9339

View Live Chart for the AUD/USD

Australian dollar has a really bad day after RBA Governor Stevens down talked the currency early Asia, with the AUD/USD also hit by US employment figures. The pair tests 0.9330 support area, maintaining a strong bearish tone despite indicators in oversold territory in the hourly chart. The level however has proved strong in the past, so a price acceleration below it is required to confirm further falls ahead. In the meantime, immediate resistance stands at 0.9370 and risk will remain to the downside as long as below it.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9360 0.9420 0.9460

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.