Good Morning Traders,

As of this writing 5:35 AM EST, here’s what we see:

US Dollar: Down at 80.110, the US Dollar is down 60 ticks and is trading at 80.110.

Energies: Aug Oil is down at 102.78.

Financials: The Sept 30 year bond is up 4 ticks and trading at 137.07.

Indices: The Sept S&P 500 emini ES contract is up 17 ticks and trading at 1962.00.

Gold: The August gold contract is trading down at 1337.20 and is down 20 ticks from its close.

Initial Conclusion

This is not correlated market. The dollar is down- and oil is down- which is not normal and the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are higher and the US dollar is trading down which is correlated. Gold is trading lower which is not correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly lower with the exception of the Shanghai and Singapore exchanges which traded higher. As of this writing all of Europe is trading higher.

Possible Challenges To Traders Today

Federal Budget Balance is out 3 PM EST. This could affect afternoon trading.

Lack of major economic news.

Currencies

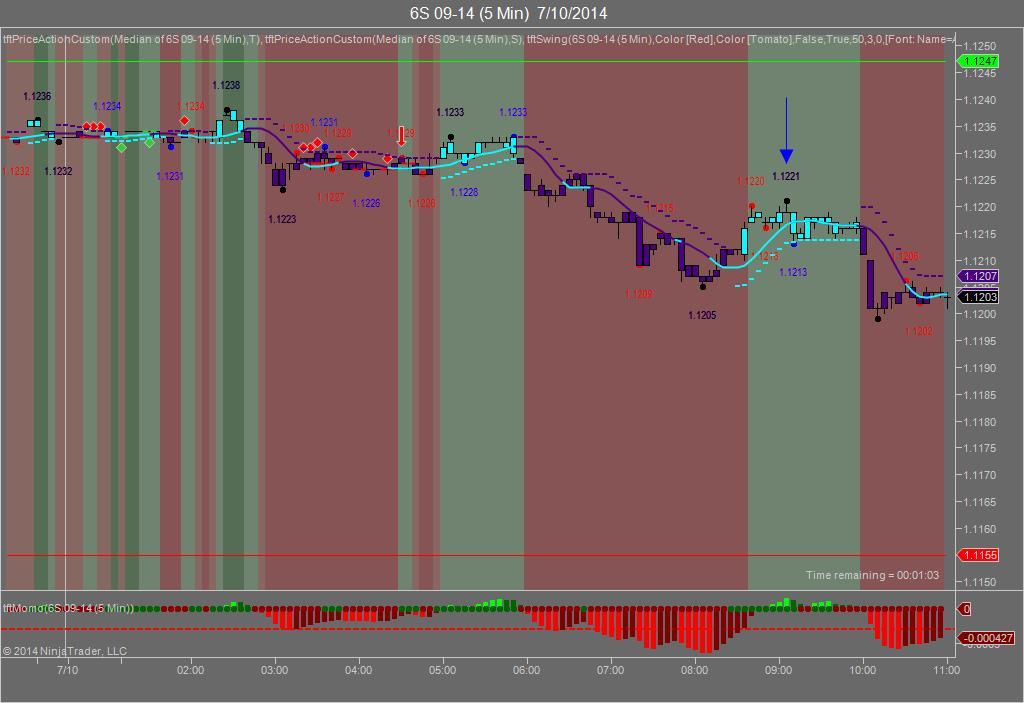

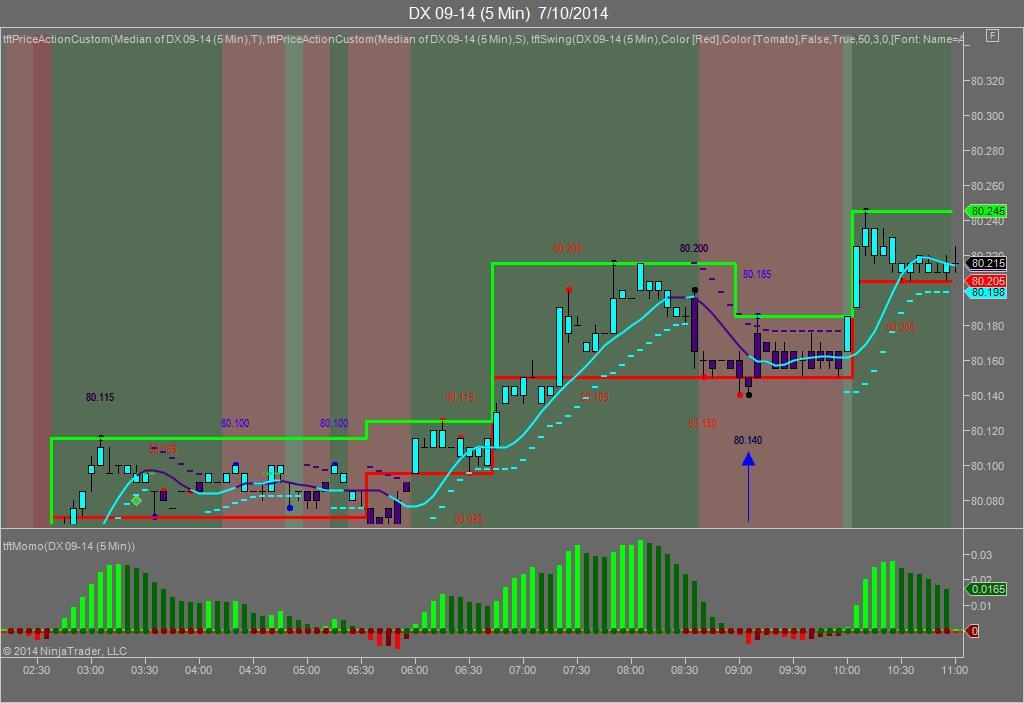

Yesterday the Swiss Franc made it’s move at 9:05 AM EST after the Unemployment Claims came out. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at 9:05 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at 9:05 AM EST and the Swiss Franc hit a high. I’ve changed the charts to reflect a 5 minute time frame and added a Darvas Box to make it more clear. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 15-20 ticks on that trade. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the downside as the markets were correlated as such. The Dow dropped 71 points and the other indices lost ground as well. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was to the downside as the markets were correlated as such yesterday morning. Unemployment Claims came in better than expected but that wasn’t enough to propel the markets forward. My thought is that everyone realized that if the Fed stops QE in October it will mean interest rate hikes sooner as opposed to later. Janet Yellen has stated publicly earlier this year that her definition of a “considerable amount of time” is 6 months after QE is completed which means April as opposed to June, 2015 like everyone thought it would be.

In other news it seems that Portugal’s Banco Espirito Santo (Holy Ghost in English) is having financial difficulties which in no small part led to European markets fall yesterday. Already there is talk of a debt/fiscal crisis reminiscent of 2012. I think it’s too early to call that right now but a telltale sign would be if the IMF steps in to alleviate the situation. Time will tell…

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.