Considerable attention has been directed towards the EURGBP pair as the pound suffered the immediate consequences of referendum last week. Technically, why should we care? Sooner or later, greater attention will begin to turn towards the potential consequences for Europe. At that point, will the Euro be able to maintain its lead on British Pound? The charts are suggesting some very interesting things indeed.

The first thing to note is in Figure 1, where we observe simple resistance in play. Prices have just pierced a declining trendline, and at this stage there is a chance that it is a false breakout. The popular cry is always that “this changes everything”, but from a pure reward-for-risk standpoint, it is always less risky to assume that a break of a long term trend is false, and that the trendline break will generate at least a tradeable short term bounce.

Figure 1: EURGBP’s Monthly Chart – Resistance in Play

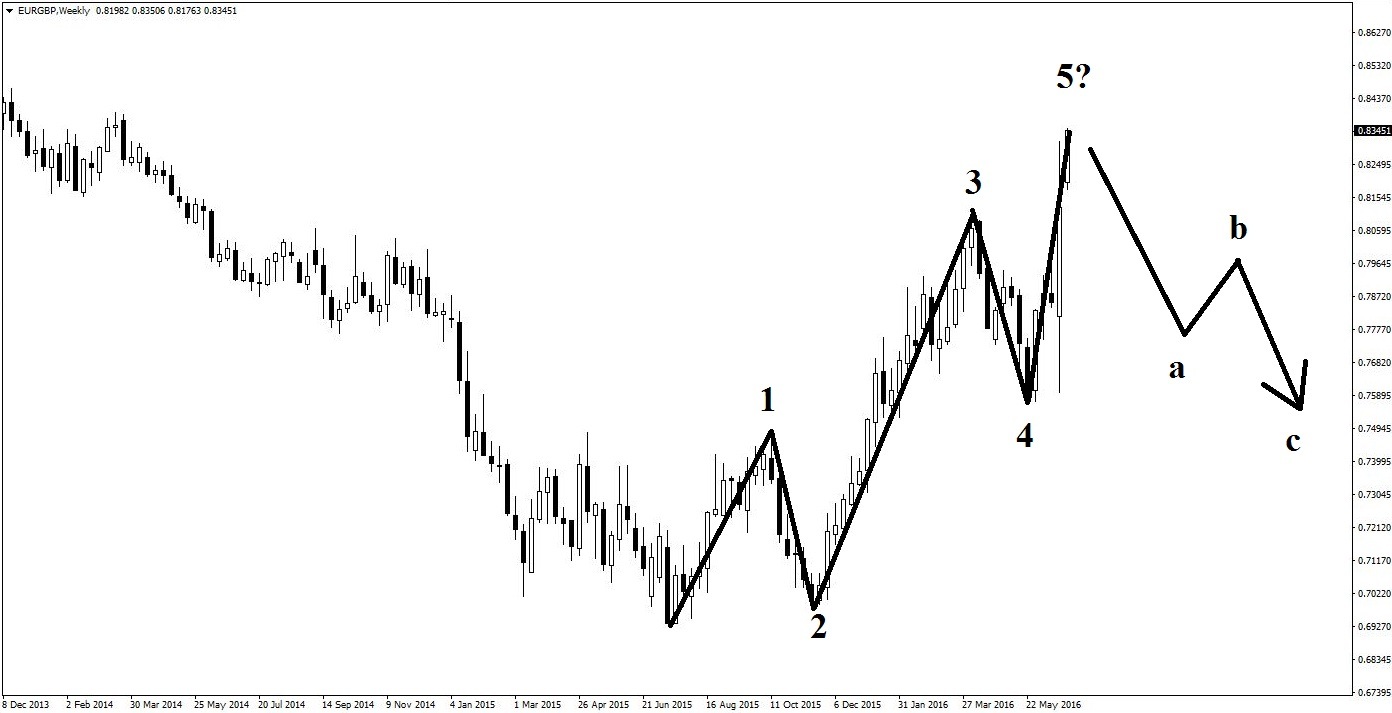

The weekly chart shows that in spite of the panic, prices are continuing to exhibit fairly common price behaviour, as shown in Figure 2. Those familiar with the behavioural theory that is encoded in the Elliott wave principles will recognise the 5-wave pattern forming that signals a potential temporary end to an upwards trend. Price has already made a new high, and that is usually a sign that a deeper retracement may occur.

Of course, those who also watch for cycles in the market will note the ferocity of the upward drive. It is momentum that is not to be underestimated, for further acceleration could cause this potential wave 5 to extend into a much larger trend. So which will occur? We do not know, and that is the point. Trading is about positioning oneself with minimal risk for maximum possible return. The point of greatest fear and/or greed is also usually the point of greatest return. In this case, to bet on the trend continuation would be an entirely valid bet, assuming prices fell sufficiently to justify this scenario. However, it is more likely that the immediate trade is the counter-intuitive, and indeed the countertrend one, as prices rise to hit invisible barriers of resistance.

