What to Expect

Sales are anticipated to rise by 0.2% in December, bucking the rather pessimistic two-month slump for the report previously. October sales declined by 0.8%, while remaining unchanged in November. And, there’s plenty of evidence that points to a likely gain.

According to the latest BRC-KPMG retail sales monitor for December, shoppers came out in droves to prep for the holiday season. The resulting momentum helped the UK economy to see a 1.5% uptick in total sales. Online sales help to holster the figure, rising by 17.8% in the month – the highest pace in a year. Individual shops were also referenced as seeing an 8% uptick in month over month sales.

Although the figures aren’t a direct barometer of what’s to come in the official report being released by the Office for National Statistics, they are reflective of overall spender optimism.

Things To Keep In Mind

At or Above 0.2% Gain. This scenario would be considered widely bullish for GBPUSD as it adds to notions that the UK economy is stabilizing. This will bolster the notion that the Bank of England will likely keep a floor on rates for the moment – leaving benchmark interest rates at the current 0.5%. With policymakers still gauging interest from the Funding for Lending measure, any bit of economic evidence that shows an improving economic outlook will help to delay the consideration.

Below 0.2% Gain or Unchanged. Although not devastatingly bearish, a below 0.2% gain would be considered pessimistic for the economy as it reflects waning consumer interest. The scenario would likely lead to consolidation in the pair ahead of the long weekend.

Below 0.2%. Bearish for pound sterling, should the report fall below 0.2%, it would spark speculation over a likely 25 basis point cut by the central bank. Even if the Funding for Lending measure remains functional, the decline in consumer spending is evidence enough that contraction continues to persist.

Outlook

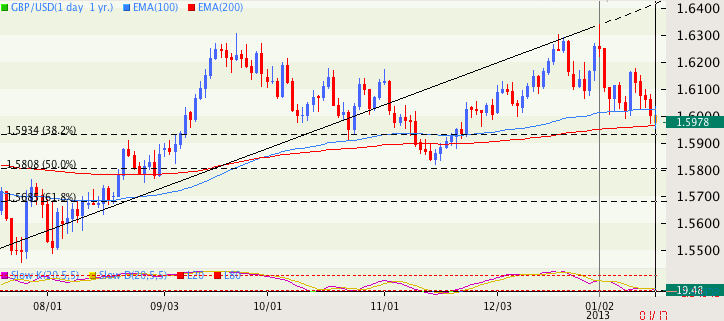

With GBPUSD falling over the last five days, support is now surfacing amid the 1.5950/1.5900 area. The region is being protected by 200-EMA support and 38.2% fib barriers. The confluence provides a formidable support level for bulls in the near term. However, a break below would open scope for a test of 1.5800.

Source: FXTrek Intellicharts

Source: FXTrek Intellicharts

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.