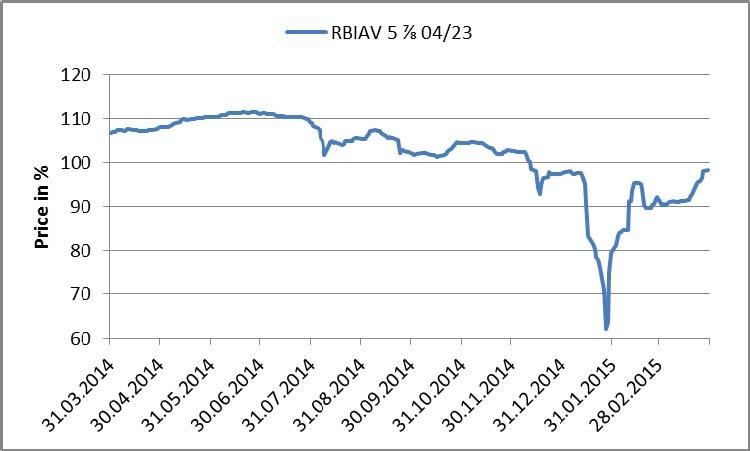

Chart of the Day:

Raiffeisen Rebound: There’s nothing like bad news to boost optimism. CEO, Karl Sevelda, told the press last Wednesday that it may take until 2016 to return to profits as the bank focusses first and foremost on restoring its capital ratios, emphasizing “We’ve said that the overriding goal is to reach the capital ratio of 12% by the end of 2017. All other goals are secondary.” Plans to raise capital ratios fall squarley on a reduction of RWA’s with the sale of Raiffeisen Bank Polska SA a major component of the plan to shrink to health. These statements from the CEO were followed up by comments from Deputy Chief Executive Officer Johann Strobl on Thursday who indicated that RBI will sell additional Tier 1 securities this year. Outstanding sub debt continued its recovery from the January 6th lows on the back of this commitment to scale back business and avoid issuing new equity.

Analysts’ View:

CEE Looking Ahead This Week: The new month is starting this week, which means that PMI indices will be released on Wednesday. For CEE, the question is if we are going to see further positive figures (which would underpin positive risks for the growth outlook), while for Turkey, the question is whether we are going to see further disappointing figures, which could additionally contribute to downside risks there. Before this data, however, on the last day of March, the Romanian central bank is expected to cut the policy rate 25 bps to 2.0%, which should end the easing cycle. Otherwise, as far as data releases are concerned, the week will be mostly packed with data of secondary importance to markets. Maybe the only exceptions from this are the Czech and Turkish 4Q14 GDP releases on Tuesday, and the Slovenian inflation data also on Tuesday. Still on Tuesday, we will see industrial output, retail sales and current account data releases from lots of countries in the region. These data releases should not be extremely important for market movements, but could help analysts ascertain if the currently observable improvement in growth prospects is supported by stable external balance developments in CEE.

Traders’ Comments:

CEE Fixed income: CEE government bond markets remain lackluster as central banks continue to fret over the risk that FX appreciation will derail their efforts to expand monetary policy. Sentiment will be highly dependent on Greece and Fridays US Non-Farm Payrolls this week.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.