Good Morning Traders,

As of this writing 5:45 AM EST, here’s what we see:

US Dollar: Up at 81.720, the US Dollar is up 185 ticks and is trading at 81.720.

Energies: September Crude is down at 97.35.

Financials: The Sept 30 year bond is down 5 ticks and trading at 139.08.

Indices: The Sept S&P 500 emini ES contract is up 14 ticks and trading at 1936.00.

Gold: The August gold contract is trading up at 1311.40 and is up 17 ticks from its close.

Initial Conclusion

This is not correlated market. The dollar is up+ and oil is down- which is normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and the US dollar is trading up which is not correlated. Gold is trading higher which is not correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly higher with the exception of the Shanghai and Singapore exchanges which traded down fractionally. As of this writing Europe is trading mainly higher with the exception of the German DAX and Paris exchanges which are trading lower. This is because the German Zew numbers came out that were disappointing.

Possible Challenges To Traders Today

NFIB Small Business Index is out at 7:30 AM EST. This is not major.

JOLTS Job Openings is out at 10 AM EST. This is major.

Federal Budget Balance is out at 2 PM EST. This could affect afternoon trading.

Currencies

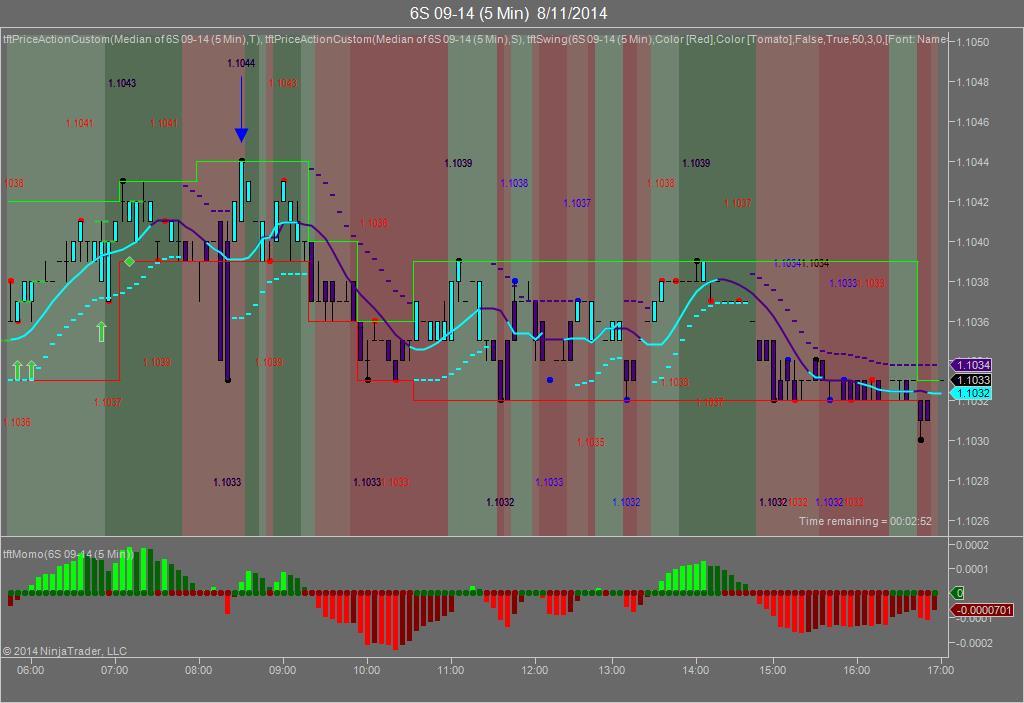

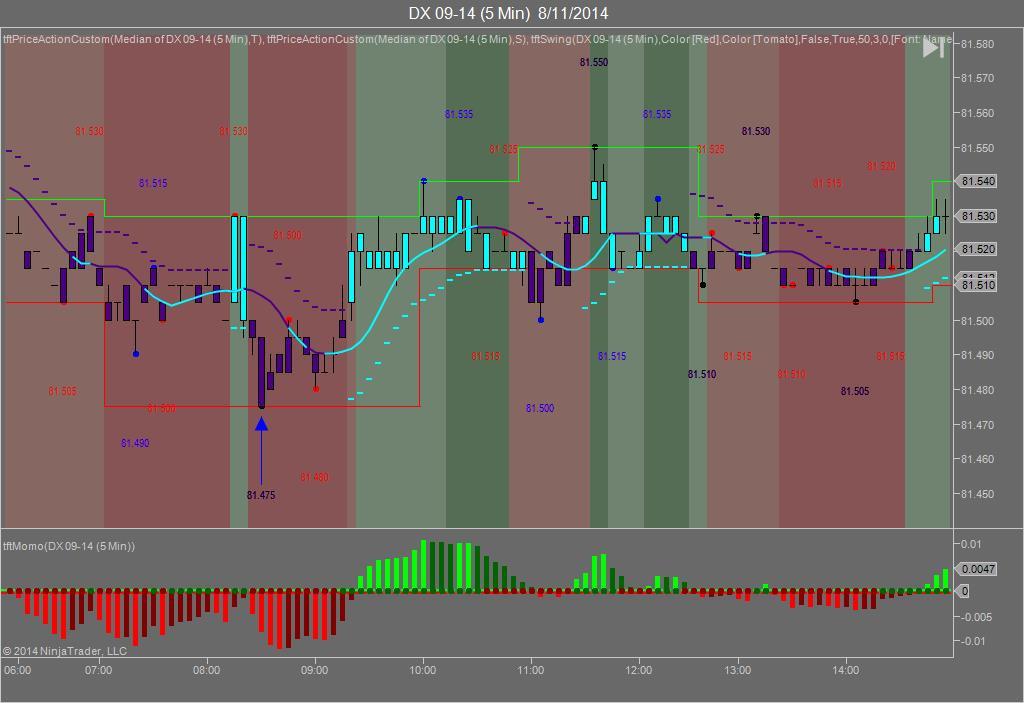

Yesterday the Swiss Franc made it’s move at around 8:30 AM EST with no economic news in sight. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 8:30 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at 8:30 AM EST and the Swiss Franc hit a high. I’ve changed the charts to reflect a 5 minute time frame and added a Darvas Box to make it more clear. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 10-12 ticks on this trade. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the upside as the markets were correlated that way. The Dow gained 16 points and the other indices gained ground as well. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday the markets for no other reason other than the markets were correlated that way. There was no economic news to speak of and unlike Friday, we had no geopolitical hoopla to drive the markets in one direction or another. All in all a quiet day to be sure, but a predictable one. Yesterday morning the Asian markets were up, the European markets were up and the Bonds were pointed down which bodes well for an upside day. It didn’t hurt that it was reported that the rebels in the Ukraine want a ceasefire. Russia reportedly wants to be the umpire in such a scenario however the Ukraine government shot that down as they suspect the Russians of a hidden agenda. You can’t really blame the Ukrainians as it would be liken to letting the fox in the hen house. Today we have the JOLTS Job Opening numbers and we consider it to be a major report and certainly a market driver. The last two reports did move the markets so it’s something to be mindful of if trading today.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.