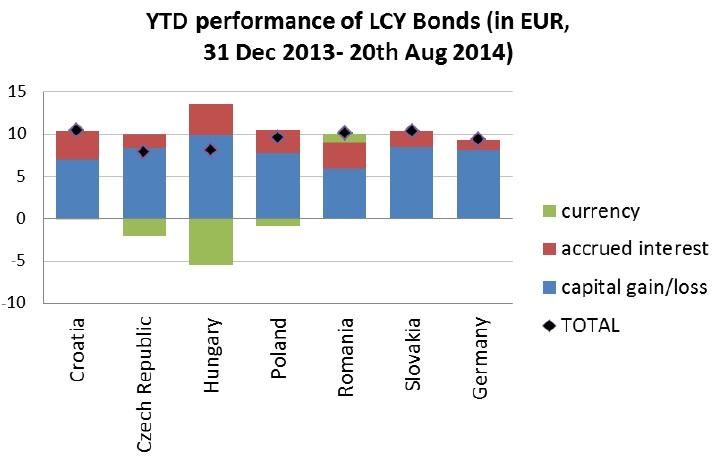

Chart of the Day:

CEE bond yields – Yields on CEE government bonds reached a new all-time low in Czech Republic, Poland and Slovakia this week. CEE bonds have been performing very well, the total flat returns from holding LCY bonds measured in EUR climbed to 8-10% if bonds were bought at the beginning of this year. It is true that it is at pair with Bunds which gained too, but with lower prospect to perform well or generate juicy accrued interest in upcoming period which would justify risk of capital loses if yields move up.

Analysts’ view:

PL Macro: Industrial output grew 2.3% y/y in July, slightly above market expectations. Thus, the data may not not seem that disappointing, but it fits the recent overall tendencies, suggesting that the economy is indeed slowing. In our view, the MPC has every argument to lower the policy rate. At this point, September seems too soon, as not all MPC members are convinced that such a move is necessary, but we should see further easing in November, at the latest. Expectations of a maximum 50bp cut support the low level of yields (10Y close to 3.4% at the end of 3Q14).

Traders’ comments:

Yesterday was more of a consolildation day with no major moves in yields with the exception of Croatia. In Crotian local currency bonds bids dominated the local curve with CROATE 16 outpeforming ending the day 15 bps tighter in yield. While the long end of the Croatian EUR curve traded weaker with yields rising slightly for CROATI 22. In macro data for this morning, the focus will be on markit manufacturing and services surveys from France, Germany and the Eurozone while in Croatia the unemployment rate. In the second part of the day market focus will shift to US with IJC, US markit manufcturing and US exiting home sales in the spotlight.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.