The price of Bitcoin is not all that matters in the Bitcoin community. Developments in the protocol and particularly in the ease-of-use and security departments are extremely important, in our opinion, for the success of the cryptocurrency. A new feature for the Bitcoin system, called Bitcoin Box, has recently come out. This is a kind of terminal that allows to process Bitcoin transaction without the access to the Internet, we read on CoinDesk:

A prototype cryptocurrency point-of-sales (POS) terminal called Bitcoin Box can process transactions without the need for an Internet connection. Instead it relies on Near Field Communications (NFC) and Bluetooth to enable payments.

The device has been developed by Hive developer Jan Vornberger, who said the customer simply needs to touch their smartphone on the device and it completes the transaction via Bluetooth.

(…)

Vornberger explained the benefits of offline bitcoin transactions:

“So far, most bitcoin POS solutions rely on simply having the customer broadcast the bitcoin transaction over the bitcoin network. This can be unreliable, as sometimes the shop system does not see the transaction immediately, resulting in delays.”

We’re very much interested to see how this evolves. If this really helps in speeding up the transaction times, it would be a significant step forward as far as the ease of paying with Bitcoin is concerned. One of the major problems with how Bitcoin transactions work today, apart from the lack of vendors accepting cryptocurrencies, is the fact that confirming a Bitcoin transaction might be lengthy process, making it very difficult for customers to pay with Bitcoin for goods and services just as they would pay using a credit card.

Even if the Bitcoin Box itself is not the device that will make Bitcoin payments a lot easier, we can expect to see this kind of technology, or technology inspired by it used in other kinds of extensions to the Bitcoin system.

For now, let’s focus on the charts.

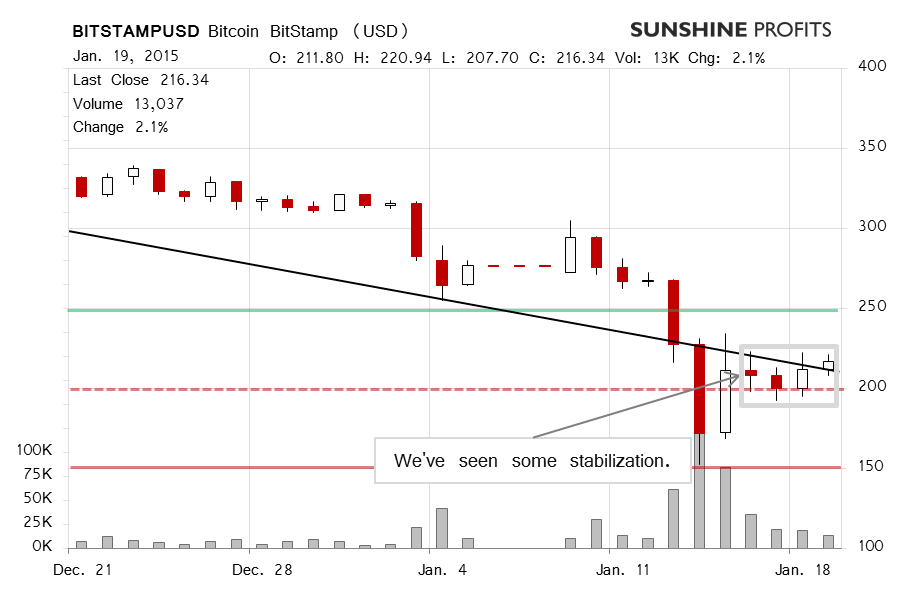

On BitStamp, we saw Bitcoin move above a possible declining trend line. This is a positive sign but it was only one day above the line and the volume was not very significant, at least not in comparison with the recent volatile moves. It was also lower than on the day before. Yesterday, we wrote:

There’s been some important clarification here. Bitcoin hasn’t really shot up like it did in April 2014 and the lack of a move up is, in our opinion, some indication that the market might actually still be weak in the short term. We think this tilts the short-term outlook to more bearish.

Today (…), the action on BitStamp has been muted – Bitcoin hasn’t moved much and the volume has been relatively weak. We still see the currency above $200 but below a possible declining trend line. Our best bet here would be a period of trading between $200 and $250 followed by a move down to $150 or even lower.

Bitcoin ended yesterday above $215, but today the move has been down to around $205 (this is written before 9:00 a.m. ET). The volume hasn’t been particularly strong or weak for that matter. The most bearish indication here might be that Bitcoin hasn’t really gone up so far and that the general trend seems to remain down. The most bullish indication is that Bitcoin has stayed above $200 but the move above the possible recent trend line might end up being erased today (this is far from certain, though).

On the long-term BTC-e chart, we saw Bitcoin on the move up but the move itself was relatively weak. There was no move above any trend lines visible on the chart. Bitcoin stayed above $200 (dashed red line in the chart) but the move was not very strong.

Today, the move has been down but the volume hasn’t been really strong. All of this seems to suggest that the recent move has already run out of steam. This points to lower Bitcoin prices in the weeks to come but the entry point for a short trade doesn’t seem to be here just now since the fact that Bitcoin has largely remained above $200. As such, the situation is still unclear enough, in our opinion, to open any speculative positions in the market.

Summing up, we don’t support any short-term positions at the moment.

Trading position (short-term, our opinion): no positions.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.