The AUD has been on the sidelines over the last few days with the market’s focus elsewhere. AUD/USD has traded in pretty tight 50 pip ranges but that might change today when we get the jobs data. There is very large selling interest near 1.0600 and stops immediately above 1.0605, so these levels are certain to keep dealers nervous.

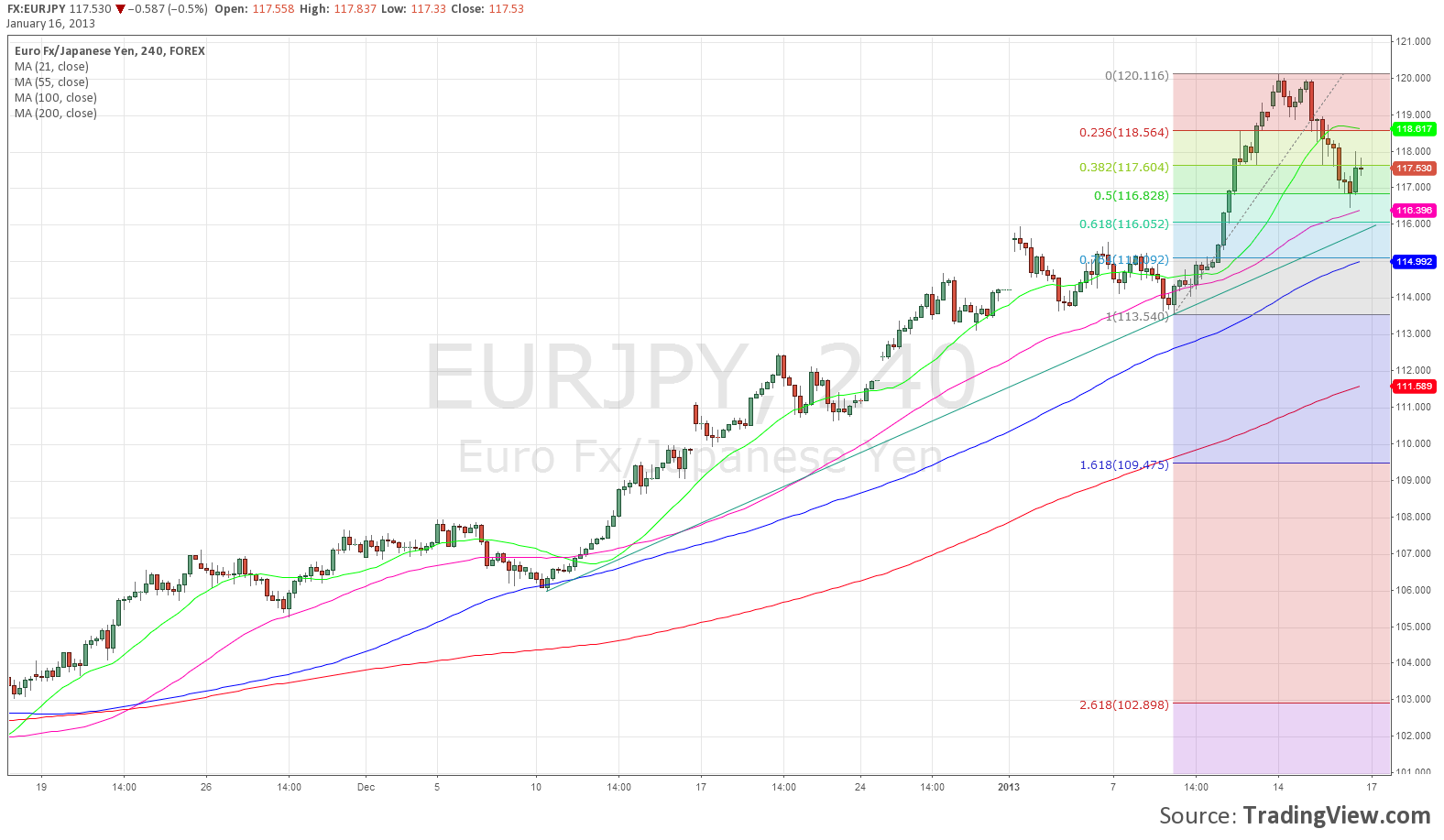

EUR/JPY looks like it wants to test a 61.8% retracement level at 116.05 (see chart) and that is the bears most immediate target. With an interim top in place at 120.00, any rallies towards that level will attract plenty of profit takers. I’d play as close to the edges of this range as possible, with a bullish bias in line with the recent dominant trend.

