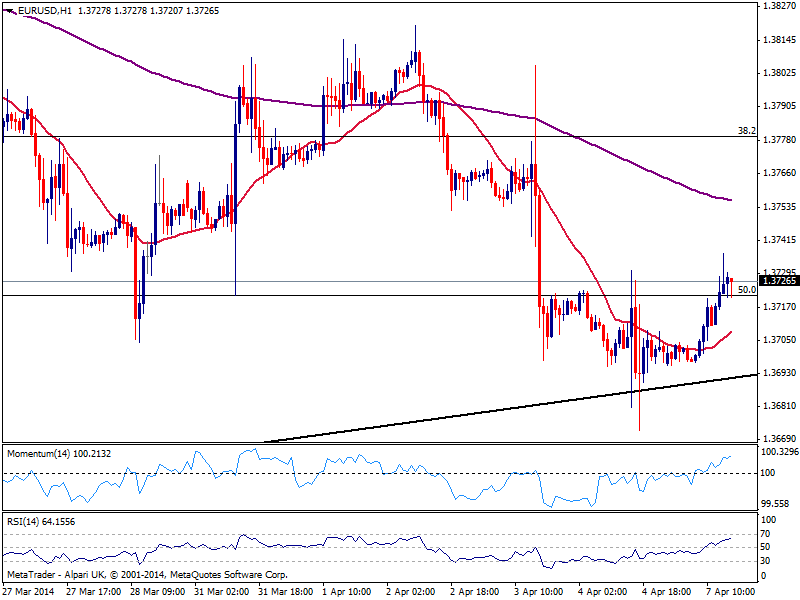

EUR/USD Current price: 1.3726

View Live Chart for the EUR/USD

The EUR/USD extended up to 1.3737 in the European session, but again had trouble to extend its gains beyond current 1.3720/30 area. Ahead of US opening, the hourly chart shows a slightly bullish tone, with indicators heading higher above their midlines and price above its 20 SMA, albeit the market lacks momentum to push the pair higher. In the 4 hours chart indicators head higher from oversold readings yet still in negative territory, while 20 SMA caps the upside around mentioned daily high. Steady gains above the level may favor an upward continuation towards the 1.3750/80 area, although more gains are not yet seen.

Support levels: 1.3680 1.3650 1.3610

Resistance levels: 1.3750 1.3780 1.3820

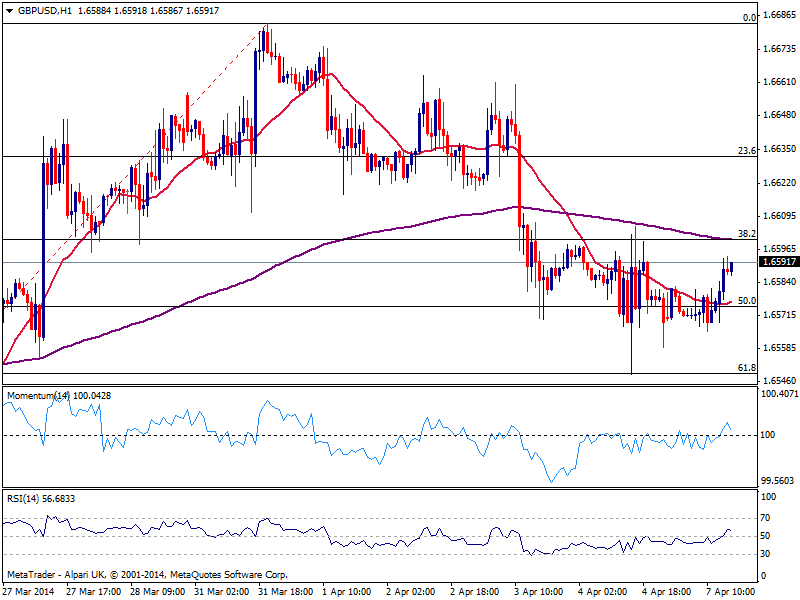

GBP/USD Current price: 1.6591

View Live Chart for the GBP/USD

The GBP/USD grinds higher, approaching the 1.6600 figure ahead of US opening also presenting a slightly positive short term tone according to the hourly chart: indicators stand above their midlines and price moves away from its 20 SMA now offering support around 1.6575. In the 4 hours chart however, technical readings show the upside remains limited as per moving averages heading lower above current price and indicators holding in negative territory. Steady gains above 1.6610 may suggest further upward extensions, yet failure to regain mentioned 1.6600 level should bring the pressure back to the downside.

