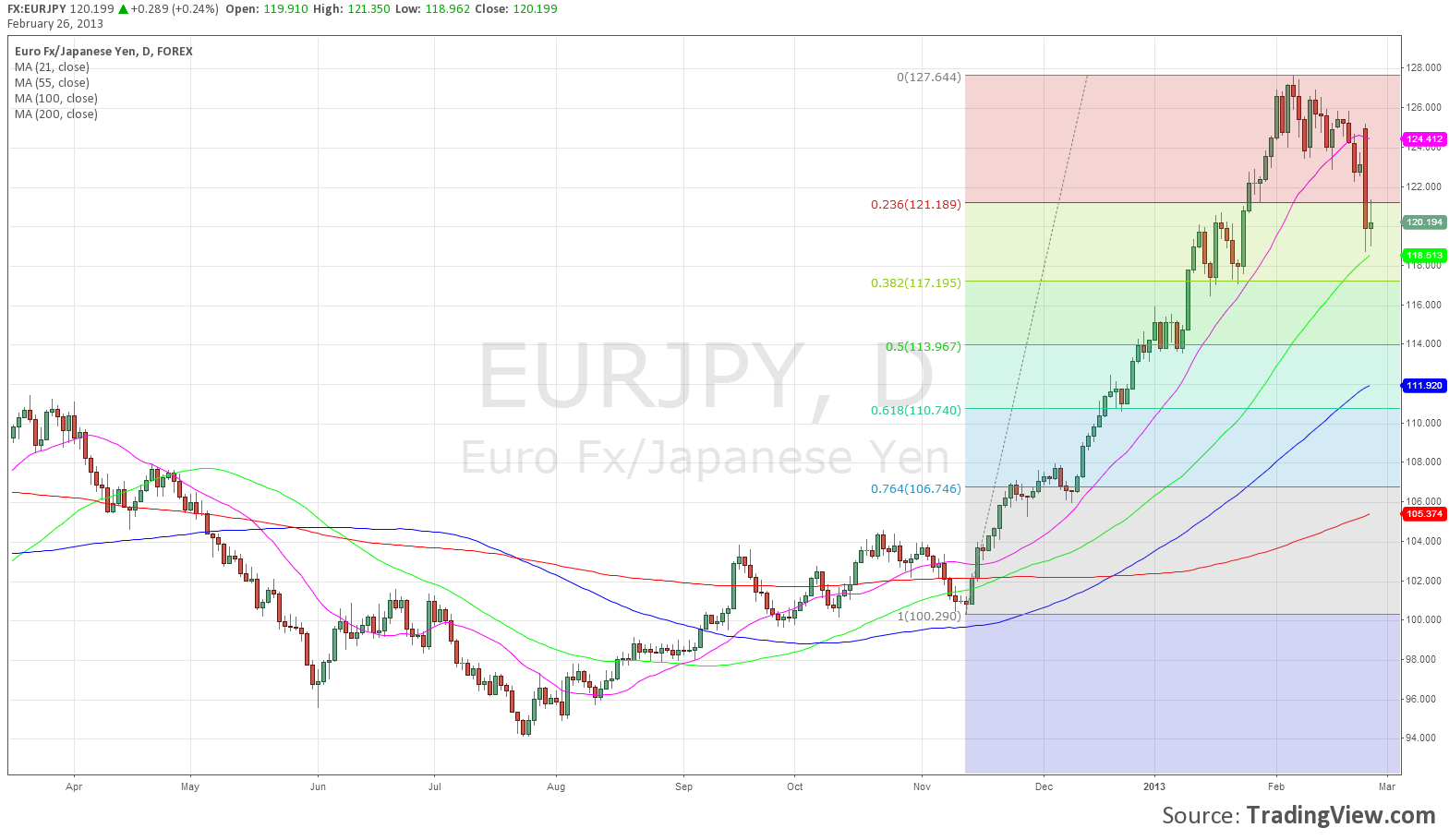

After some wild panic yesterday, particularly in EUR/JPY, the market has steadied and the heavy month-end flows have started to ease. Banks report that an almost perfect storm of EUR sales caused the panic, which then snowballed into trailing stops upon more trailing stops.

After some wild panic yesterday, particularly in EUR/JPY, the market has steadied and the heavy month-end flows have started to ease. Banks report that an almost perfect storm of EUR sales caused the panic, which then snowballed into trailing stops upon more trailing stops.

It’s fairly quiet again on the economic calendar in Asia, with NZ trade data and Japanese retail sales to provide some interest.

