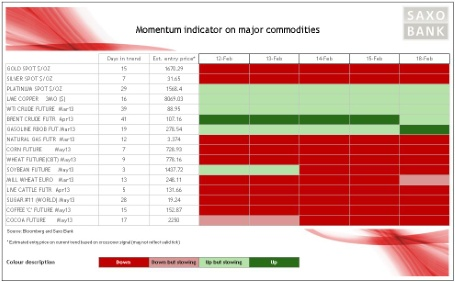

The negative momentum seen in precious metals and the whole agriculture sector over the past week could now potentially also engulf copper. Being a growth dependent commodity, copper has, just like energy - minus natural gas -been well supported at the beginning of this year. But since February 4, we have seen lower highs almost every day. Yesterday resulted in a breach of support and today this weakness has continued. The drop was triggered by concerns about the strength of Chinese demand after local media reported that further initiatives to prevent property prices from rising too fast was being considered.

Crude oil prices are currently trading sideways, with support in WTI crude oil at 94.90 USD/barrel and resistance in Brent crude oil above 118 USD/barrel being the two levels the market is focusing on. The main driver, however, is gasoline which, at the moment, is the only commodity showing a double-digit return in 2013. This continued rally could become a concern for drivers in the US, who are paying record prices at the pump for this time of year. The current national average retail price for gasoline currently costs 3.73 USD/gallon, some 30 percent above the average for the past five years and only 9 percent away from the peak reached in July 2008 just before the collapse.

It goes to show that energy prices can not continue to rally without a sound foundation in terms of economic growth to back it up. We are once again facing the risk of an early beginning-of-the-year rally running out of steam and being followed by a correction. With WTI Crude potentially showing negative momentum from today and given the continued weakness in all other sectors, the risk of a correction in both crude oils is rising.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.