Trade carefully, that’s all I can comment for now. The first phase of correction is over the rupee (against the major currencies). The next wave will be there only on a fall below yesterday’s lows. RBI interest rate cut yesterday will be positive for the rupee in the medium term.

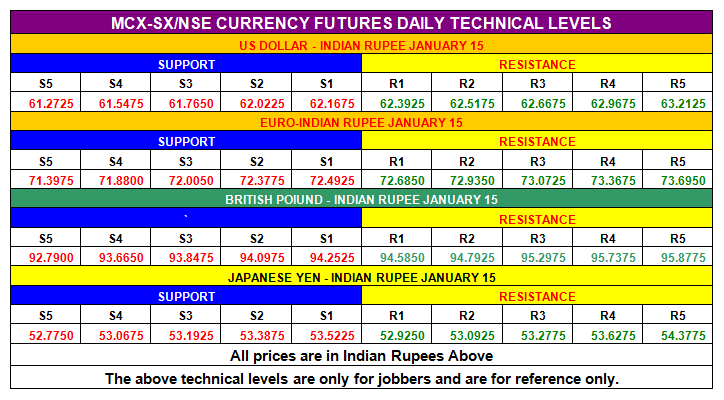

Usd/inr January 15 (expiry on 28th January 15):

Jobbers aggressive buy over: 62.32 stop loss 61.19 for6 62.52-62.79

Jobbers aggressive sell below: 62.12 stop loss 62.2475 for 61.9650-61.7650-61.6175

Key resistance is at 62.3675. Only a consolidated break of 62.3675 will result in another wave of rise to 62.5225 and 62.7675. Initial support is at 62.10 with 61.7675 and 61.5125 as key supports.

Euro/inr January 15 (expiry on 28th January 15):

Jobbers aggressive buy over: 72.72 stop loss 72.59 for 72.89-73.12

Jobbers aggressive sell below: 72.42 stop loss 72.51 for 72.2925-72.0775

Euro/inr needs to trade over 72.2225 till Monday to prevent sell off to 71.7875 and 70.6775. Only a break of 72.86 will resume the intraday bullish zone.

Gbp/Inr January 15 (expiry on 28th January 15):

Jobbers aggressive buy over: If trade over 94.7775 (after 2:00 pm IST) stop loss 94.6375 for 95.0550-95.6750

Jobbers aggressive sell below: No call

Cable needs to trade over 94.7675 today to rise to 95.03-95.76. As long as cable trades below 94.7675, it can still fall back to 94.25 and 93.99.

Jpy/Inr January 15 (expiry on 28th January 15):

Yen/inr can rise to 54.30 and 55.12 by next week as long as it trade over 53.3375. There will be sellers if yen/inr trades below 53.3375 in UK session anyday till next week.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.