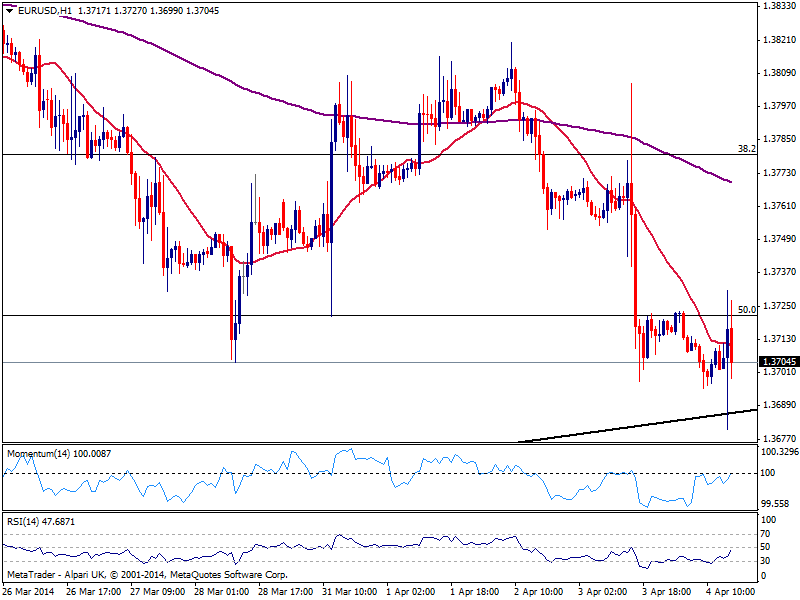

EUR/USD Current price: 1.3705

View Live Chart for the EUR/USD

US Payrolls printed a nice 192K a bit below expected, while unemployment rate stood steady at 6.7% in March, also below expectations. Market was for the most waiting for a stronger number to help greenback extend the initial boost gave by Draghi yesterday, and did not get it: the initial reaction saw the greenback ease against most rivals, with the EUR/USD bouncing from a major long term support, a daily ascendant trend line coming from 1.2755, past July 2013 monthly low. But the bounce is still shallow, with the pair up to 1.3730 so far, unable to open current candle above the 1.3720 immediate Fibonacci resistance.

The star of the day is being the Canadian dollar as local employment figures overcame expectations, leading to a massive sell off in USD/CAD holding now below the 1.1000 key psychological level. For the most, commodity currencies present a strong upward potential, while European ones held above mayor supports, but remain unable to gain upward momentum.

The hourly chart presents a slightly positive tone coming from technical readings, albeit not yet sustainable due to the fact the pair faltered around mentioned resistance. To the downside, a Fibonacci level at 1.3660 along with the trend line at 1.3680 provide strong support and seems hard a break below them for today, as buyers will likely surge on approaches to it. Nevertheless, the upside is also limited, pointing for a maybe slow end of the week.

Support levels: 1.3670 1.3640 1.3610

Resistance levels: 1.3725 1.3750 1.3780

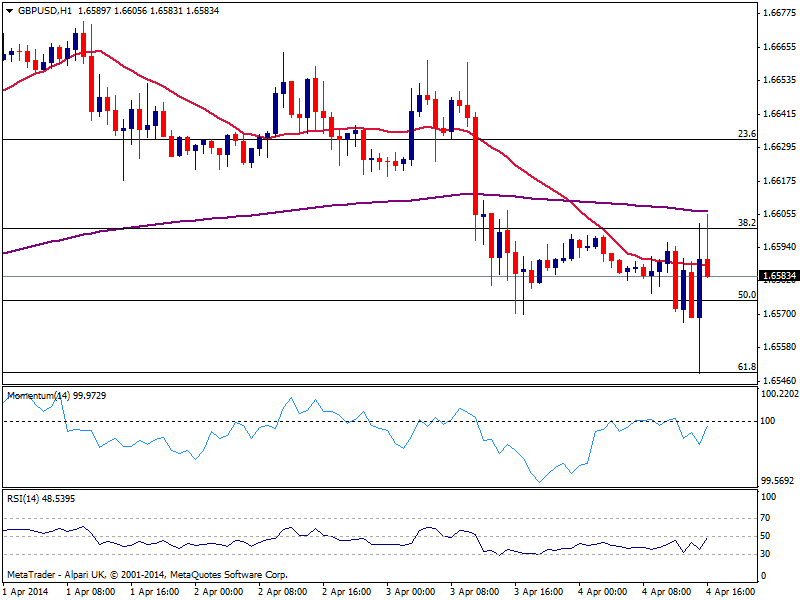

GBP/USD Current price: 1.6586

View Live Chart for the GBP/USD

The GBP/USD also regained the upside after testing a key technical support, the 61.8% retracement of the latest bullish run around 1.6550. The upside however, is being limited by the 1.6600 figure, where the pair presents the 38.2% retracement of the same rally, leaving the pair still directionless. Technically, indicators head slightly higher in negative territory and price hovers around a flat 20 SMA in the hourly chart, while the 4 hours one shows the mild bearish tone of the week prevails. Nevertheless, movements need to unfold from here to be able to set a more directional move for the upcoming week, with a break below 1.6550 mentioned support suggesting a downward midterm continuation again towards 1.6250 midterm support.

Support levels: 1.6550 1.6510 1.6470

Resistance levels: 1.6600 1.6645 1.6690

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.