Barclays is interested in the Bitcoin technology and has partnered with a Bitcoin exchange to explore blockchain technologies, we read on CoinDesk:

Barclays has signed off on a proof-of-concept to trial bitcoin technology.

Following an agreement with bitcoin exchange Safello, the UK bank says it will explore how blockchain technologies could bolster the financial services sector.

(…)

Schuil [Safello CEO] described the programme as a "mutual learning experience" for Barclays and Safello. While exact details of the pair's proof-of-concept are currently under wraps, he indicated Safello's bitcoin spending platform could reach an important demographic for the bank.

"Our target group are the millennials that banks find hard to reach, and we are doing it with a technology that they need to understand," he said, adding: "In that way and in other ways we are building a bridge between the traditional financial world and bitcoin."

This is yet another sign that banks are coming around to the conclusion that Bitcoin is a technology worth considering and they’re looking into opportunities to get to know more about digital currencies. So far this has been done either by investing in Bitcoin startups, partnerships or by internal work of research and development departments. Barclays is going for the starup option, possibly hoping to learn how exactly Bitcoin might be of use to the bank.

In the future, we expect even more banks to join this kind of activity. So far, we’ve heard about several instances but this is far from what might come in the next couple of years. It seems that we might hear about much more cases of Bitcoin development within banks.

For now, let’s focus on the charts.

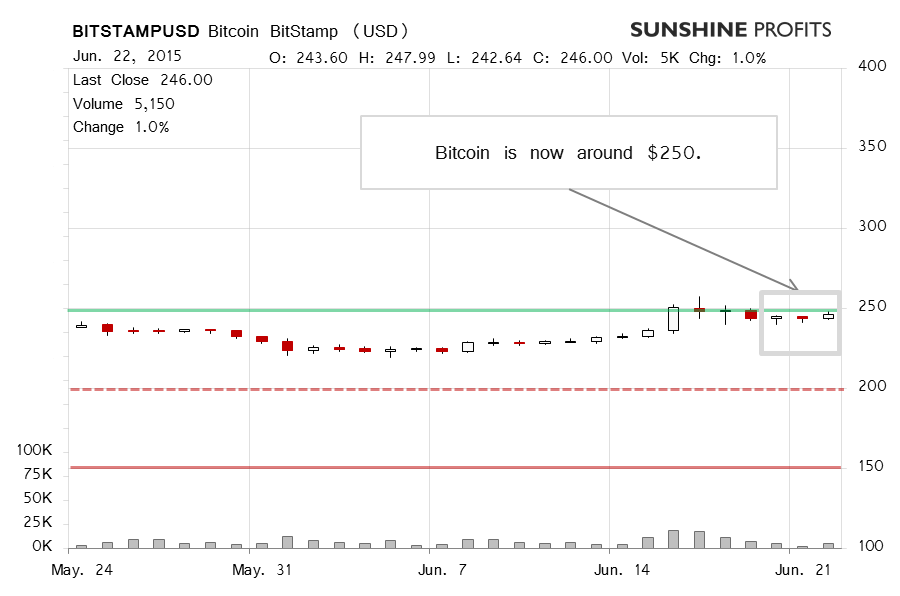

On BitStamp, we didn’t see much action yesterday. Bitcoin stayed below $250 (green line). The volume was higher than on the day before but not very high by any means. If you recall, yesterday we wrote:

So far it has turned out that sideway trading is what we’re seeing. This has also been the case today (…). The volume is already higher than it was yesterday but it isn’t really suggestive of strong action. At the moment, it still seems that we’re in the pause period after the recent move up. Declines might follow but we haven’t really seen the beginning of that.

This is still the case. We have seen depreciation today (this is written around 10:45 a.m. ET) but the volume hasn’t really been strong. Bitcoin is now below $250, the move is down and we haven’t seen very significant action? What does this all mean? It might mean that we’re seeing sideways trading after the recent local top. Our best bet is on more indecisive action followed by a move down below $240. If we see more weakness, we might suggest hypothetical short positions.

On the long-term BTC-e chart, we still see Bitcoin below $250 and a possible trend line. Yesterday, we wrote:

(…) there has been no meaningful action to the downside. Bitcoin seems to be down from a possible local top but there is a possibility of a sideway move now. We would still prefer to see more signs of a possible move down before considering shorts.

We still haven’t seen enough action to consider shorts at the moment. Bitcoin seems to be tipping and it might be in for more depreciation but the situation doesn’t quite favor short positions at present.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.