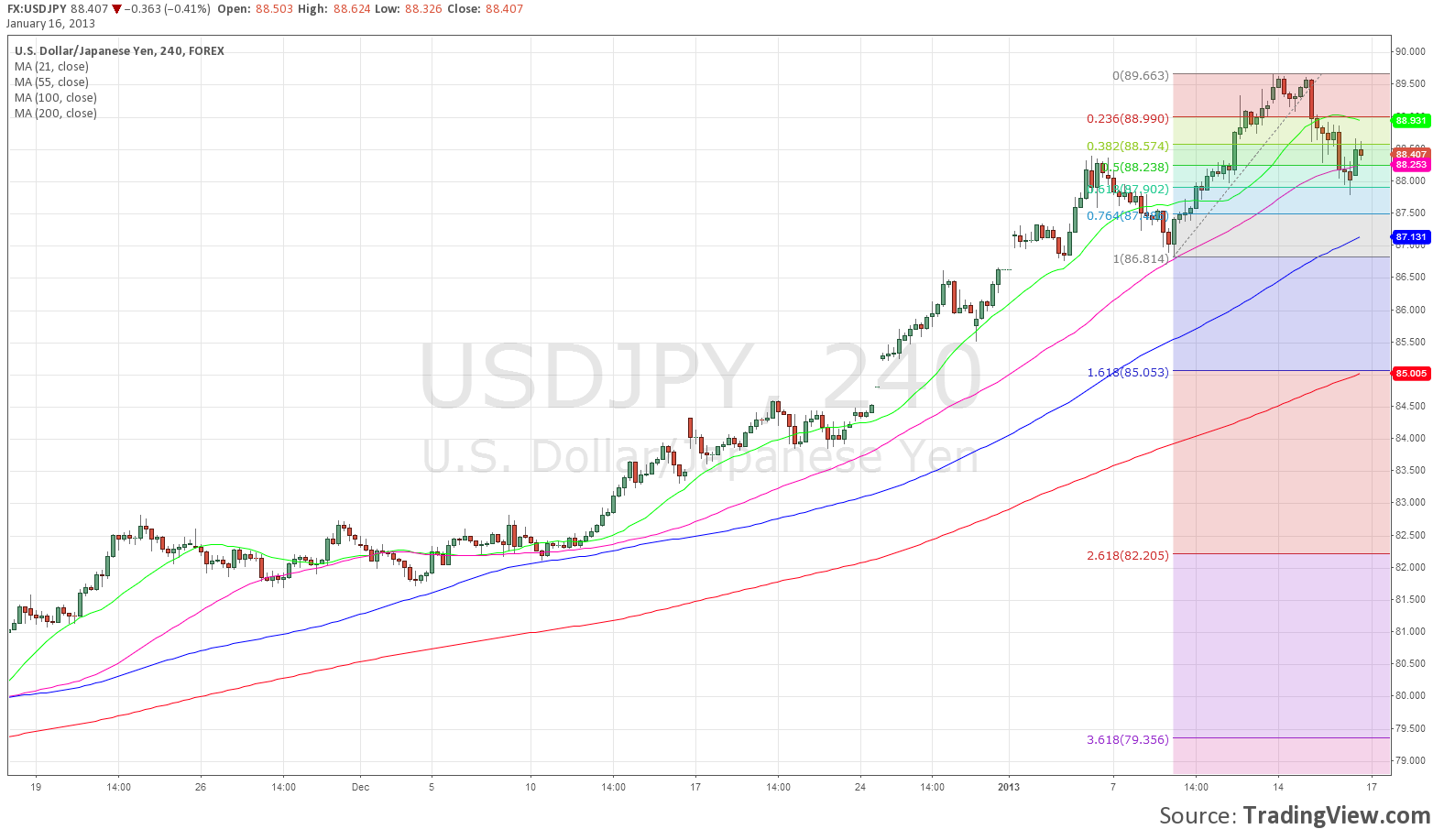

USD/JPY is also in consolidation mode and it may well be that we fit into an extended 85/90 range just as the Japanese officials are calling for. The 4-hour chart is still overbought (see chart) but starting to ease and I prefer a period of range trading here, possibly 88.00/89.50 in the short-term.

EUR/USD is being totally dominated by flows in the crosses, falling yesterday when EUR/JPY profit-taking emerged but then bouncing when EUR/GBP and EUR/CHF dip-buyers emerged. I very much expect this trend to continue for the next few sessions. Sovereign and real-money buyers are reported at 1.3250/60 with plenty of trailing stops now below 1.3240.

Cable fell in early European trade on heavy GBP/CHF flows and there is talk of large orders on the 1.59 handle, with buyers at 1.5930/45 and stops below 1.5900.

EUR/CHF is still being magnetically drawn towards massive optionality at 1.2500 in my opinion.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.