Briefly: no speculative positions.

Rakuten, a Japanese e-commerce company, has begun accepting Bitcoin from its U.S. customers, we read on the Wall Street Journal website:

Japanese e-commerce giant Rakuten Inc. has started accepting bitcoin for purchases in the U.S., adding momentum to the rapid growth of cryptocurrencies as a form of payment.

Customers using the company’s virtual shopping mall in the U.S. site can already buy items using the Internet-based currency, a Rakuten spokesperson in Japan said Tuesday.

Rakuten executives have previously said the company’s Germany and Austria units will allow payment by bitcoin starting in the second quarter of this year.

It is good news for Bitcoin users since yet another company is now accepting the cryptocurrency, albeit only in the U.S. at the moment. As we have stated before, the fact that companies all over the world are beginning to accept Bitcoin shows that there is interest in the system. Of course, retailer adoption is not necessarily the same as customer adoption, since it is the customers that might actually “pull” Bitcoin further into the payment space, but retailer adoption shows that companies are more actively considering Bitcoin a valid payment alternative in which customers might be interested.

Since Bitcoin is slowly gaining attention in various countries with various laws and various business environment, this might as well show that the currency might have value for various kinds of customers. It still seems that we are at least years away from a point at which “Bitcoin accepted here” signs will be seen in store windows as frequently as credit card stickers, but if the trend continues, Bitcoin will gain a presence in this space.

For now, we focus on the charts.

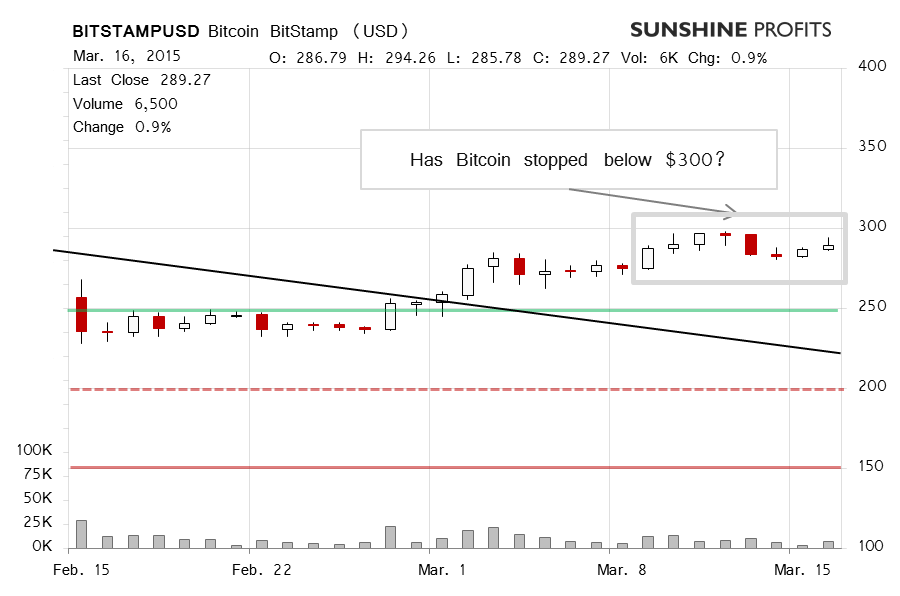

On BitStamp, appreciation was what was visible on Sunday and Monday. Bitcoin came close to $290 but didn’t really move to $300 at any point. Yesterday, we wrote:

(…) the action so far has been supportive of this kind of approach. We haven’t really seen a move down and the volume levels don’t support a strong move down. This is also true at the moment of writing (…). We’ve seen slight appreciation but the trading has been relatively subdued. Right now, we might be witnessing an important day or the next couple of days from the point of view of a trader. This is because the action in the near future might somewhat confirm a new trend or possible negate an uptrend.

If we see a move above $300, this might be an indication of the rally going even further up. For this, a move above $300 would have to be strong. On the other hand, a move back to the level of $250 and below would suggest that Bitcoin is returning to the downtrend.

This has also been true today as Bitcoin hasn’t really moved (this is written around 10:00 a.m. ET). The volume has been relatively weak. The situation as it is, the outlook has just become more bearish. Bitcoin hasn’t moved above $300, it hasn’t even really reached this this level. It may be the case that we’ve already seen a second top within this correction. If not, we might see one within the next couple of days. The mains factor here seems to be the continued weakening in volume levels. It looks like the rally might have run out of steam. We’re not exactly ruling out a move up, but the situation seems to be becoming increasingly tilted toward a bearish short-term outlook.

On the long-term BTC-e chart, we have seen a possible local top. Yesterday we wrote:

The depreciation we’ve seen (…) has somewhat confirmed a possible bearish outlook. In our opinion, it’s still too early to jump in and open hypothetical short positions. We are in fact not far from the point when short hypothetical positions might become potentially profitable but we’re not quite there, in our opinion. If we see more depreciation, we might consider short bets.

Now, we’ve seen some appreciation but not enough to bring Bitcoin above $300. In this light, our yesterday’s comments remain up to date. The drop in volatility seems to be indicating that the rally might have lost its momentum and this might be a hint that Bitcoin could return to its long-term trend which has been down. The situation doesn’t seem clear enough to open hypothetical short positions. This is mainly because $300 is still not far away and a strong move above $300 could change a lot in the short-term outlook at the moment. On the other hand, a move to $250 would indicate more declines to come, perhaps even to the $200 level.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.