EUR/JPY volatility is sure to remain high and I think we could easily get 200 pip moves in either direction. Any dips towards the trend channel base near 118.00 (see chart) are likely to attract plenty of buyers but with the market already quite short of Yen(and maybe getting a bit unsure of the EUR), any decent rallies will bring the profit takers flocking. I’d play a 118/122 range and be ready for plenty of swing trading.

USD/JPY has steadied near 90.00 and most of the interest has been in the cross pairs in recent times. The up-trend does seem to be slowing down here so I suspect that we may be a bit overbought near current levels (see chart). I’m looking to play an 88.50/90.50 type range but certainly do prefer buying the big-dip play.

EUR/USD is on the sidelines, being driven by cross plays in EUR/JPY, EUR/CHF, and EUR/GBP. I’m pretty confident that we are still in medium term range trading mode inside a broad 1.30/1.36 range so plenty of patience is required for the pure EUR/USD trader.

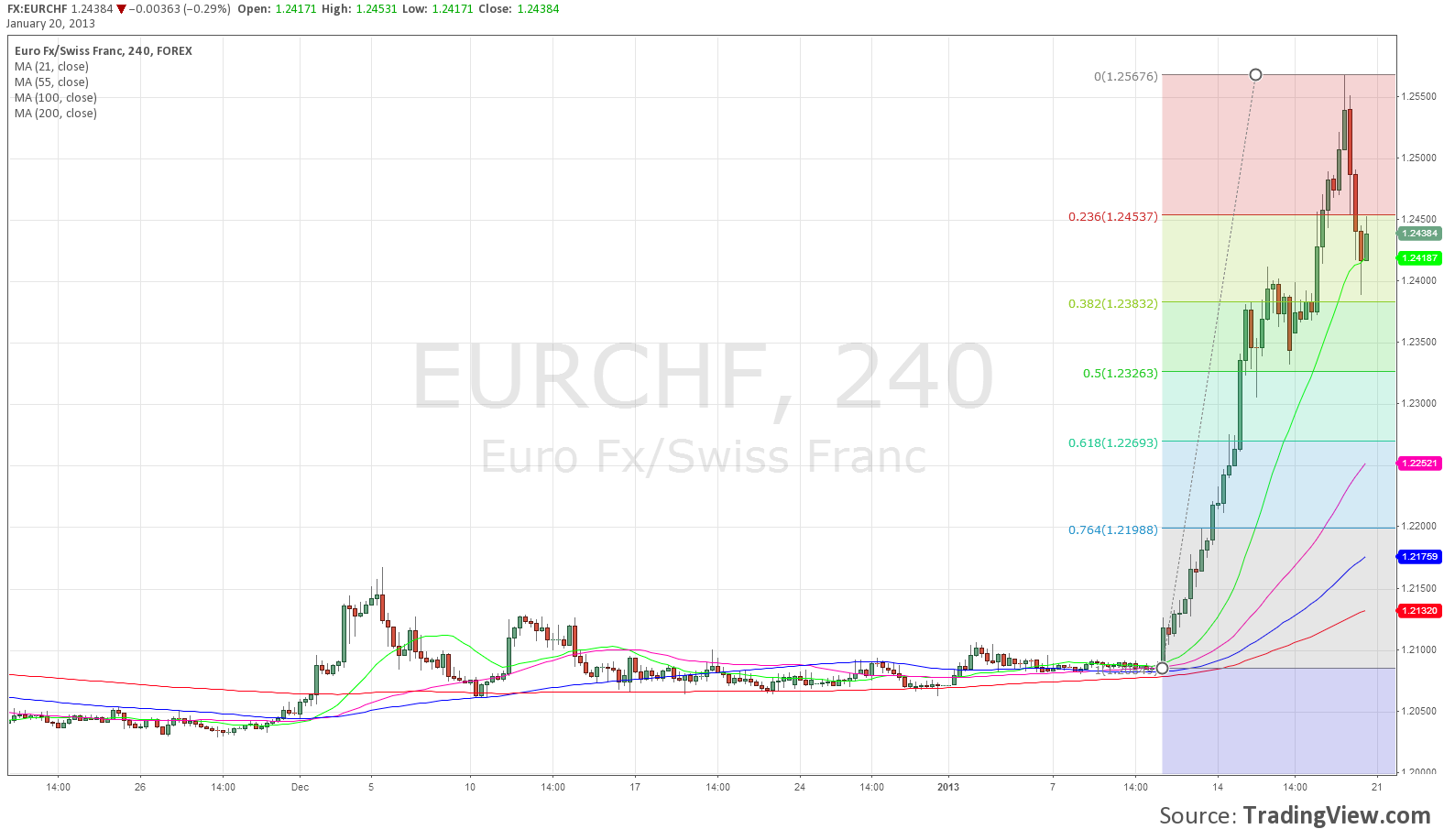

EUR/CHF got hit with a sharp bout of profit taking, falling from 1.2565 to 1.2385. This was a 38.2% retracement (see chart) so it will attract buyers now as well as trailing stops below. I’d look for a few sessions of consolidation inside of this range.

Cable got hit hard on Friday, with the double-whammy of continued EUR/GBP strength as well as a stronger USD. This pair has been range trading for so long now that I’m wary of getting overly bearish near range lows, but caution is certainly warranted when GBP sentiment starts to turn sour. As the old adage goes, “it’s never too late to sell sterling!”

The AUD is sidelined and still playing a 1.0450/1.0600 range, with most interest elsewhere.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.