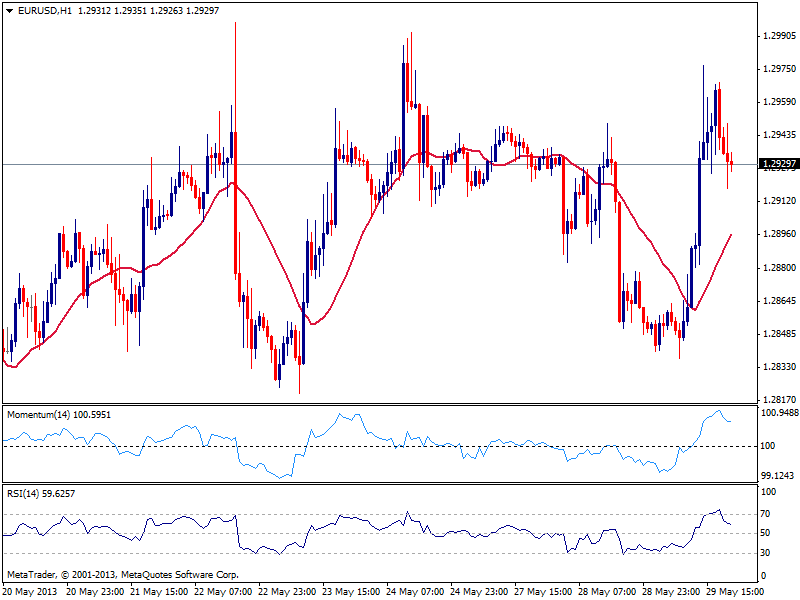

EUR/USD Current price: 1.2930

View Live Chart for the EUR/USD

Lots of volatility but little definition was seen in markets today, with majors surging strongly against the greenback early US session with not much behind the movement but yen accelerating against most rivals on falling stocks. US indexes traded in red most of the day, until mid American afternoon FED’s Rosengren talked about maintaining an accommodative police, noticing that with current unemployment and low inflation, tapering is not on the immediate agenda: stocks recovered, and so did the greenback, still closing negatively against most rivals.

The EUR/USD has traded near both of its range extremes, having been as low as 1.2836 and as high as 1.2976 this Wednesday. Stuck in the 1.2920/1.2950 area for most of the American session, the hourly chart presents a positive tone as momentum heads higher after correcting extreme overbought readings, yet as stated earlier, the 1.2840/1.3000 range will likely hold until next week Central Banks and NFP news.

Support levels: 1.2920 1.2885 1.2840

Resistance levels: 1.2950 1.2990 1.3030

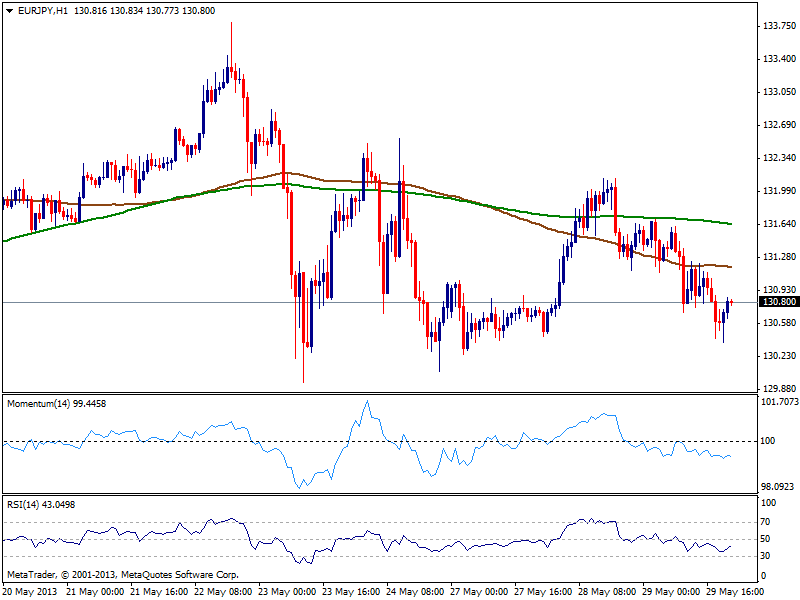

EUR/JPY Current price: 130.80

View Live Chart for the EUR/JPY (select the currency)