EUR/JPY looks to be in retracement mode with a target at the 38.2% Fibo level near 117.20 (see chart). Resistance levels start at yesterday’s highs near 121.30 and get stronger near previous support at 122.30.

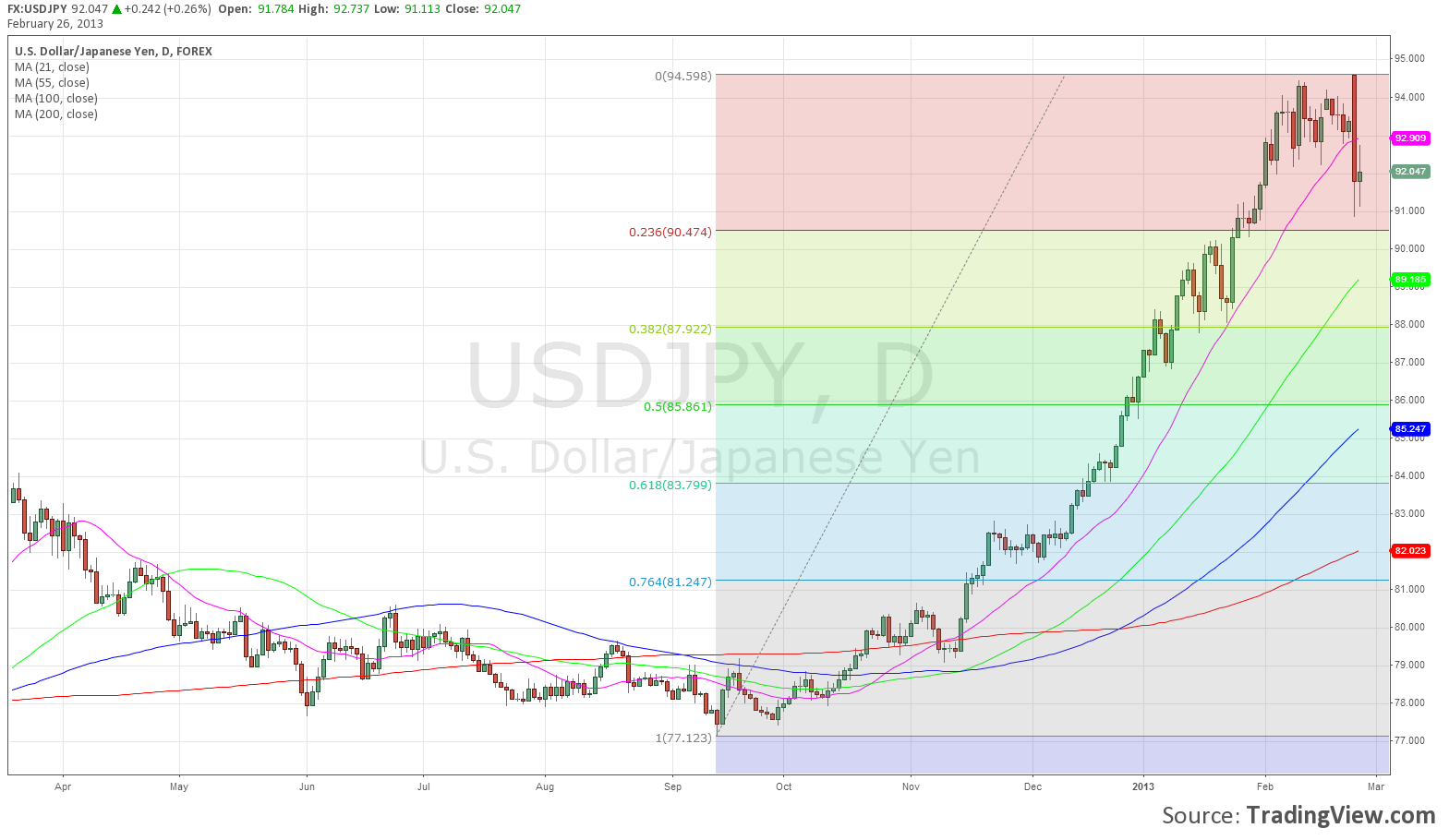

USD/JPY looks like it may have posted an interim top now above 94.50 and the danger is for a retracement back towards 88.00 (see chart) in coming weeks. The overall trend remains bullish so dips should still be seen as buying opportunities.