Support levels: 1.6550 1.6510 1.6470

Resistance levels: 1.6580 1.6610 1.6650

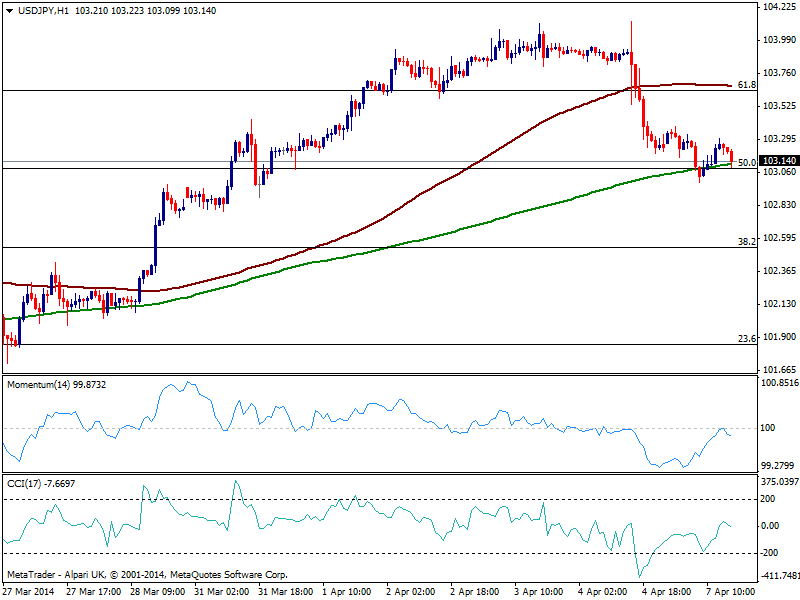

USD/JPY Current price: 103.13

View Live Chart for the USD/JPY

The USD/JPY turns negative dragged lower by falling stocks all over the world. The hourly chart shows price finding short term support at its 200 SMA around current level, which converges with the 50% retracement of the latest daily fall. Indicators in the mentioned time frame retrace from their midlines, while 100 SMA offers intraday resistance around 103.60 in case of recoveries. In bigger time frames momentum maintains a strong bearish tone, supporting rather a downward breakout than a recovery for today.

Support levels: 103.00 102.60 102.20

Resistance levels: 103.30 103.60 104.10

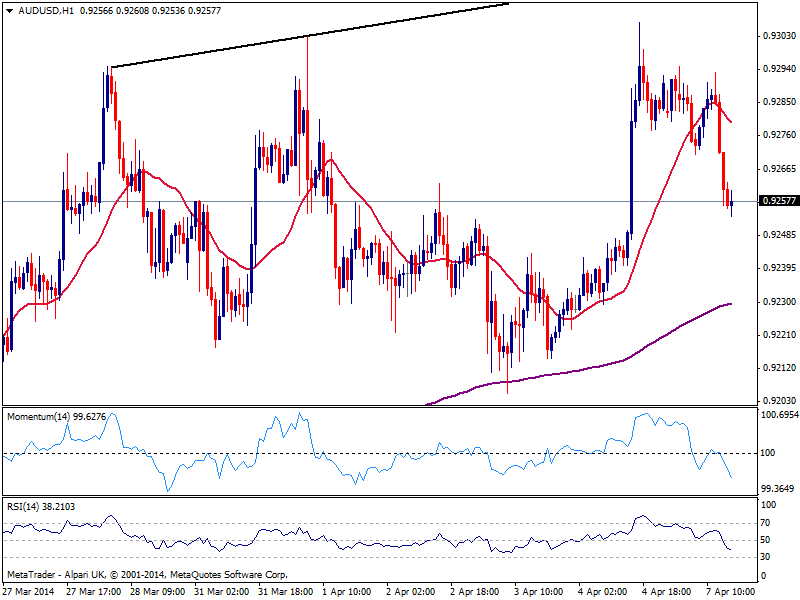

AUD/USD Current price: 0.9257

View Live Chart for the AUD/USD

The AUD/USD extends its decline after faltering again around the 0.9300 figure, trading with a strong bearish momentum according to the hourly chart, and pointing for a retest of the base of its latest range around 0.9215. In the 4 hours chart price stands right above its 20 SMA while indicators turn south still above their midlines, suggesting the movement may not have the strength enough to break lower. Overall the bullish trend prevails in the longer term, and seems attempting a buy on approaches to mentioned support may be the way to play the pair.

Support levels: 0.9215 0.9170 0.9130

Resistance levels: 0.9300 0.9345 0.9390

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.