It seemed that the Zloty will be regaining value after a period of depreciation. Well, reality was different. Worse than expected macro data from the US forced analysts to think that the Fed might not be tightening its monetary policy so soon as they were expecting. The USD lost some ground against the Euro and such depreciation had its effect on global markets. In Poland, the major issue (still) remains the possibility of rating agencies (Moody’s and Fitch) to lower Poland’s debt rating denominated in foreign currency due to increased government spending. This is combined with a lower than expected Industrial PMI reading, which in January stood at 50.90, just above to crucial 50 points limit. The event we were waiting for though, was the MPC’s decision regarding interest rates. Many expected, the MPC in its new squad will cut interest rates to its new historic lows. The depreciating Zloty though caused the central bank to keep the cost of money unchanged at 1.5%. Another cut would have driven the Zloty to new yearly lows. It also has to be noted that another 10y treasury bond auction was successful as the government got 7.5 bln (around 1.7 bln EUR) in financing. The worrisome signal: financing costs (yield) has increased to over 3.15%. Nevertheless, the local currency remained under the effect of global worsening sentiment.

The EUR/PLN continued to decline at the beginning of the week and it reached its weekly lows of just above 4.37 (almost 50% retracement of the last upward move). The market turned around and it is currently trading close to 4.41, the level at which it began the week. The stochastic oscillator is not providing a clear signal but it seems the market has lost impetus. Much depends on how foreign investors perceive the local market. Political risk is still on the table and it is not going to go away soon. Sure, the GDP outlook (published by the European Commission) is really positive, but much depends on global factors. At this moment, is the EUR/PLN goes south, the closest supports are at 4.40, then at 4.37 and finally at 4.34. The first resistance to be tested is at 4.45.

_20160205170707.png)

Hungarian Forint (EUR/HUF) – Strong Forint bulls

According to the Hungary’s Central Statistical Office (KSH), the country’s external trade surplus decreased by €22 million in November (yearly basis), to 687 mln EUR, with the export volume growing by 8.4% and the import volume increasing by 11.2%. Exports increased by 6.9% and imports by 7.9% in Euro terms. Despite that, the Forint was trading at 310.46 to the euro at 5:30 pm on Thursday’s interbank forex market up from 311.35 late on Wednesday. Following a sharp appreciation, the EUR/HUF has corrected its versus the euro and is now being quoted close to the 310 level, which is 0.26% lower than on Wednesday. The National Bank of Hungary is still not fretting about the Forint's course. "There is no exchange rate target," Deputy Governor László Windisch told Reuters on Thursday. The NBH has said it would maintain the current record low interest rate of 1.35% for the entire two-year policy horizon and employ non-conventional tools if loosening was necessary.

Today, the EUR/HUF seems to have found some kind of support and a major rejection at 309.39, which also happened to be the weekly 100 EMA. Even if we were to test the 310 area over the next week or two, I would still be cautious of a further downtrend unless the Euro starts to rally upwards.

_20160205170740.png)

Romanian Leu (EUR/RON) – Rates stay at 1.75%

The National Bank decided to keep rates at 1.75% and maintain the minimum reserve requirements, on Friday. The NBR Governor said that even though there may be risks stemming from the elections this year, but does not believe they will materialize. The Romanian central bank is among the first in the region to be able to look towards a tightening cycle, but that may be at least one year ahead. For the first 5 months of the year we may see deeper negative inflation, but its effects while dissipate gradually afterwards. Macro data has been positive, with a 0.6% m/m jump in retail in December and a 13% y/y gain, while the new cuts and wage raises in the public sector may keep the momentum going, as unemployment was stable at 6.7% and vehicle registrations grew by 15% for all of 2015. It may be one of the reasons behind RON’s advance, which ignores the general downtrend of interbank rates and Treasury yields. Apparently, the country appears to be more stable relative to some others in the region, and the bets for a large depreciation had to be taken off. We may see further short-term Leu strength, but can hardly see ways to avoid pressures of opposite sign further towards the spring.

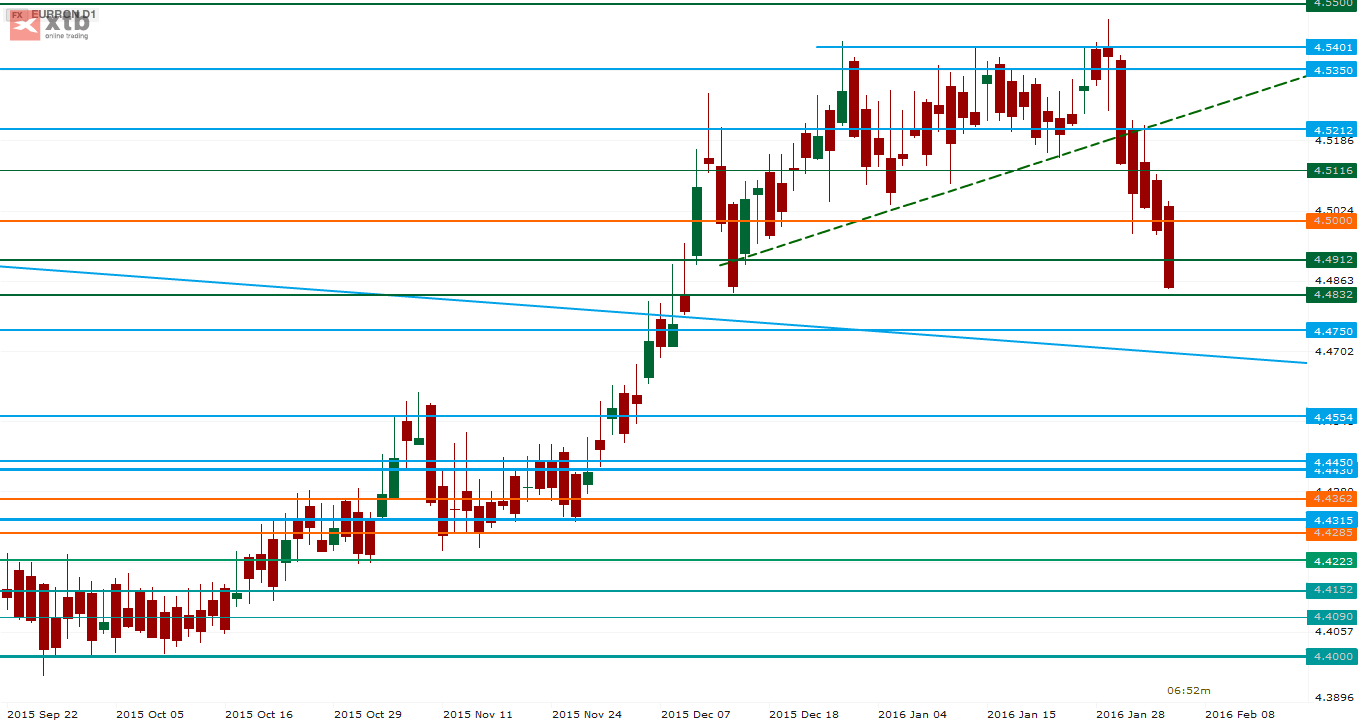

Technical outlook is for once very clear: the consolidation in an ascending triangle pattern turned to a reversal setup. We view the market on a momentous move lower that implicitly suggests a great deal of surprise. The support is to be found at 4.4750 and further towards a previous uptrend around 4.4680, which we would see holding. A first resistance is at 4.5000 and then 4.5116 and 4.5212 followed by the recently broken trendline at 4.5300. It may take some time for the market to weather the bearish sentiment, and next week may not be enough time for that, but in a larger scheme this seems to be only a pause.

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.