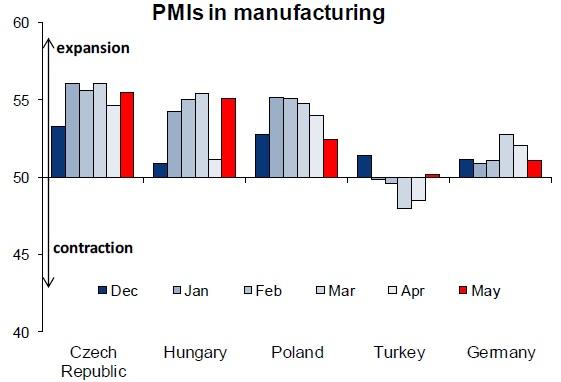

Chart of the day:

PMIs in manufacturing – Only Poland’s PMIs were following the decelerating German’s PMIs in May. Czech PMIs stood firmly at around 55 increasing chances for upward revision of our new GDP forecast for 2015 (which will be released this month). Hungarian PMIs, albeit very volatile, also point to solid growth in 2Q2015.

Analysts’ View:

CZ Fiscal: The Czech state budget deficit arrived at CZK 22.1bn for the Jan- May period, i.e. CZK 12.6bn higher compared to the same period of the previous year. However, year-to-year comparison is heavily distorted by the base effect as the revenues were boosted by several one-off factors in early 2014 (e.g. by the sale of licences for frequency bands to mobile operators of CZK 8.5 bn), but recent development gives a hope that this years's state budget balance will end up in a considerably lower deficit (fairly below the level of 2% of GDP), compared to the central government's plan of CZK 100bn (2.3% of GDP). As the yields of the Czech 10Y T-Bonds remained untouched by the MinFin's release, we continue to see them at 0.42% at the end of 2015.

PL Politics: It seems that victory of Duda in presidential election triggered changes on Polish political scene. Yesterday’s Millward Brown polls shows that Law and Justice can count on 25% of votes while Civic Platform (ruling party) would get only 17% of votes noting 8pp drop within the month. At the same time, the new move of Pawel Kukiz (former rock singer) enjoys 20% support mirroring Kikiz’s support from presidential elections. There are still few months left until the parliamentary election (scheduled for October), but at this point, all signs suggest that it is very likely that Law and Justice will be forming new government. Such a development can make market somewhat nervous (due to fiscal risks and generous pledges), we therefore may see increased volatility on the bond market the throughout the next half of the year and we see upward risks to our current forecast yield forecast of 10Y at 2.7% at the end of the year.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.