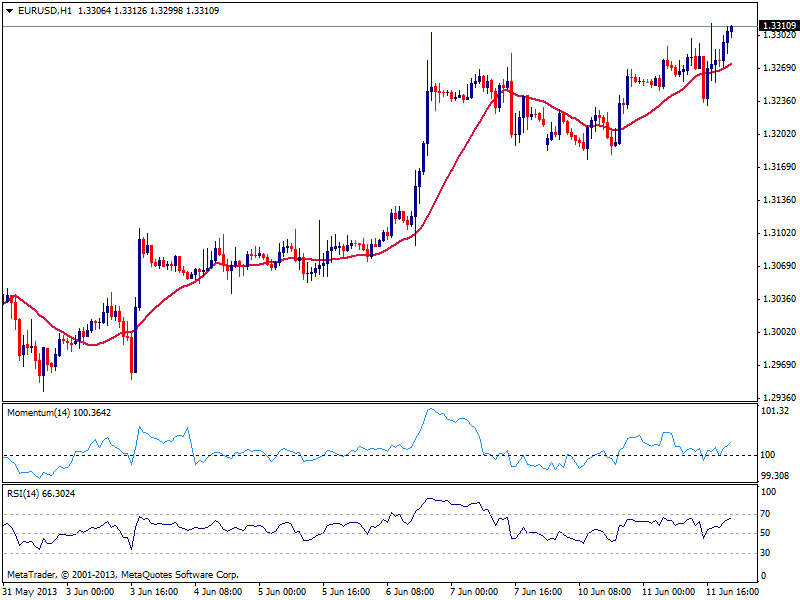

EUR/USD Current price: 1.3311

View Live Chart for the EUR/USD

The EUR/USD trades above 1.3300 finally, with a slow but steady advance in the US session, and having been pretty wild over the last few hours, coming and going in a 100 pips range on headlines. Again yen gains lead dollar losses, as further position unwinding is seen in JPY crosses. The EUR/USD however remains limited on speculation a rate cut is quite firm on ECB table, although maintains the bullish stance according to technical readings: the hourly chart shows price firming up above 20 SMA, as indicators head north in positive territory. In the 4 hours chart technical stance is just the same, with scope now for an advance towards 1.3360 in the short term.

Support levels: 1.3290 1.3245 1.3200

Resistance levels: 1.3325 1.3360 1.3400

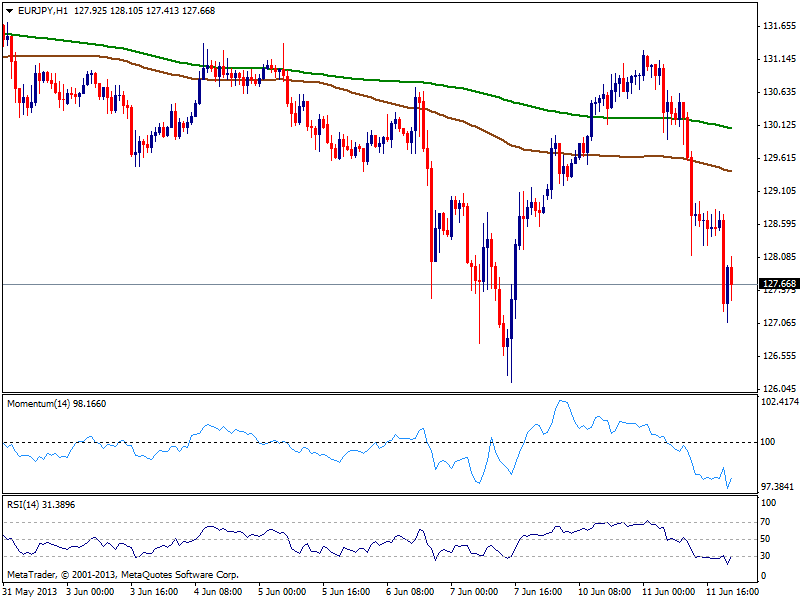

EUR/JPY Current price: 127.68

View Live Chart for the EUR/JPY (select the currency)

The EUR/JPY lost most of the ground recovered in the past to day, again nearing key dynamic support, its 100 DMA today around 126.30. As for the hourly chart, indicators head south in deep red after having barely corrected extreme oversold readings, while moving averages gain bearish slope well above current price. Bigger time frames show technical readings also favoring a downward continuation, with 127.10 as immediate support to break to confirm a test of the mentioned 100 DMA.

Support levels: 127.10 126.30 125.50

Resistance levels: 128.40 129.00 129.60

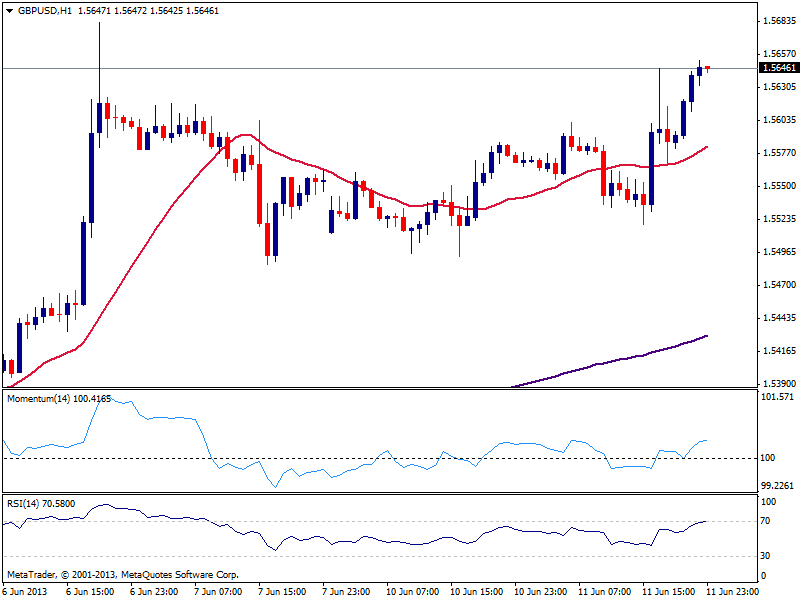

GBP/USD Current price: 1.5646

View Live Chart for the GBP/USD (select the currency)

