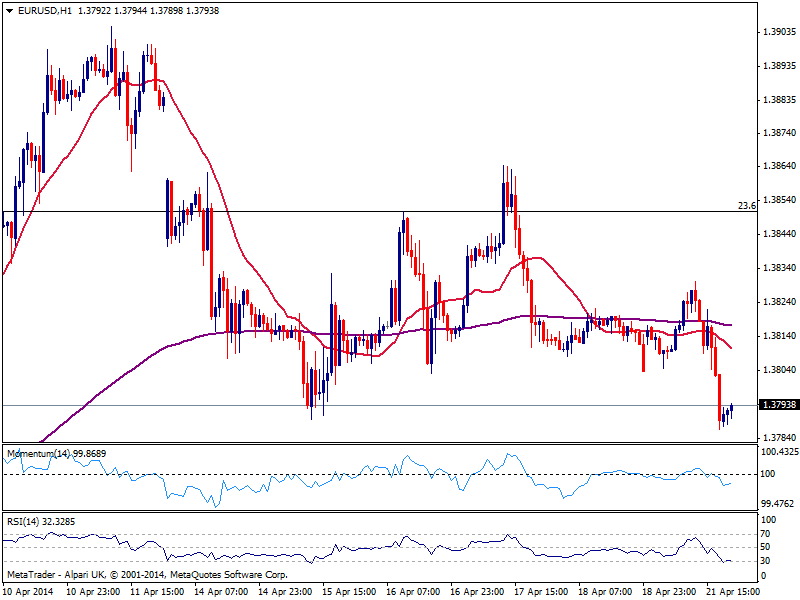

EUR/USD Current price: 1.3798

View Live Chart for the EUR/USD

The EUR/USD edged lower in the US session, falling down to 1.3788 and holding steady a few pips above as thin trade extended all over Monday. Ahead of Asian opening, the EUR/USD hourly chart shows a mild bearish tone, with price below its moving averages and indicators heading lower in negative territory, albeit holding above key 1.3780 support, showing little aims to extend its slide. In the 4 hours chart technical readings also present a mild bearish tone, with price hovering around its 200 EMA that offers dynamic support now at current levels.

With a light calendar for upcoming session, market attention will likely focus on corporate earnings reports later this week. In the meantime, stocks are slightly up, with escalating tensions around Russia and Ukraine still being ignored by market players. For the EUR/USD, a break below mentioned 1.3780 support area should see some stops getting triggered, and therefore a downward extension down to 1.3730 price zone. Steady gains above 1.3825 on the other hand, should see the pair accelerating higher towards 1.3860 in the short term.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

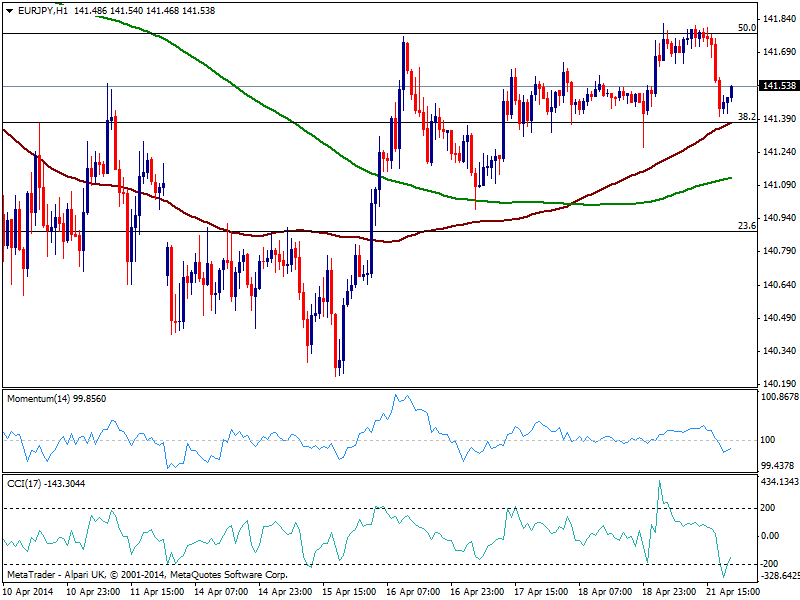

EUR/JPY Current price: 141.54

View Live Chart for the EUR/JPY

The EUR/JPY lost some ground amid EUR weakness, maintaining nevertheless the range: the hourly chart shows recovering after approaching 141.35, where the 38.2% retracement of the latest bearish run converges with 100 SMA. To the upside the pair is capped by the 50% retracement of the same rally around 141.80, while the 4 hours chart presents a neutral stance with no clear direction coming out.

