- Dollar Outlook - 5 Changes We Expect From The Fed

- GBP/USD Closing In on 4 Year Lows

- NZD Crushed by Fall in Dairy Prices

- AUD: RBA Reiterates Dovish Bias

- USD/CAD Hovers Below 5 Year Highs

- Euro Shrugs Off Mixed ZEW

Dollar Outlook - 5 Changes We Expect From The Fed

Tomorrow is the big day - we expect the Federal Reserve to drop the word "patient" and guide the market towards higher interest rates. Normally one would expect this to be positive for the U.S. dollar but today's inconsistent performance of the greenback indicates that investors are divided on the central bank's level of hawkishness. The dollar held steady versus the Japanese Yen, weakened versus the euro and strengthened against the British pound. While most investors also expect the Fed to drop "patient" from the FOMC statement this change will undoubtedly contain dovish undercurrents. 2015 ushered in a less hawkish FOMC with Plosser, Fisher and Mester replaced by Lacker, Williams and Evans. The recent slide oil prices and rise in the dollar also lowers inflation expectations while the surprise contraction in retail sales and slowdown in manufacturing activity raises the concern about the momentum of the recovery. Outside of labor market data, we have seen more weakness than strength. However with 3 months between the March and June meeting, the Fed will want maximum flexibility to maneuver, which is why the word patient is going out the window. Instead the Fed will tell us that a rate hike is data dependent and right now there is a case to be made for a longer period of steady rates. Janet Yellen will go to great lengths to ensure that the market understands that a rate hike in June is not guaranteed because they haven't made up their mind and they probably won't until the June meeting when they have another 3 months of data on hand.

Here are 5 Changes we Expect from the Fed

1. Drop the word "Patient"2. Introduce New Language to Indicate that Rate Hikes will be Data Dependent3. Make No Commitment to Raise Rates in June4. Lower Inflation Expectations, Downgrade Assessment of Economy5. Change "Dots" Forecast to Signal a Slower Rise in Rates

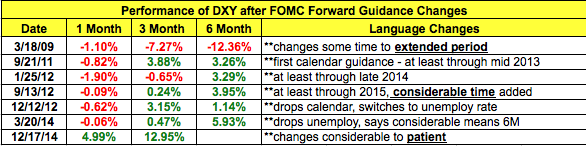

Dollar - A Look at How DXY Reacts to Fed Guidance Changes

As for how the Dollar will trade, the disappearance of the word patient will cause the dollar to jump initially but the gains should evaporate once Janet Yellen starts to speak because her number one priority will be to ensure that the market does not misinterpret the change to mean that rates will be rising quickly and aggressively. The following table shows how the dollar index reacted 1 month, 3 month and 6 months after changes to forward guidance and as you can see any losses in the first month were short lived. This is consistent with our view that the dollar will continue to trade higher in the coming months and because of that, we will view any decline in the greenback tomorrow as an opportunity to buy at lower levels. If it trades higher, we will look to join the move targeting a 3 to 5% rise in USD/JPY and corresponding slide in the EUR/USD over the next 6 months.

Here's also a great chart published by @claudiowall on how forward guidance changes have impact stock and DXY.

GBP/USD Closing In on 4 Year Lows

The British pound sold off sharply against the euro and U.S. dollar ahead of the labor market report and minutes from the most recent Bank of England meeting. We continued to be surprised by the weakness of sterling because the BoE is still talking about raising interest rates but there is a fear that the decline in oil prices could delay a move. However MPC officials have said repeatedly that gentle rate rises may be necessary which indicates that they still maintain a moderately hawkish bias. The BoE won't pull the trigger before the Fed but they will still be the second major central bank to tighten and this dynamic should eventually lead to a recovery in sterling particularly against non-dollar currencies. More specifically monetary policy in the U.K. will be drifting further away from the Eurozone in the coming months which makes selling EUR/GBP on a bounce a particularly attractive opportunity. We are also looking for an upside surprise in tomorrow's labor market report with the PMI numbers showing an uptick in job growth in the manufacturing and service sectors. The last time the minutes were released back in February, policymakers voted 9-0 to leave rates unchanged but two members said the decision was "finely balanced" while two others felt "there may well be a case" for raising rates in 2015. Sterling soared to fresh 7-year highs versus the euro on the back of the report and a similarly strong move could occur if the minutes are hawkish. Of course if the BoE shifts course, cautionary comments would drive sterling to 4 year lows against the dollar.

NZD Crushed by Fall in Dairy Prices

The New Zealand dollar sold off sharply today after a steep fall in dairy prices. For the first time in 3 months, the Fonterra Global Dairy Trade index declined and the -8.8% move was not small. While this move can be largely attributed to a threat last week to poison infant formula, dairy prices saw significant gains at the last 6 auctions and with supply not expected to be as tight in the coming months a further fall in prices is possible. New Zealand experienced dry conditions in February and March but as the weather improves, that will ease. Terrorists have given the government until the end of March to stop using pesticide 1080 and with Prime Minister Key's Cabinet still crafting a response, importers will be particularly cautious, which could weigh on prices at the next auction and on the New Zealand dollar. The last time Fonterra had a milk scare in 2013, China maintained restrictions for months even though tests showed that it was a false alarm. So far China has not imposed restrictions but Chinese consumers could grow worried about buying infant formula produced in New Zealand. Meanwhile the Australian dollar also traded lower after the RBA minutes confirmed that further rate cuts are likely. The sell-off was small because the central bank wants to give the economy time to respond to their last move before taking additional action. Finally, oil prices stabilized, leaving USD/CAD hovering right below its 5 year high. Euro Shrugs Off Mixed ZEW The euro continued to rebound against the U.S. dollar today but the gains were nominal as traders treaded cautiously ahead of Wednesday's FOMC rate decision. Where EUR/USD heads next will be determined by the tone of the Fed and not EZ data. The latest Eurozone economic reports were mixed. According to the ZEW survey, investors grew more optimistic about the Eurozone and Germany but the expectations component of the German ZEW index fell short of its lofty expectations. This suggests that while investors believe that Eurozone economy is recovering they are still worried about Greece and the possibility that the confidence boost provided by QE has peaked. As our colleague Boris Schlossberg wrote in his morning note, "we've noted earlier the 1.0400-1.0500 zone remains key support for the pair and after relentless liquidation over the past several months it appears to be finally stabilizing at these levels. Although the deck is clearly stacked against the unit with US and EZ monetary policies diverging broadly," the EUR/USD could be due for a short squeeze. "One key problem dollar bulls right now is that sentiment is wildly skewed. Every day brings a new ever lower forecast from the banks for the EUR/USD with some already predicting exchange rate of 8000 cents by 2017. The problem with such linear thinking in the forex markets is that it is almost inevitably wrong. Just as we could find no EUR/USD bears when the pair was in the 1.5000s so too now euro bulls are non-existent. Such lopsided sentiment typically set ups for sharp reversals, although perhaps we haven't fully reached the bottom yet until the Economist puts the currency on the cover, wrapped in bandages with headline screaming "the end of Euro?"

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'