Yen recovered its strength across the board, with the EUR/JPY falling as low as 130.37 before bouncing some with US stocks late recovery. However, the bearish potential has increased after latest failure to regain the upside. The hourly chart shows price developing below 100 and 200 SMAs, while the distance in between both widens, pointing for more downward moves. Technical indicators stand in negative territory, showing not much strength at the time being, but also supporting the downside: 130.20 is the support to watch as once below, the pair has scope to extend its slide towards 128.80 price zone.

Support levels: 130.60 130.20 129.60

Resistance levels: 131.20 131.70 132.10

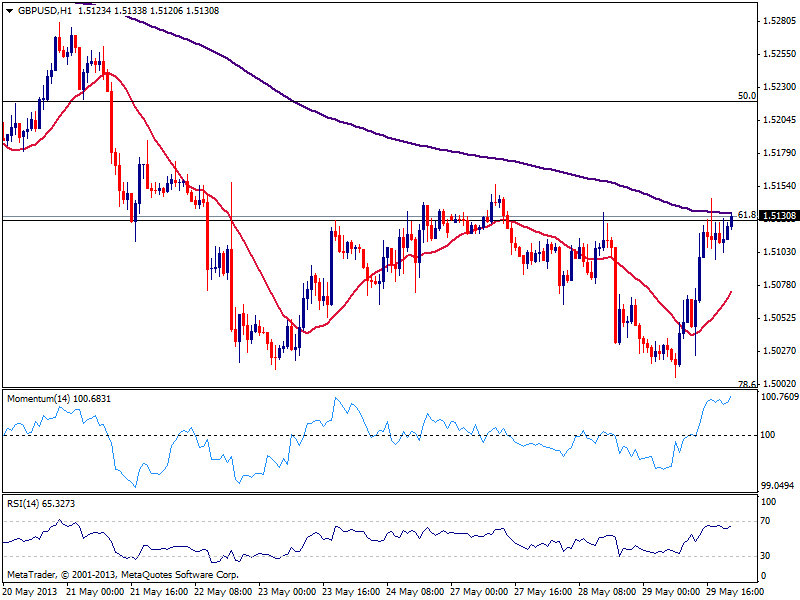

GBP/USD Current price: 1.5130

View Live Chart for the GBP/USD (select the currency)

The GBP/USD holds to its daily gains, stuck around 1.5130, strong Fibonacci level, 61.8% retracement of its latest daily run. The hourly chart shows a strong upward momentum coming from indicators after a limited correction, but as long as price does not shows a clear break above this area, the picture remains unclear. Pullbacks should found support around 1.5050/60 area, while only below this last the intraday bias will turn negative.

