Polish Zloty (EUR/PLN) – Zloty appreciation? Forget about it for now

What a week we had. Sorry, not week, but one day. It was all going smoothly till Thursday when the Swiss National Bank decided to “entertain” us. Despite the promises of keeping the 1.2 EUR/CHF rate stable, it decided to let it go! At the same time the deposit rate was cut to -0.75 but come on, how could the market react? So, Thursday was the most volatile day on currencies’ markets in years. It all has been said yesterday about the CHF but how the Zloty market has behaved? It was stable from the beginning of the week. The MPC kept interest rates unchanged at 2% although many market participants expect a cut in March at the latest. Why? Again we had confirmation from macro publications. The CPI inflation declined by 1% in December (yearly basis), which was more than expectations. So we have deflation and the MPC is doing little to fight. Nevertheless, the reaction on the PLN market was mediocre. The market went ballistic on Thursday. After the Swiss decision, the Zloty started depreciating. The EUR/PLN quickly jumped from the 4.25 area reaching even a daily high of 4.36. Afterwards, the market calmed down and currently the market trades around the 4.32 area. The drama went on the CHF/PLN market. Over 550 thousand families have mortgages denominated in Swiss Francs and those were watching the charts in shock. The CHF/PLN, which has been trading in the 3.50 area, dramatically spiked, reaching a theoretical value of 5 PLN at some point! Trading was suspended as no financial institutions were able to quote the CHF. When trading resumed, the CHF/PLN quote stood up at 4.20 and till the end of the week it has increased to 4.24. This means mortgage rates will increase and so can the rate of defaults.

As for technical analysis, it seemed the EUR/PLN will be testing 4.25 at the 61.8% Fibo retracement level of the last upward move. It did not get the chance as the Swiss boys came into play. The market climbed quickly breaking all resistance levels that stood on its way. After reaching the weekly high of 4.36, the market retreated to trade just below 4.32. In the current, volatile situation, it is hard to expect the Zloty will regain ground. I do not see a chance the EUR/PLN could test 4.25 and break it. For next week I rather predict trading above the 4.30 level, unless the ECB’s monetary policy decision (more easing?) changes everything.Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – flying high

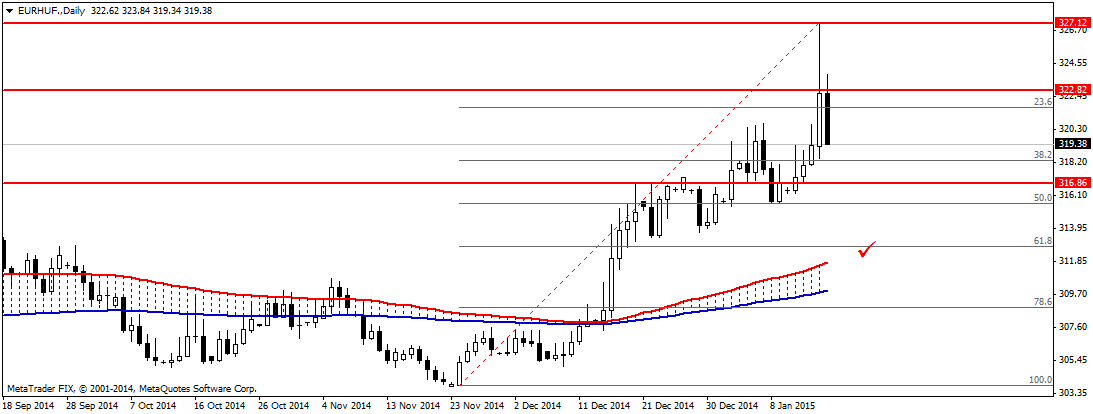

Not only the SNB was in the spotlight on the Hungarian market. It seems Hungary’s construction sector had a good run over the last two years. Unfortunately, construction output in November 2014 was 1.1% (lower than in the preceding month), the Central Statistical Office (KSH) has reported on Friday. On the other hand, since the June collapse, macro data indicators have been improving. This factor kept the EUR/HUF back from the historicalal highs this week when the SNB came and put it higher. The Hungarian Forint eased sharply versus the CHF but against the Euro it remained stable and in the end it even slumpped back to 320. We are expecting that the Forint will regain some ground against the Euro in the next couple of weeks weeks.

From the technical perspective, we also see an open freeway for Forint bulls. We are moving far from the 100 and 200 DMA’s and the EUR seems overbought. If the 322 resistance is not broken, we should the the EUR/HUF heading towards 317.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Lei (EUR/RON) – RON reasonably stable against EUR, not so much vs. USD

The Leu has been reacting very calmly too the general turmoil in the markets. It has slowly given ground, reaching above 4.50 units/Euro for the second time this year. This happened against a background of decent macro data, including a 1.8% jump in GDP. Industrial production however dropped by 6.2% m/m in November, mostly as the manufacturing and mining sectors stepped back by at least 7.2% each. The National Bank is, despite some reassuring comments, relatively satisfied with the outcome of a gradually depreciating currency, and we see this trend continuing. The more dramatic moves happen however on USD/RON, where we reached new record highs this week (above 3,90), and may be on track to breach the 4 level.

We have aimed towards 4.52 even this week, and next week may see another try and even a successful breaout above this level. While the trend channel is ongoing, the 4.5350 resistance is far from safe. We view the risks as seriously biased to the upside. Support is at 4.5000 and then around 4.4850.

_20150116160322.png)

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.

_20150116160206.png)