Support levels: 141.35 140.90 140.40

Resistance levels: 141.80 142.20 142.60

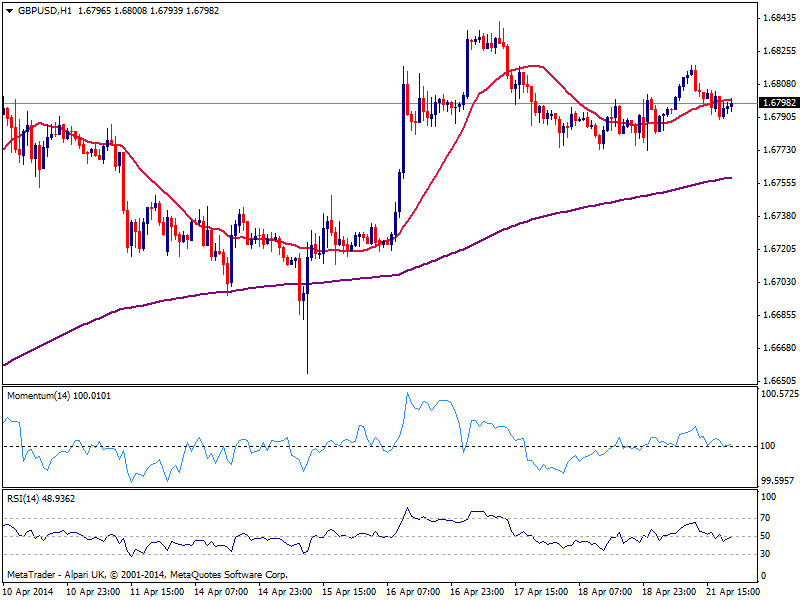

GBP/USD Current price: 1.6798

View Live Chart for the GBP/USD

The GBP/USD trades mostly unchanged having however posted a high of 1.6818 early Europe. The hourly chart shows indicators flat around their midlines, while price hovers around an also flat 20 SMA, maintaining a strong neutral stance. In the 4 hours chart indicators present a mild bearish tone as per heading lower in negative territory, and current candle developing below its 20 SMA. However, further technical confirmation is required to call for an intraday bearish run, with a break below 1.6770 favoring a deeper correction down to 1.6745.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

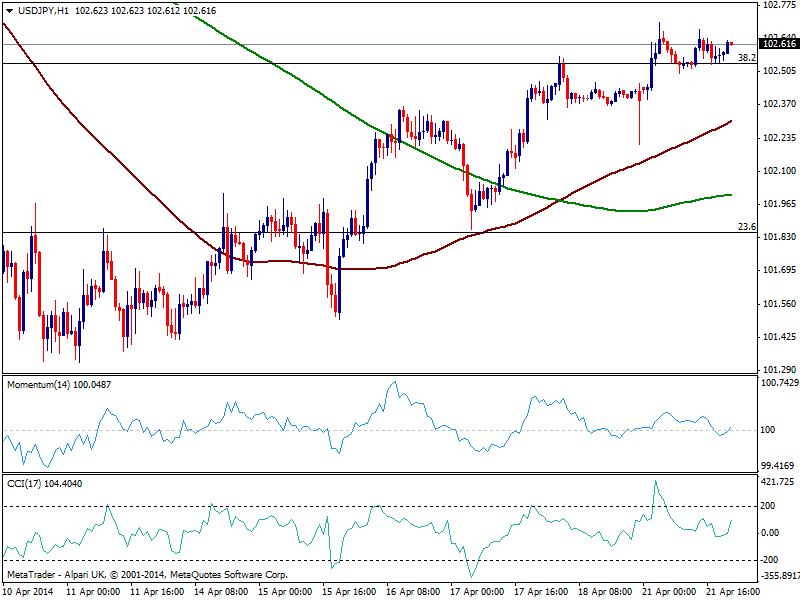

USD/JPY Current price: 102.61

View Live Chart for the USD/JPY

The USD/JPY continues to consolidate around the 102.60 level, also lacking direction in the short term amid low volumes. The pair however, may extend its gains over upcoming hours looking for a possible test of the 102.90/103.00 area.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.95 103.20 103.70

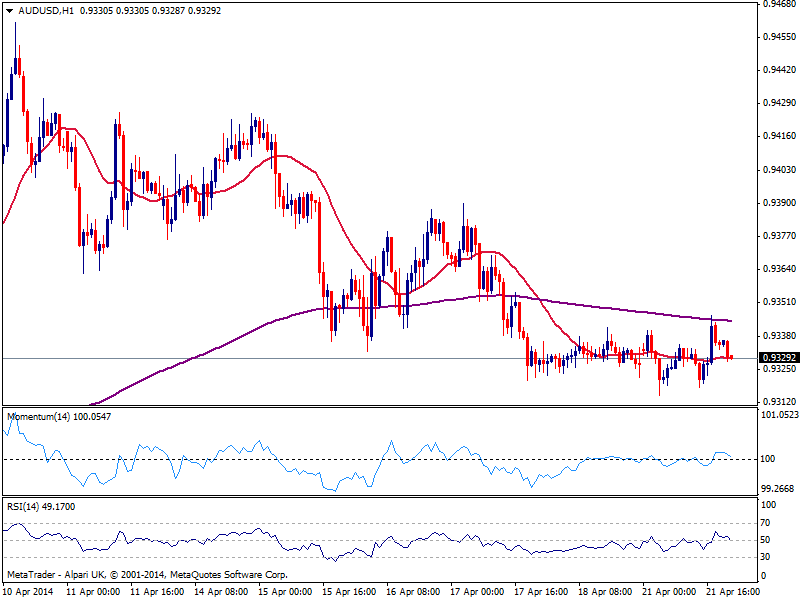

AUD/USD Current price: 0.9329

View Live Chart for the AUD/USD

Australian dollar saw a spark of demand early US opening, advancing 20 pips altogether against the greenback. But hopes for some action were quickly diluted as the pair slowly retraced back towards daily opening levels, still looking pretty neutral in the short term, with an increasing bearish potential in bigger time frames.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9355 0.9390 0.9445

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.