Support levels: 1.5070 1.5045 1.5010

Resistance levels: 1.5130 1.5175 1.5210

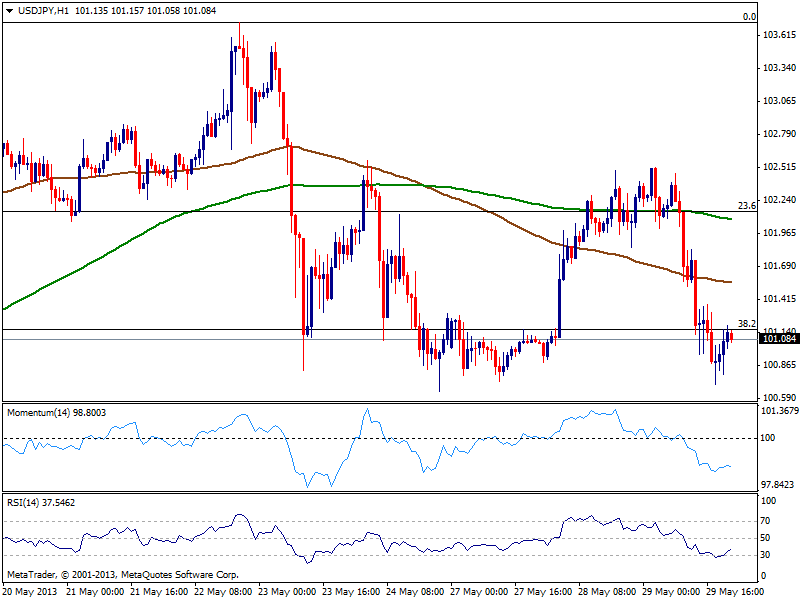

USD/JPY Current price: 101.08

View Live Chart for the USD/JPY (select the currency)

USD/JPY trades again below key 101.20 area, 38.2% retracement of May bullish run. Investors may continue buying dips, but are now rushing to take profits out of the table. And while the long term bullish trend remains in place and there are no much signs of a top underway, downside potential continues to increase. As for the technical picture, the hourly chart shows price back below 100 and 200 SMAs, with the distance between both widening, supporting the bearish bias in the pair. Technical indicators stand in negative territory while bigger time frames show technical indicators turning south, supporting the shorter term view. Break below 100.65, this week low should anticipate further slides with 99.70, former high, then at sight.

Support levels: 101.00 100.65 100.20

Resistance levels 101.25 101.60 101.95

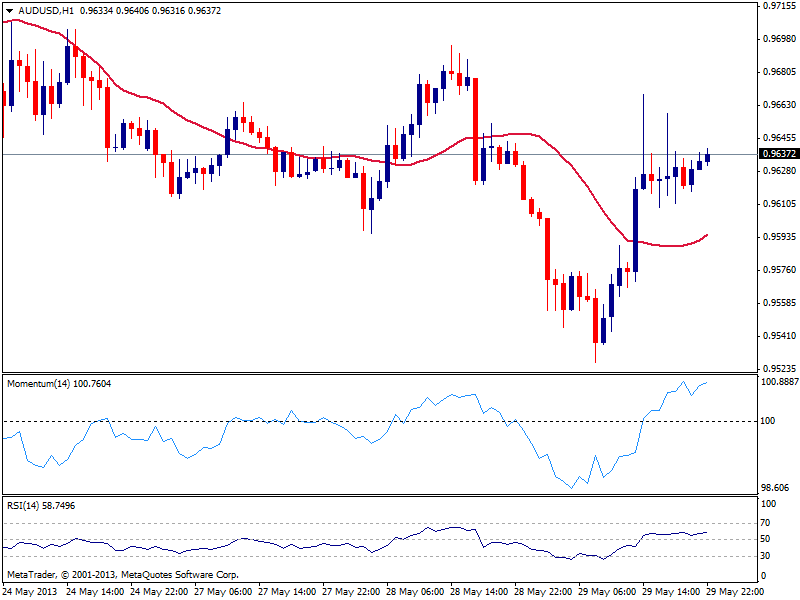

AUD/USD: Current price: 0.9637

View Live Chart for the AUD/USD (select the currency)

Australian dollar posted a fresh low of 0.9527, and despite late recovery, the daily candle continues with the lower low, lower high routine seen over the past few weeks that supports the dominant bearish trend. The hourly chart shows a positive stance ahead of Asian opening, with indicators heading higher in positive territory and price developing above its 20 SMA, although price seems unable to regain the 0.9660 immediate resistance area. In the 4 hours chart, technical picture is still bearish, helping maintain the upside limited.

Support levels: 0.9590 0.9540 0.9500

Resistance levels: 0.9660 0.9700 0.9740

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.