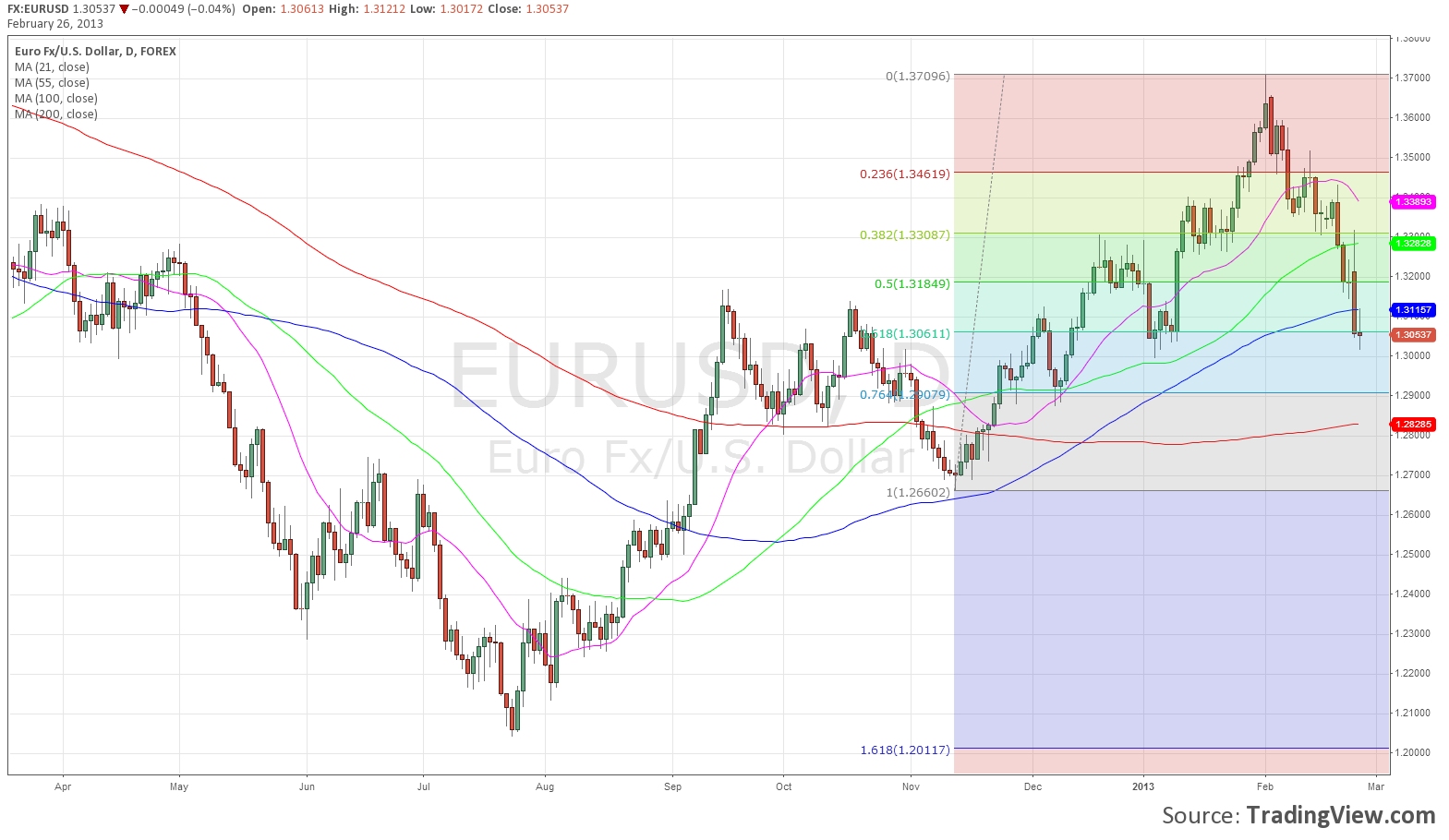

The break in EUR/USD below Fibo support at 1.3060 (see chart)hasn’t really been confirmed so I’m cautious in declaring that support has broken. The shorter-term MAs have turned bearish but overall I think we need a bit more information here. Sovereign names were noted buyers near 1.3020 overnight lows.

EUR/CHF held the trendline support level near 1.2125 (see chart) but the recent up-trend has totally lost momentum. Resistance levels begin at previous support near 1.2260 and I would play the edges of this range for now.

AUD/USD traded down to 1.0200 overnight, where barrier protection and Sovereign buying interest was noted. Hedge funds and Macro Funds were the main sellers. Any further losses are likely to be slow with more optionality and asset manager support seen at 1.0150 as well.

Cable failed above 1.5200 as EUR/GBP finally hit a pocket of support near .8575. More optionality is reported in the cable at 1.5050 and this level may well prove magnetic in coming sessions.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.