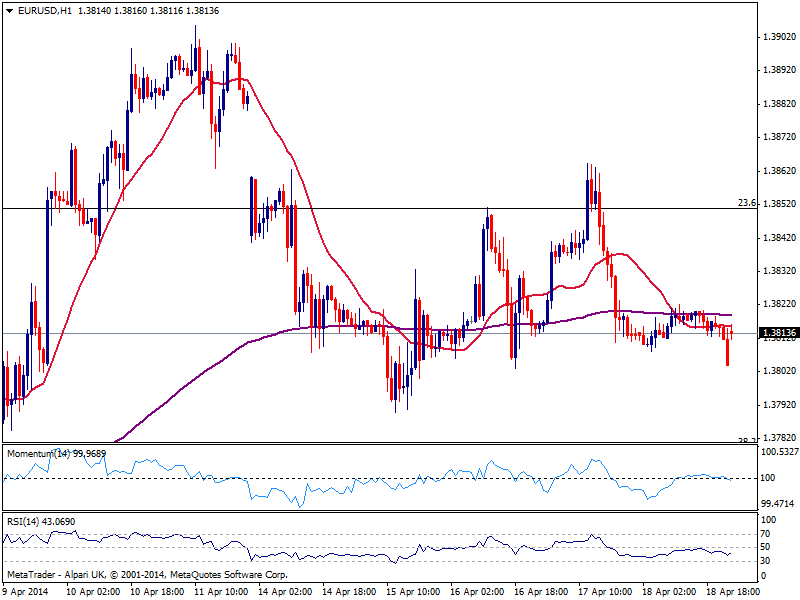

EUR/USD Current price: 1.3813

View Live Chart for the EUR/USD

With Australia and New Zealand closed for Easter Monday, market will actually kick start later today, with Japan; European stocks will also be off with the US finally opening. Overall, there had not been much forex related news over the weekend besides continued tension in the Ukraine/Russia conflict. So far, the situation has not been enough to trigger a run to safety albeit the risk of such is pretty high, and should not be disregarded.

As for the EUR/USD the pair closed Friday right above the 1.3800 level, gapping slightly higher with this new weekly opening. The technical short term picture is quite neutral after the holidays, and will likely remain so over the upcoming hours; immediate support comes at 1.3780 strong Fibonacci level, while 1.3825 caps the upside in the short term. A break of either extreme will probably favor some short term continuation in the set direction, although thin Monday should not see any critical breakout across the board.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

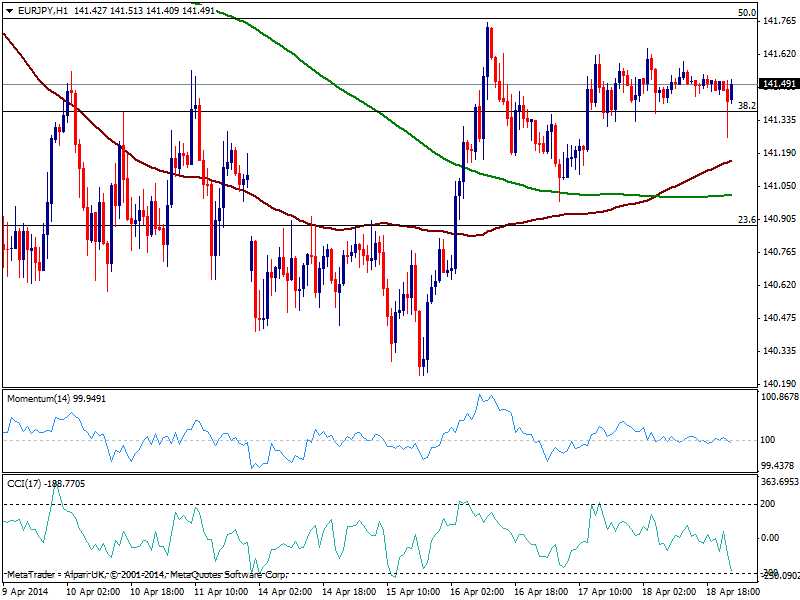

EUR/JPY Current price: 141.49

View Live Chart for the EUR/JPY

Yen weakness from early past week left the EUR/JPY consolidating above the 141.00 figure, having found sellers around the 50% retracement of its latest bearish run at 141.75, and buyers around the 38.2% of the same rally at 141.36 immediate short term support. The hourly chart shows price above 100 and 200 SMAs and indicators flat around their midlines, reflecting recent consolidative stage. In the 4 hours chart indicators lost the upward potential and stand near their midlines, still far from suggesting a bearish run. Japanese Trade Balance to be released today may bring some action to yen crosses, with the pair probably following Nikkei over current session.

