Chart of the day:

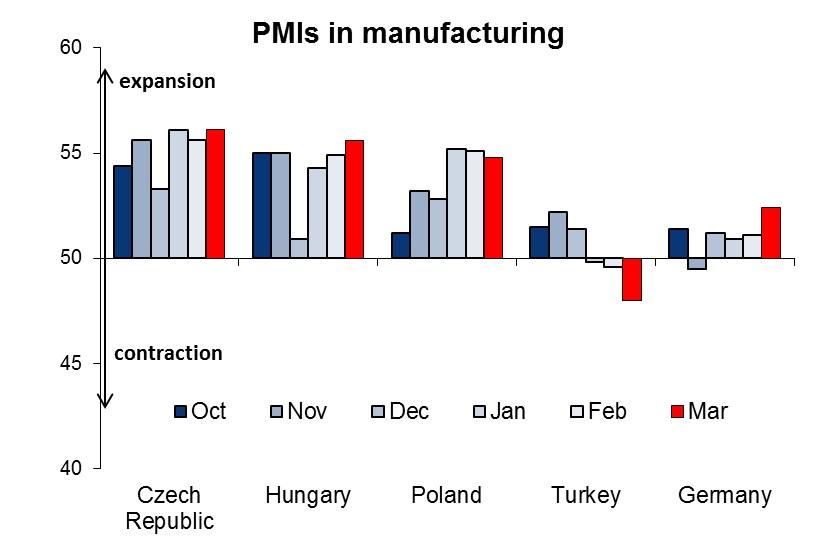

CEE PMIs: PMIs in manufacturing held up well in March in CEE countries, as yesterday’s releases show that data are still robustly above the 50 point benchmark that marks the line between expansion/contraction. In fact, figures are closer to 55-56 points in the Czech Republic, Hungary and Poland, signaling the good health of the manufacturing sector in these countries.

Importantly for CEE, the German PMI figure increased notably in March. The releases indicate that risks to our GDP forecasts (2.4% for CZ, 3.1% for PL and 2.5% for HU) are rather tilted to the upside than the downside. As for Turkey, however, the 48 point reading underpins downside risks to our call for GDP growth of 3.8% for this year.

Traders’ Comments:

CEE Fixed income: Will they, won’t they? Rumours that Greece will not honour an IMF debt repayment due on April 9th may have helped propel yields on German sovereign bonds to new record lows. Investors bid EUR 5.4 bn for the EUR 4 bn on offer in the OBL 0% 4/2020 auction, pushing the yield down to -0.1%. Even more breath-taking is the level on the 2y which now yields - 0.262%. Given that the ECB limits purchases under the QE programme to yields equal to or higher than their deposit rate of -0.2%, it must be private investors who are bidding the yield down even further. The ECB Governing Council raised the cap on Emergency Liquidity Assistance provided by the Bank of Greece by EUR 700 m but this is less than the increase of EUR 1 bn granted last week. Throw in a breakdown in talks with Iran and the advance of Yemeni rebels into Aden (which pushes up oil prices) along with the prospect of solid US labour market data tomorrow and an extended Easter weekend ahead and you could be forgiven for assuming that bonds outside of the safe-havens in the Eurozone would be under pressure. Yield moves have been contained this week in directionless CEE fixed income markets amid low turnover but FX is well bid in both CEE bellweather currencies HUF and PLN. That said, since the beginning of February the 10y2y yield curve spreads in these 2 countries have bear steepened and the 10y yield spread to Bunds has widened. In CZGBs, the safe-haven of CEE, the central bank has jaw-boned the CZK weaker vs EUR, the yield on the 10y has risen since mid-March and the 10y yield spread to Bunds has increased to over 23 bps from -8 bps in January.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.