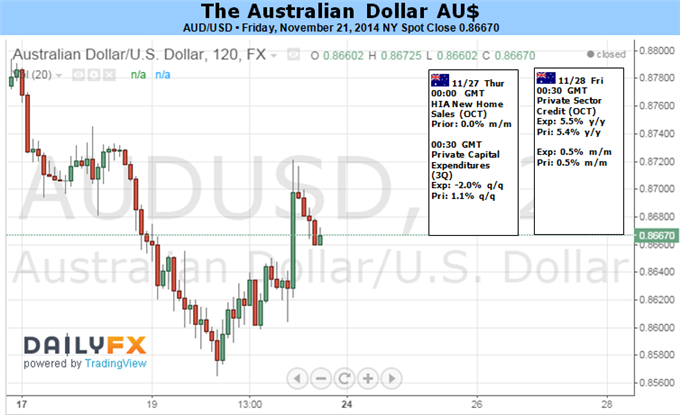

Fundamental Forecast for Australian Dollar: Bearish

- AUD/USD Suffers Intraday Volatility Yet Remains Above 2014 Low

- Scope For Gains Questionable As Elevated Volatility Caps Carry Demand

- Downside Risks Centered On Recent Lows Near The 0.8540 Mark

The Australian Dollar witnessed another week of intraday volatility, yet limited follow-through. Local economic data once again proved uneventful for the currency, amid well-anchored RBA policy bets. Indeed the latest Minutes reiterated the central bank’s preference for a “period of stability” for rates and offered few fresh insights into policy makers thinking.

Looking to the week ahead; local Capital Expenditure and New Home Sales data headline the domestic economic calendar. Rampant speculative lending in the housing market has been a concern for policy makers and has created a reluctance to cut rates further. However, the rather volatile upcoming home sales data is unlikely to materially alter the rate outlook. Similarly, it would likely take a significant surprise to the Capex figures in order to change policy bets. This in turn could continue to leave the Aussie to take its cues from elsewhere.

One of the biggest threats to the currency remains the potential for a further pick-up in implied volatility. Measures like the CVIX are near their peaks for the year suggesting traders are anticipating some large price movements amongst the major currencies. Such an environment generally bodes ill for the high-yielding currencies, who stand to outperform in low-volatility settings.

Meanwhile futures positioning suggests the wave of short-selling has turned into a trickle. Yet it remains off the extremes witnessed last year, suggesting more room may exist in the trade.

Downside risks for AUD/USD are centered on the 2014 lows near 0.8540, which if broken may set the pair up for a run on the July 2010 trough near 0.8320.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.