There are a lots of iffs and butts going around in the markets on policy expectations by the new government in the next three week to four weeks. I do not foresee big policy reversals from the current UPA government. However policies and laws implemented by the current UPA government will be tweaked in larger national interest and in interest of the masses. Food price inflation will be a cause of concern for the new government as well as for the Reserve Bank of India. Indian corporates and banks may like the RBI will not change interest rates if the current heat wave conditions in large parts of India continues for long.

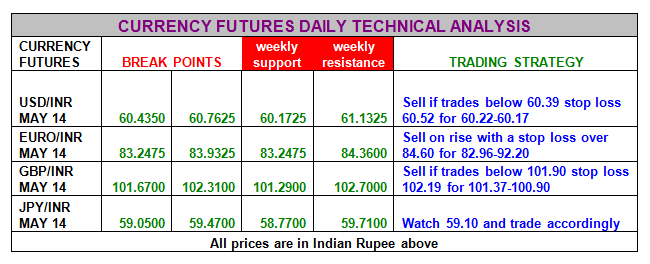

Usd/inr May 2014: It needs to trade over 60.56 to prevent further selling to 60.22 and 59.96. Only a break of 60.76 will result in further gains.

Euro/inr May 2014: It can fall to 83.56 and 83.12 as long as it trades below 84.19. Only a break of 84.19 will resume the bullish zone.

Gbp/Inr May 2014: There will be a technical break down below 101.90 to 101.62 and 101.19. Only a break of 102.40 will result in further gains

Jpy/Inr May 2014: It needs to trade over 58.70 till next week to target 59.70-60.40. There will be sellers only below 58.70

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.