It was all about USD/JPY on Friday as an overly long market started to book profits ahead of the traditional August holiday period. Copper prices fell heavily after inventory data out of China but this had little impact on currency markets. Equity and debt markets were very steady.

Japanese retail sales data is the only release of note on the economic calendar and this normally has little influence on the Yen. We can expect a fairly quiet session today ahead of some big risk events in Europe and the US later in the week.

USD/JPY fell below 98.00 earlier this morning in thin interbank trade as the market went chasing stops. This pair has fallen quite sharply from 100.25 and we should expect support levels to be very firm below 97.50 through 97.00. Volatility is likely to stay high and this pair looks like the perfect vehicle for day traders.

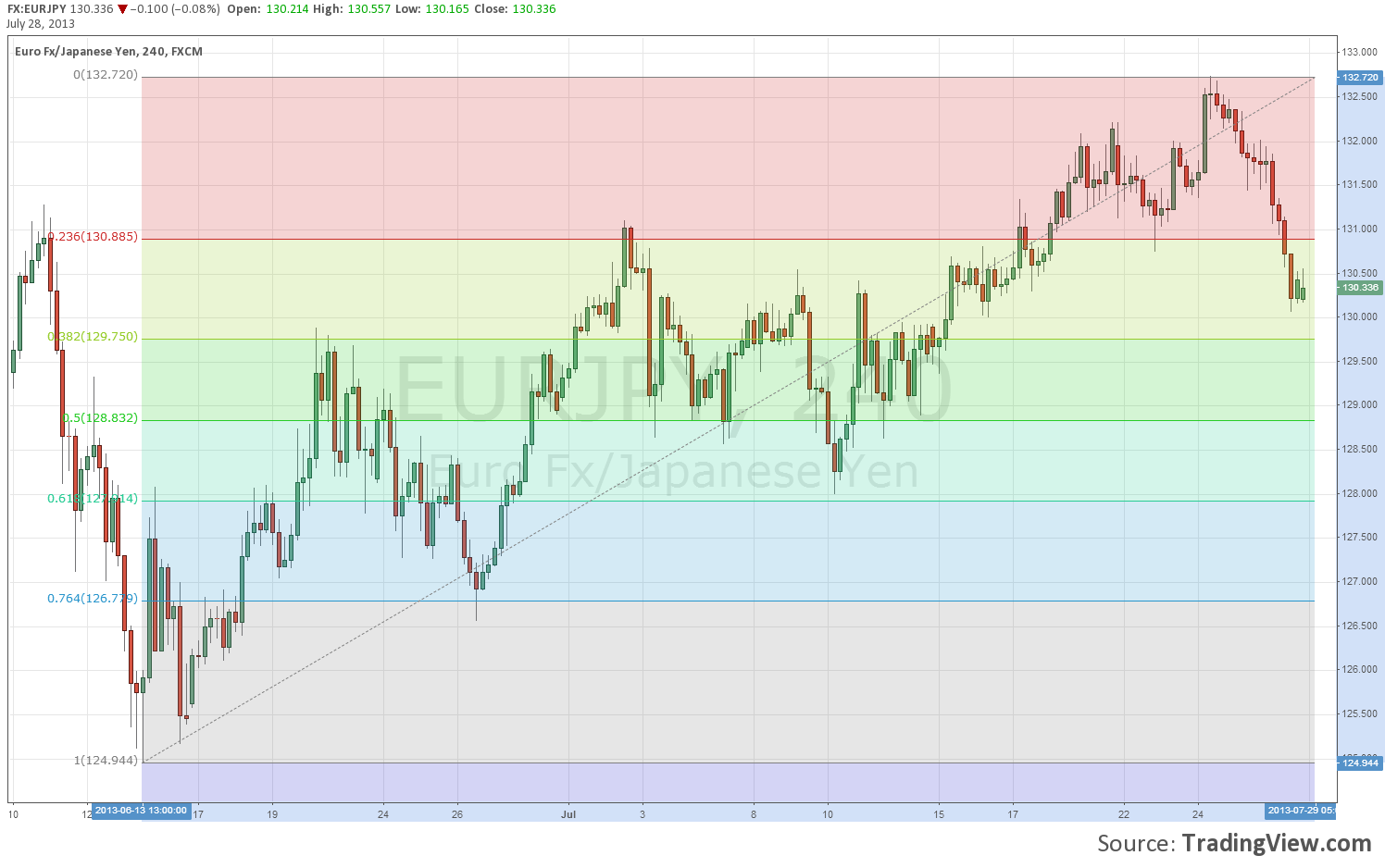

EUR/JPY will find technical support near 129.75 with resistance levels now starting at 130.75.

AUD/JPY still looks to be in sideways consolidation between 90.00/93.50 so play the edges of this range.

AUD/USD is trying to form short-term support now near .9230 and the bulls will try to build a base for an attack on important medium-term resistance levels .9330/50. Stops are reportedly quite large above .9350 and the fact that the AUD didn’t react to the lower copper prices does suggest that the bears are getting tired.

EUR/USD is chopping sideways between 1.3250/1.3300, with short-term USD buying being balanced by EUR selling on the crosses. The medium term target here is 1.3400/20 and only a clean break above there will alter the range-trading mode.

EUR/GBP looks mildly bullish whilst above .8550 but EUR/CHF is grinding lower again and frustrating the many CHF bears.

Good luck today.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.