Figure 2: Elliott Wave Counts on the EURGBP Weekly Chart

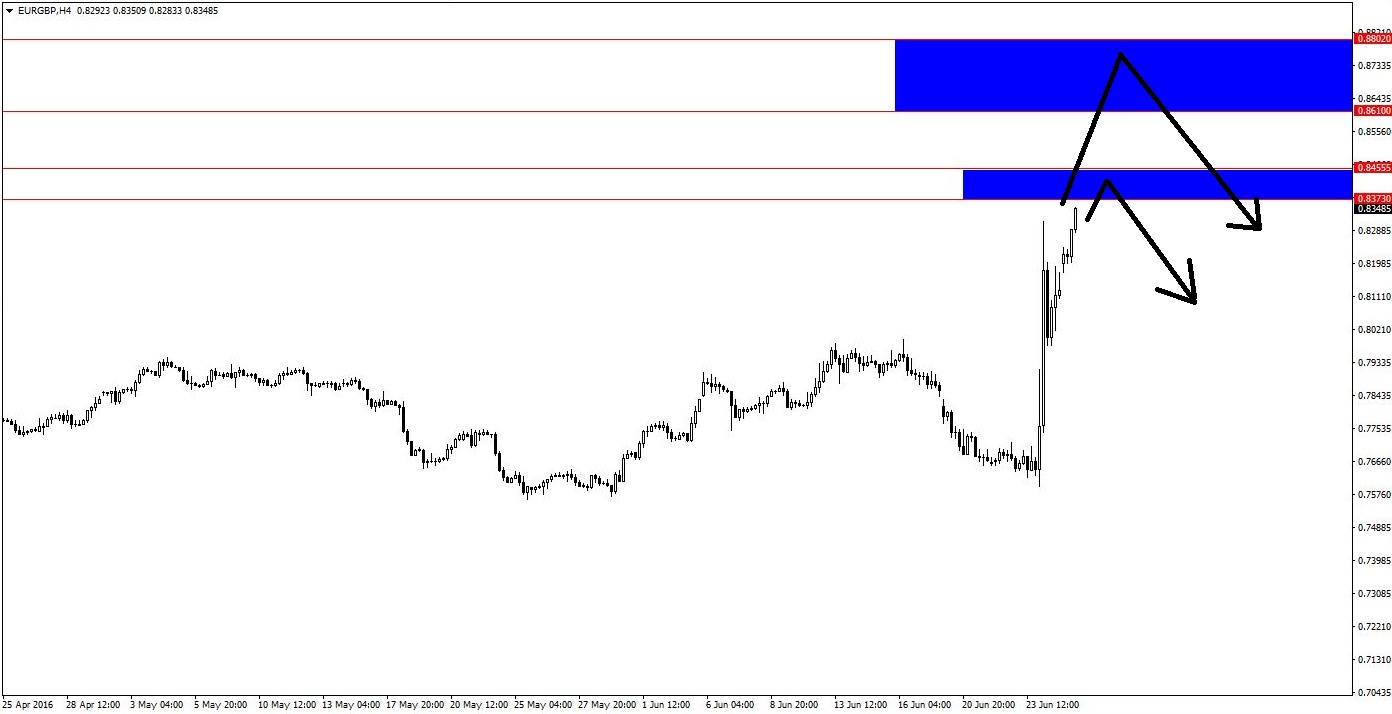

So the question that remains is what constitutes an adequate barrier. Figure 3 shows where confluences of technical resistance are, and there is a potential Blue Box ceiling just overhead at 0.8373-0.8455. The next Blue Box ceiling is further up at 0.8610-0.8802.

Figure 3: Countertrend Scenarios with Blue Boxes Coming Up

As this is a decidedly countertrend scenario on the daily chart at this point, we would aim to get in on smaller risk. The objective would be to enter a trade with as small a stop loss as possible so that the move captured would potentially be more lucrative. Thus, the four-hourly is likely to be the best opportunity for the trade. This is shown in Figure 4 below.

Figure 4: The Four-Hourly Chart is Likely to Provide the Best Trade Setup

Traders should look for appropriate opportunities to enter as price reaches these Blue Box zones. Any sign of momentum reversal could turn into a trade opportunity. Each trader should consult his or her own trading rules as to what a valid reversal would be. We would favour divergence entries in particular for this scenario, especially for the first Box, although some variety of candlestick pattern trigger might well work as well. Once in the trade, the objective would be to scale out quickly in case the uptrend continues, and then to leave a smaller portion of the trade to ride the potential trend reversal.

RISK DISCLOSURE: Trading foreign exchange (FX) and contracts for difference (CFD) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in FX or CFDs you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with leveraged trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.