It all kicked off on Saturday with better than expected NBS Chinese Manufacturing PMI which was at 50.8 both better than expected but also higher than the previous month. This has helped the Aussie rally 30-40 points from Saturday mornings pre-release close but the relaity is that with such a big day of data we'll know by this time tomorrow which way the markets are headed.

Looking back on Friday's data it is clear in the US that consumers are struggling with a lack of wages growth. Indeed it seems the key behind the fall in US stocks and the worries that are gripping investors is that the talk of tapering in the Fed's purchases of bonds is at odds with the data that seems to be flowing in the US economy and a lack of self sustainability in the economic recovery. Take Friday's core personal expenditure data which was flat month on month and up only 1.1% year on year with the full numbers printing -0.3% and 0.7% respectively. Hard for a recovery based on consumers to continue when spending is stagnant or weak.

Remember the construction of GDP numbers requires the C+I+G+(X-M) grows each period otherwise GDP goes backwards and in that construction you can see why Q1 growth in the US was just 0.6% (2.4% annualised). Indeed over the weekend the head of the ECRI who said the US went into recession last year was on the hustings pushing his case asking the question of how spending is going to grow without income growth - it's a very good question.

Anyway at the close we saw stocks under pressure with US markets closing on their lows with the Dow down 1.36% or 209 points at 15,116, the S&P 500 was in our support zone at 1,631 down 23 points or 1.42% and the Nasdaq was 1.01% lower. In Europe the FTSE dropped 1.11%, the DAX was 0.61% lower and the CAC fell 1.18%. In Italy stocks were down 0.79% while in Madrid they fell 1.33%.

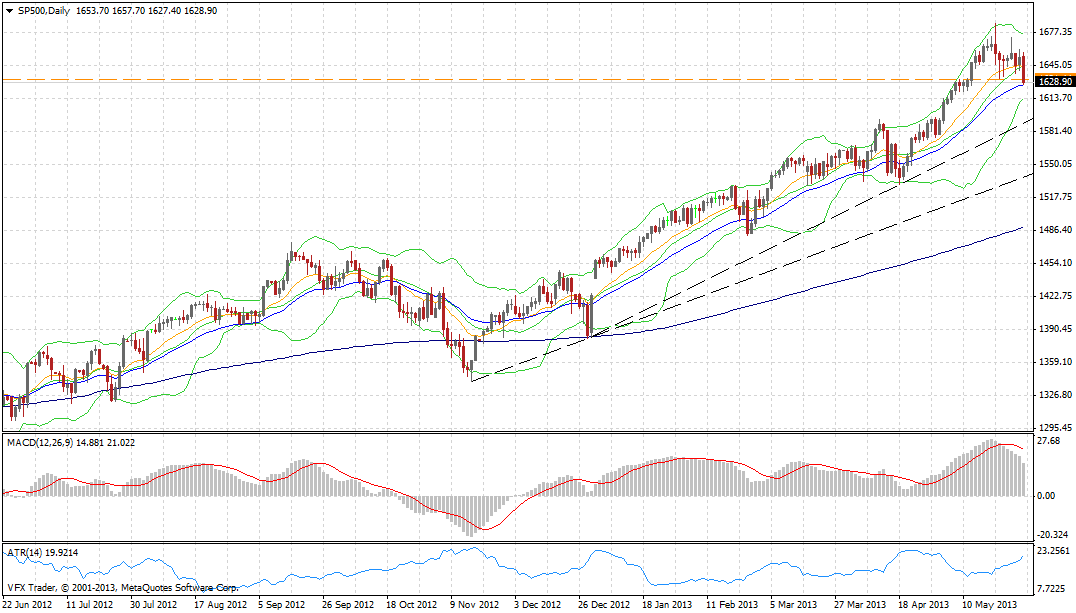

As you can see in the S&P 500 chart from my VantageFX MT4 platform the S&P is in the support zone I have highlighted recently and a break of 1,620 opens up a 40+ point retracement. Based on my usual trading style and system the S&P is headed lower.

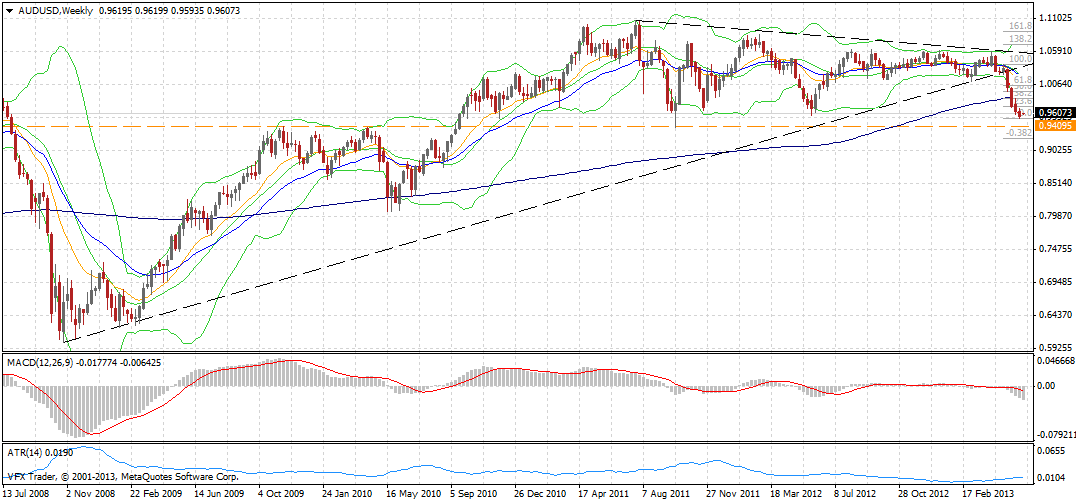

on the Australian dollar it is a bit of a messy open this morning and the 7am open of MT4 has been a bit frantic with Aussie trading a 20+ point range already. The Main thing I would say about the Aussie Dollar is that we now know there is plenty of selling in front of 97 cents and whether or not that selling remains will largely depend on the data flow for the week - the weekly close below 96 cents however was pretty weak but closing in on very important support.

Key levels are 0.9525 and then 0.94 on the bottom side with 0.94 massive support. Topside it is 0.9780 and then 0.9870 the latter of which is just a garden variety 38.2% retracement off the recent low. The dialies continue to suggest that the Aussie will find support in this 0.94-95 region for the moment.

Elsewhere in FX land the Euro has two levels to watch if either 1.3070/80 or 1.2840 give way. And USDJPY - well its almost tested support I was looking for at 99.90/100 with a low of 100.21 overnight but this zone is key. If it breaks it could get very interesting for both the USDJPY and the Nikkei.

On Commodity markets Nymex crude fell 1.75%, gold was off 1.34%, silcver fell 1.97% and copper was down 0.65%. Corn, wheat and Soybeans were up 1.18% and then 0.95% and 0.97% repectively.

Data

A heavy data load on Today which sees the release in China of non-manufacturing PMI and the HSBC manufacturing PMI, TD inflation in Australia as well as Australian Gross operating profits, retail sales, the RBA Commodity index and then it is onto Europe and the US with the Markit Manufacturing PMI's.

Twitter: Greg McKenna

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.