In short: short speculative positions, $stop-loss at $247, take-profit at $153.

The cryptographic system underlying Bitcoin might be more adaptable to bank needs than could be generally believed, we read in a commentary by Bitcoin Magazine:

“A company like Goldman Sachs or JPMorgan is hesitant to rely or work with a financial network in which the people keeping it alive are essentially anonymous,” says Popper [a NY Times’ reporter] in a Forbes interview. “Banks have to know who’s transacting and flag it if someone suspicious is involved in the transaction. But it’s quite easy in Bitcoin to have an identity tied to an address in a way that would make a bank feel comfortable.”

(…)

Financial operators are attracted by blockchain-based financial networks with no single point of failure, which could keep running even if one of the participating nodes stops working or is taken out. They are also attracted by the relative speed and low cost of blockchain transactions.

(…)

But, according to Popper, Bitcoin remains a thorny issue for Goldman Sachs, JP Morgan and other top financial players. The problems are Bitcoin’s potential for anonymity, and the fact that the Bitcoin blockchain is “powered by thousands of unvetted computers around the world, all of which could stop supporting the blockchain at any moment.”

Popper reports that JPMorgan and other major banks envisaged a new blockchain that would be jointly run by the computers of the largest banks and serve as the backbone for a new, instant payment system without a single point of failure. The new blockchain, decentralized but closed, would offer the benefits of the current Bitcoin network without relying on end-users for its operations.

We wrote about IBM working on a similar non-Bitcoin blockchain some time ago. We also discussed Goldman Sachs and its investment in a Bitcoin startup. It increasingly looks like banks and other financial institutions are thinking on Bitcoin and that they are simply waiting for more technological solutions. If IBM or some other company comes up with an alternative ledger-based system that could be adapted for the needs of the banks, this might be the breakthrough.

Banks themselves are not very innovative institutions, at least not in terms of specific technology solutions. Because of that, they rely on other entities to deliver appropriate technologic infrastructure. The same may be the case with Bitcoin. IT companies might be working on distributed Bitcoin-based systems that would conform to banking security standards and would allow the financial institutions to avoid anonymity. IBM might be the first company working on such a solution – it is still unclear what final form the IBM research will take. We expect further to follow.

For now, we focus on the charts.

Yesterday, we wrote:

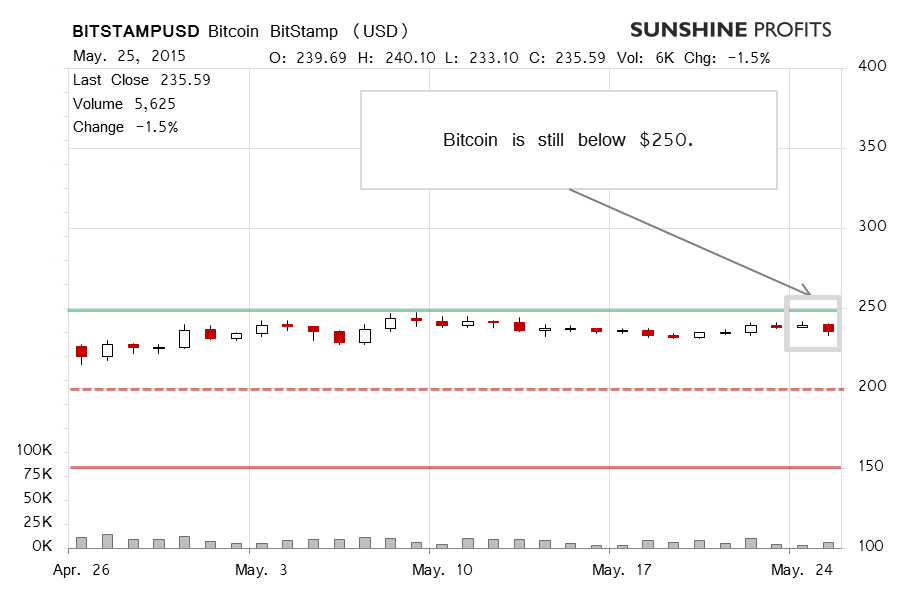

On BitStamp, we saw a move up on Friday. Bitcoin went above $240 and the volume was double the figure we had seen on the previous day. Afterwards, Bitcoin remained relatively stable around $240. Today (…), the currency depreciated, at the very lowest point completely reversing Friday’s gains, before it rebounded slightly. Currently, the currency is still in the red for the day. The volume, however, hasn’t been very strong. What does the Friday’s move mean for Bitcoin traders? Is a new move up underway?

It seems that this is not the case. The currency stopped short of $245 on BitStamp and there has been no more appreciation and no more significant jumps in volume. Quite importantly, part of Friday’s move up has been erased today, so far. Bitcoin is now further away from our $247 stop-loss level. The lack of more appreciation and the price/volume action now seems to support a move back in line with the longer trend, to the downside.

There was depreciation yesterday and on increased volume. Does this mean that the big move has already started? This might not be the case. The situation still looks very much bearish as outlined in our yesterday’s comments. The move, however, hasn’t been strong enough to suggest that a slump has started just now. This might mean that there’s still time to position oneself ahead of the possible move.

On the long-term BTC-e chart, we don’t see many changes compared with yesterday. In our previous commentary, we wrote:

Bitcoin is still below both $250 (green line in the chart) and the possible rising trend line, and the situation doesn’t look all that bullish. Actually, it seems largely unchanged from Thursday

(…)

(…)

(…) Bitcoin has come back since then [Friday], and the most recent move has been to the downside. It seems now that Bitcoin might actually be closer to a move down. The environment remains tense and observing the market particularly closely at this time might be a good idea.

As we haven’t really seen much change, it seems that our previous comments remain up to date and the short-term outlook remains bearish.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.