Support levels: 141.35 140.90 140.40

Resistance levels: 141.70 142.20 142.60

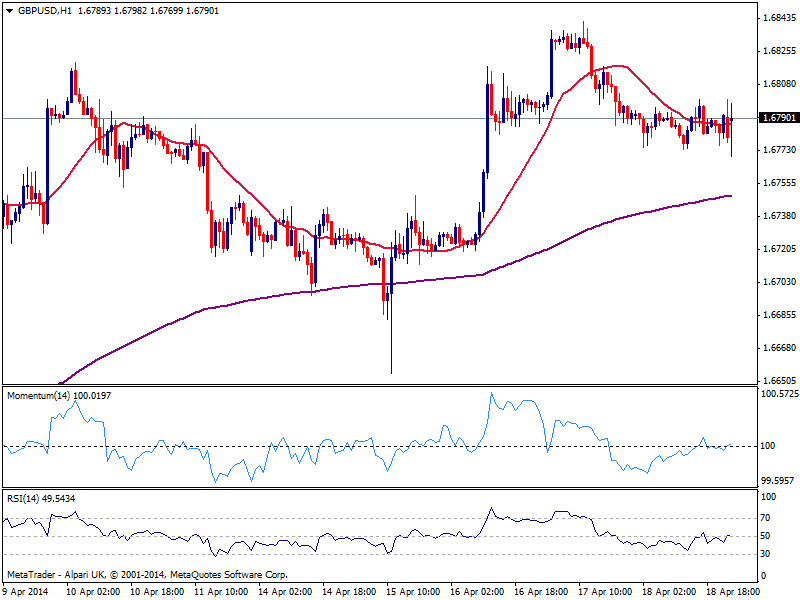

GBP/USD Current price: 1.6790

View Live Chart for the GBP/USD

The GBP/USD downward corrective movement after posting a fresh year high of 1.6841, held so far above the 1.6770 level, immediate short term support. As a new day starts, extremely modest by the way, the pair advances some approaching the 1.6800 figure and with a slightly bullish short term tone comes from the hourly chart, as price stands above its 20 SMA and momentum aims higher in neutral territory. In the 4 hour chart price stands also above a strongly bullish 20 SMA, while indicators are flat around their midlines. Despite the lack of action, the bullish trend remains well in place with buyers probably defending 1.6745 price zone, in case of short term slides.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

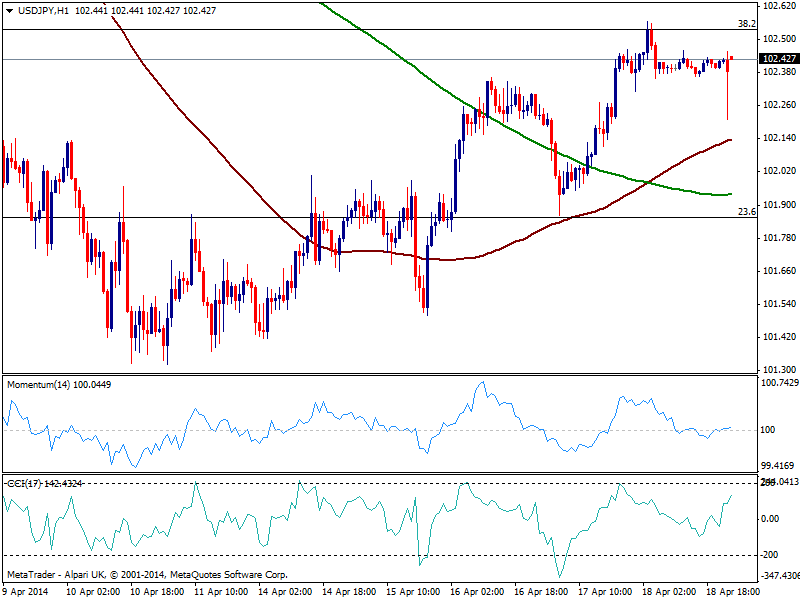

USD/JPY Current price: 102.42

View Live Chart for the USD/JPY

The USD/JPY continues to trade below the 102.60 static resistance area, with a mild positive tone according to the hourly chart that shows price above its moving averages and CCI heading north in positive territory. The latest recovery of the pair has been pretty much contained, with not much buyers around despite stocks strong recovery over the last few days. Above mentioned resistance the pair may extend towards 103.00 area yet further gains seem limited for now.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.60 102.95 103.20

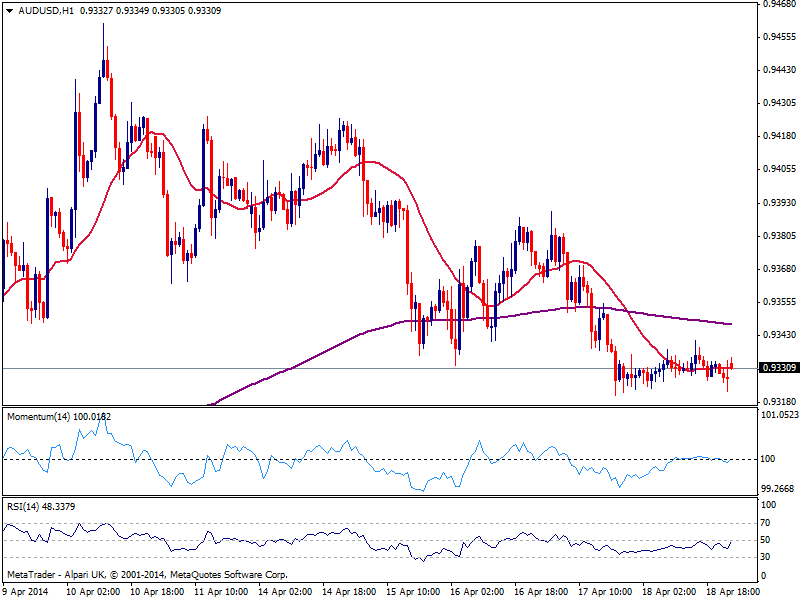

AUD/USD Current price: 0.9331

View Live Chart for the AUD/USD

Consolidating near its recent lows, AUD/USD has found it hard to maintain the bullish tone after flirting with 0.9460 earlier this month, short term neutral but still mild bearish in term. A break below 0.9320 should lead to a downward extension towards key .09260 strong midterm support. So far, stocks upward momentum has prevented the pair from falling big, but has not been enough to favor a recovery. If stocks turn red over the upcoming days, the pair can become more clearly bearish with a break below mentioned 0.9260 favoring a test of the 0.9000 figure.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9355 0.9390 0.9445

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.