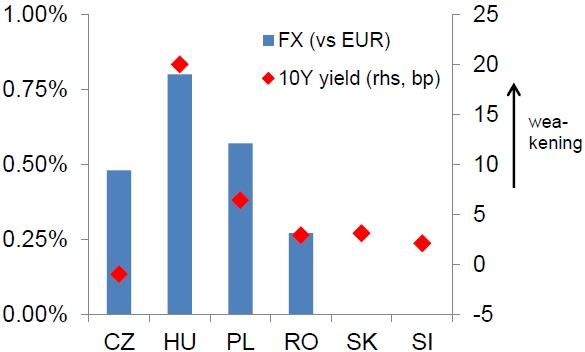

Chart of the Day:

CEE FX and FI markets: Amid increasing geopolitical tensions, CEE FX and FI markets took a beating yesterday. Logically, countries with a lower policy rate and/or a higher external indebtedness (like Hungary) suffered strong yield increases and currency depreciation but it didn’t stop there: Poland which is in close proximity to Ukraine and also has a high share of non-resident investors in its debt markets (danger of capital flight) saw its bonds and currency sell-off as well and even the CEE safe-haven, the Czech Republic, which is typically perceived as the funding currency in the CEE carry trade came under pressure in a sign that contagion doesn’t differentiate.

Analysts’ Views:

HU Bonds: The Government Debt Management Agency (GDMA) sold HUF 40 bn in 12M T-bills, as planned, despite investor demand in excess of 65 bn. The average yield came in at 1.77% (bids were submitted between 1.70-1.80%). The policy rate is currently at 2.1% and is not expected to be reduced any further. The auction was held in the morning, and the developments tied to Ukraine did not have an impact on the auction. Investors also seem to have come to terms with central bank ‘unorthodoxy’, the latest of which is news about HUF 200 bn (exceeding 0.6% of GDP) of ‘fundraising’ to finance new endowments that will promote ‘new economic thinking’. The Governor told the press that the financing will be sourced from 'money creation and loans made available by the 2-week deposit’ and the endowments can purchase both ‘HUF and EUR denominated Hungarian government bonds’ out of this amount. We see 10Y yields at 4.8% at the end of this year.

Traders’ comments:

CEE Fixed Income: The EURHUF is starting today’s trading session where it left off yesterday with the HUF under selling pressure. Although news of an escalation of the conflict in Ukraine had already broken in the morning hours of yesterday’s trading session, the sell-off in the HUF didn’t really start in earnest until the EUR began it’s decent against the USD just before midday following weak economic confidence data and moderate inflation figures. Equities were already lower before the opening and Bund yields broke to new record lows in sync with the drop in the EUR around about midday. This looks like investor capitulation due to technical factors rather than anything new fundamentally. A good example of this was apparent in the Croatian bond market. Croatian bonds started the day better bid but also gradually succumbed to the selling pressure over the course of the day with yields on HRK bonds more or less unchanged and yields on Eurobonds 5 – 10 bps higher. HGBs got whacked along with the HUF but selling pressure was evident across all markets. The biggest moves came in the more liquid FX markets with little attention paid to fundamental differences in the underlying economies. In the cash corporate space, buying dried up but we didn’t see panic selling.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.