The GBP/USD was also benefited by yen momentum, recovering up to 1.5652, so far the daily high. While technical readings lack a strong upward momentum, the dominant trend is bullish, and there’s little to do about it, but buy on dips. The hourly chart shows 20 SMA gaining a bullish slope and indicators in positive territory, which supports more gains despite the lack of strength. In the 4 hours chart the technical outlook is also bullish, supporting the shorter term view and a test of the weekly target of 1.5770.

Support levels: 1.5610 1.5550 1.5500

Resistance levels: 1.5650 1.5690 1.5730

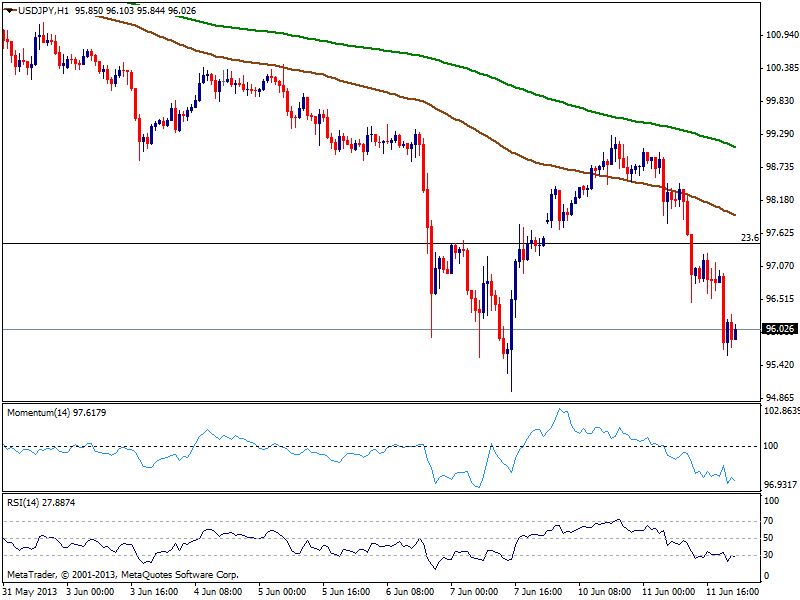

USD/JPY Current price: 96.04

View Live Chart for the USD/JPY (select the currency)

Yen again advanced for most of the day after the BOJ disappointed: the USD/JPY reached an intraday low of 95.58, breaking below 100 DMA, and about to close the day below it, first time since mid October 2011. Despite trading around 50 pips higher, the technical picture continues to be strongly bearish, with indicators heading south in oversold territory, and moving averages gaining even more downward slope above current price. Having a hard time to hold above the 96.00 level so far, a break below mentioned low should lead to a test of 95.00 area while once below this last, 93.60, 38.2% retracement of these months bullish run, comes at sight.

Support levels: 95.45 95.10 94.70

Resistance levels: 96.20 96.50 96.90

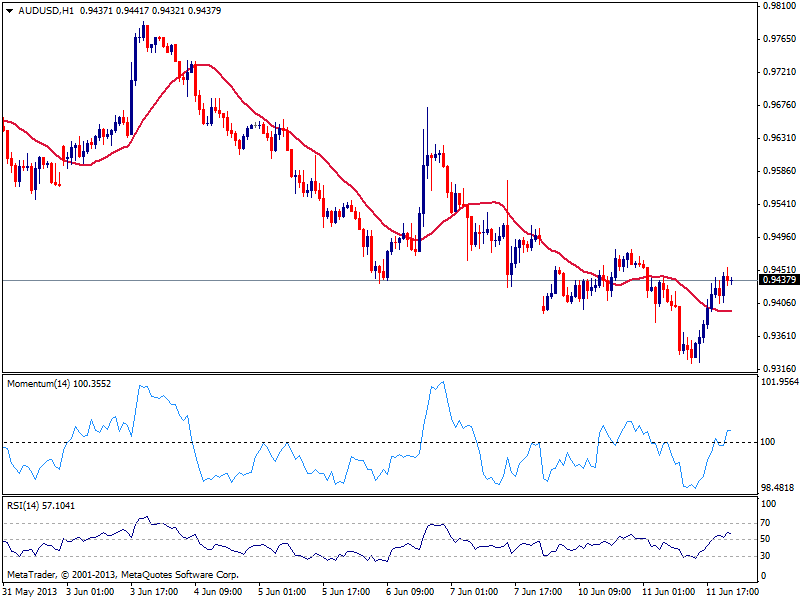

AUD/USD: Current price: 0.9437

View Live Chart for the AUD/USD (select the currency)

Even AUD got benefited for dollar fall, as despite the slide in stocks and commodities, the pair managed to recover some ground, trading back above the 0.9400 mark. Short term bullish according to the hourly chart, the pair may extend its advance towards 0.9570/0.9500 area, where next hurdle of sellers awaits. Renewed selling pressure leading to a fall below 0.9380 support, will deny the chance of an upward correction and favor a retest of recent lows.

Support levels: 0.9410 0.9380 0.9320

Resistance levels: 0.9470 0.9510 0.9550

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.