On the technical front a break of 61.40 (usd/inr) in the inter-bank market will trigger sell stop losses and another wave of rise. This week there have been huge sellers of put options in usd/inr. One needs to wait for some more time and sell naked futures with a higher stop losses. I will prefer to wait for some more time to sell naked usd/inr futures for the short term.

There are two key risk in the next three weeks (a) Federal reserve meeting next week (b) Indian elections results on 16th May and thereafter. There can be profit taking in Indian stock markets before these events and short covering in the rupee.

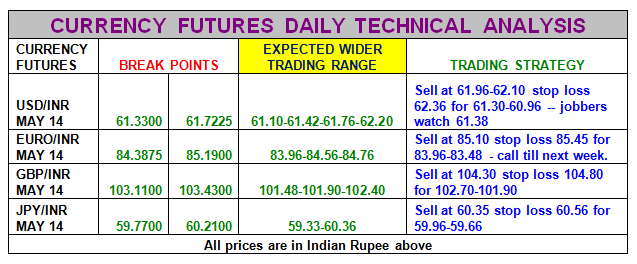

Usd/inr May 2014: Key resistance till next week is at 61.72 and only a break of 61.72 will result in further gains to 62.02-62.36. Support is at 61.22 and there will be sellers only below 61.22

Euro/inr May 2014: Key resistance is at 85.31 and only a break of 85.31 will result in further gains to 85.76-86.02. Support is at 84.92 and there will be sellers only below 84.92

Gbp/Inr May 2014: Resistance is at 103.4250 and only a break of 103.4250 will result in 103.96-104.20. Support is at 103.11 and there will be sellers only below 103.11

Jpy/Inr May 2014: It needs to trade over 59.71 to target 60.23 and 60.71. There will be sellers only below 59.71.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.