It was an interesting week. The Fed with its dovish statement along with the Scottish referendum moved the markets. The “no” given for Scottish independence, saved the Pound. That was the main event of the week but it does not mean that emerging markets focused only on external data. In Poland, the expected but disturbing news was that in August the country experienced deflation (second month in a row). The yearly CPI dropped by 0.3%. According to many, deflation will not increase but can remain for some months. This statement was proved by the PPI decreasing 1.5%. Core CPI though, increased by 0.5% (yearly basis) saving the day. On the other hand, wages increased by only 3.5% (worse than expectations), which for me confirms the MPC should react instantly and cut interest rate so it is not too late (many already complain about the MPC for not acting at all). The industrial sector is not doing much better with industrial production declining by 1.9% in August. Macro data does not sound optimistic to me. To no surprise, the zloty reacted to the negative data by decreasing to the 4.20 level during the week. From a reporting perspective, let me note that the new Prime Minister, Ewa Kopacz, presented the new ministers this Friday. Obviously, markets ignored this event.

The situation on the Zloty market stabilized during the last couple of weeks. The EUR/PLN has been trading in a 4.17 – 4.22 range not being able to break any of these levels. It seemed that a head and shoulders price formation was being formed, but the market was not able to break the neck. From one side, the EUR/PLN seems to be losing power – peaks are at lower levels. On the other hand, the support remains strong not letting for further declines. For short-term traders, the closest resistance is at 4.20 and breaking this level should trigger a move towards 4.22. The support is at 4.18 and if broken, the market will target 4.17. For larger movements, the EUR/PLN needs to break out from the range it has been trading since the beginning of August.

_20140919152322.png)

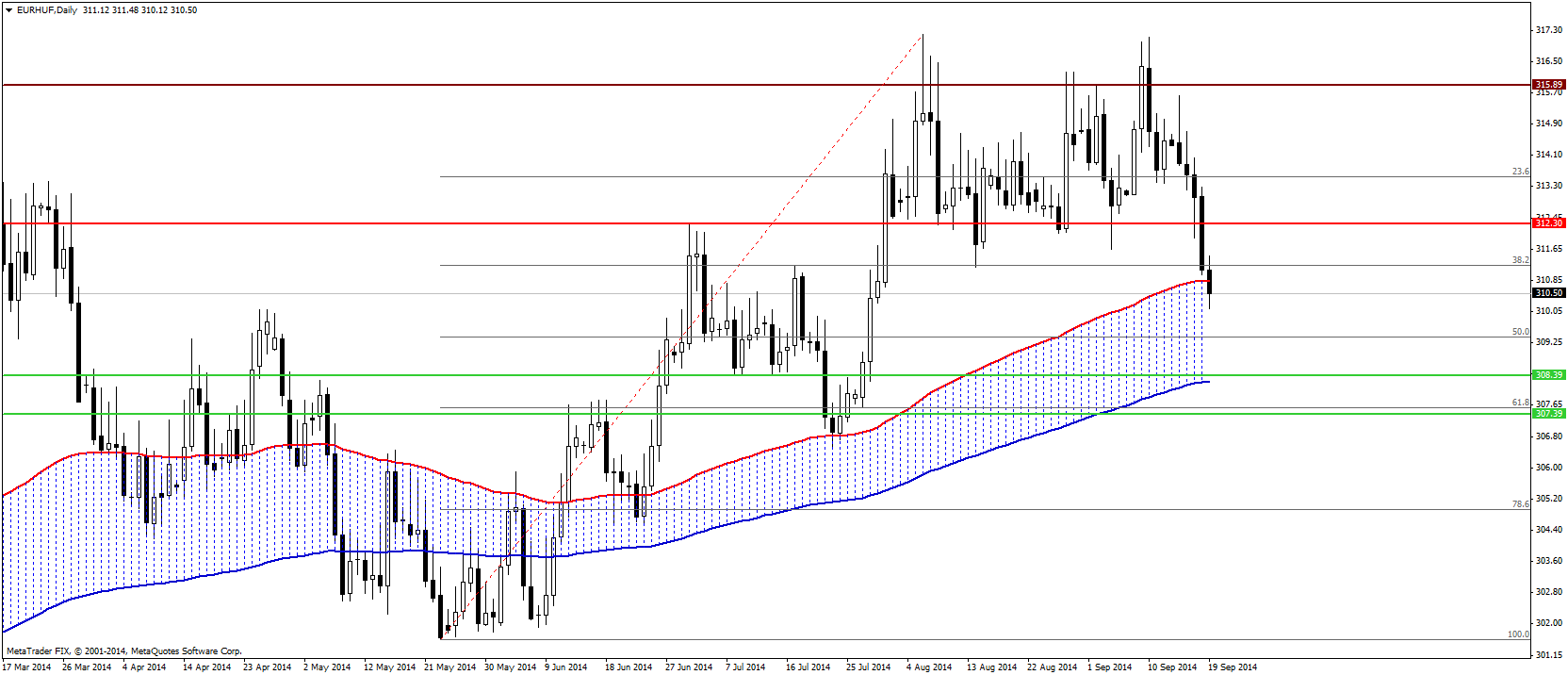

Hungarian Forint (EUR/HUF) – Escape from historical highs

The interest rate decision is coming up next week and the National Bank of Hungary (probably) will leave its key policy rate unchanged. ECB's quantitative easing measures helped emerging markets, especially the Hungarian Forint profited. From internal macro data news, real wages rose 2.9% on a yearly basis in July. The number of people employed in public works has been raising, but the public sector employees even more - people even without fostered workers. The number of employed in public works reached almost 180,000 in July, which is 31,000 more than a year earlier. We are really interested in credit rating agencies’ opinions after better than expected readings of the GDP and the trade balance – there is hope agencies will upgrade Hungary's sovereign rating in the future. Basically, Standard & Poor's keeps the worst sovereign rating. A change to 'BB' could positively impact the Forint. The Central Statistical Office (KSH) will publish the unemployment rate next Friday. Forecasts are optimistic and the market expects the unemployment rate will drop below 8%.

From the technical perspective, the EUR/HUF could touch the 308-307 levels next week at the 61.8% Fibo retracement level. If broken, the next target should be 304. The 312.30 level could be the first front line and resistance in the future. The next resistance could be at 315. Today, the EUR/HUF fell under the 100 daily SMA, which could also keep the Forint in an appreciating move.

Romanian Leu (EUR/RON) – Drifting lower like sand from an hourglass

Without major risks materializing, the market shows signs of relief; after all the RON is in the higher yield, higher risk currencies league. The Fed was seen as less hawkish than some fears – at least the capital markets did not get spooked – and Scottish referendum was concluded with a result pro-status quo. Less data on the macro front did not prevent the RON from gaining and briefly reaching less than 4,4 units/Euro. With local political waters a little more calm, things may last for a while. We view however the National Bank as leaning towards more cuts by the end of the year, which could hurt the Leu over the medium term.

From a technical analysis perspective, the lower bound of the symmetrical triangle is now threatened. Does this mean all is lost for the bulls? Not yet. The chances of a lower breakout are however significantly higher, and let us simply imagine that half of the target takes us below the local low at 4.3820 and can be projected at 4.3523, whereas the full target stands at 4.3150. Resistance around the upper bound at 4.4250 is followed by 4.4525 and the reciprocal of 4.3523 set at 4.4693.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.