Fundamental Forecast for Australian Dollar: Bearish

- AUD/USD Downside Risks Remain Following Break of Long-Held Range

- Surge In Implied Volatility Threatens To Sap Carry Trade Demand

- Bearish Technical Pattern Casts The Spotlight On 90 US Cents

The dam wall may have finally broken for the Australian Dollar following the currency’s plunge below the 92 US cent handle. The long-held line in the sand for the AUD/USD was crossed amid a parabolic increase in FX market volatility and firming Fed policy tightening bets.

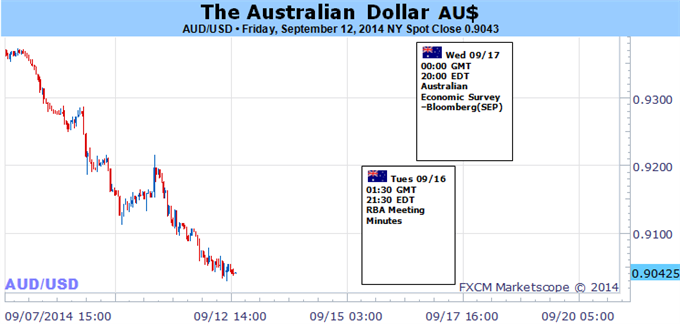

Over the coming week, a void of major local economic data alongside what is likely to be another rehashed set of RBA Minutes may leave the currency lacking catalysts to spark a recovery. The threshold for fresh news flow to yield a shift in sentiment is high, as demonstrated by the lackluster response from traders to the phenomenal Australian August jobs report.

On balance recent local data and rhetoric from the Reserve Bank reinforces the prospect that rates will remain on hold over the near-term. Yet the greatest risk posed to the Aussie is not from a shift in RBA policy expectations and a waning of its interest rate advantage. Rather the bigger threat has proven to be the looming return of general market volatility.

A persistent surge in expectations for large swings amongst the major currencies would make the Aussie’s relatively small yield advantage a much less attractive (and riskier) proposition. This may open the door to a mass exodus from carry trades that had built on anticipation of a sustained lull in market activity. Long positioning amongst speculators is at its highest since April 2013 according to futures data. Which suggests that once the floodgates open, they may be difficult to close.

From a technical standpoint the break of the 92 US cent handle and ‘head and shoulders’ pattern ‘neckline’ casts the spotlight on the psychologically-significant 0.9000 floor. - DDF

Refer to the US Dollar outlook for insights into how the USD side of the equation may influence the AUD/USD pair.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.