Fundamental Forecast for Australian Dollar: Bearish

- AUD/USD Downside Risks Remain Following Break of Long-Held Range

- Surge In Implied Volatility Threatens To Sap Carry Trade Demand

- Bearish Technical Pattern Casts The Spotlight On 90 US Cents

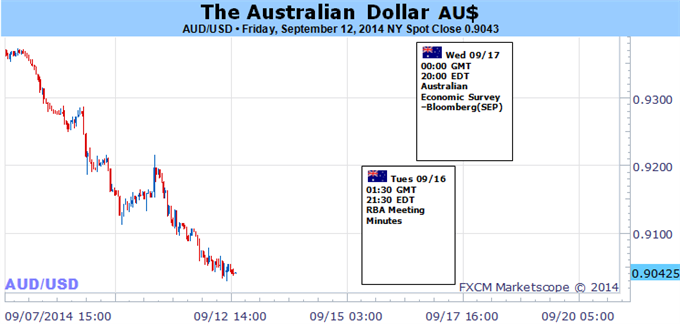

The dam wall may have finally broken for the Australian Dollar following the currency’s plunge below the 92 US cent handle. The long-held line in the sand for the AUD/USD was crossed amid a parabolic increase in FX market volatility and firming Fed policy tightening bets.

Over the coming week, a void of major local economic data alongside what is likely to be another rehashed set of RBA Minutes may leave the currency lacking catalysts to spark a recovery. The threshold for fresh news flow to yield a shift in sentiment is high, as demonstrated by the lackluster response from traders to the phenomenal Australian August jobs report.

On balance recent local data and rhetoric from the Reserve Bank reinforces the prospect that rates will remain on hold over the near-term. Yet the greatest risk posed to the Aussie is not from a shift in RBA policy expectations and a waning of its interest rate advantage. Rather the bigger threat has proven to be the looming return of general market volatility.

A persistent surge in expectations for large swings amongst the major currencies would make the Aussie’s relatively small yield advantage a much less attractive (and riskier) proposition. This may open the door to a mass exodus from carry trades that had built on anticipation of a sustained lull in market activity. Long positioning amongst speculators is at its highest since April 2013 according to futures data. Which suggests that once the floodgates open, they may be difficult to close.

From a technical standpoint the break of the 92 US cent handle and ‘head and shoulders’ pattern ‘neckline’ casts the spotlight on the psychologically-significant 0.9000 floor. - DDF

Refer to the US Dollar outlook for insights into how the USD side of the equation may influence the AUD/USD pair.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.