After a couple of weeks of increased volatility, these last couple of days were rather calm on the emerging markets’ currencies. The Zloty market remained stable as the movements on the EUR/USD eased down. From the local economy we had two important macroeconomic publications: retail sales in September (yearly basis) increase by 1.6% while the unemployment rate declined (from 11.7%) to 11.5%. The readings were not far from expectations and the market could not react to those. What is worth mentioning, the minutes from the last MPC minutes indicated that the majority of members expect another interest rate cut on the November meeting. That actually meets analysts expectations and the PLN market should be discounting this move. It would fit in the general view of Marek Belka, MPC’s governor, that the central bank will act if the economic situation does not improve. I do not expect it will so maybe the government should consider easing not only monetary but also fiscal policy? I guess I am asking for too much. The direction of the PLN next week will be determined by the movements of the USD and global stock markets as we are not expecting any important macro publications from the local economy. So far today the PLN has been regaining some ground after Belka’s statement that the Zloty is currently undervalued.

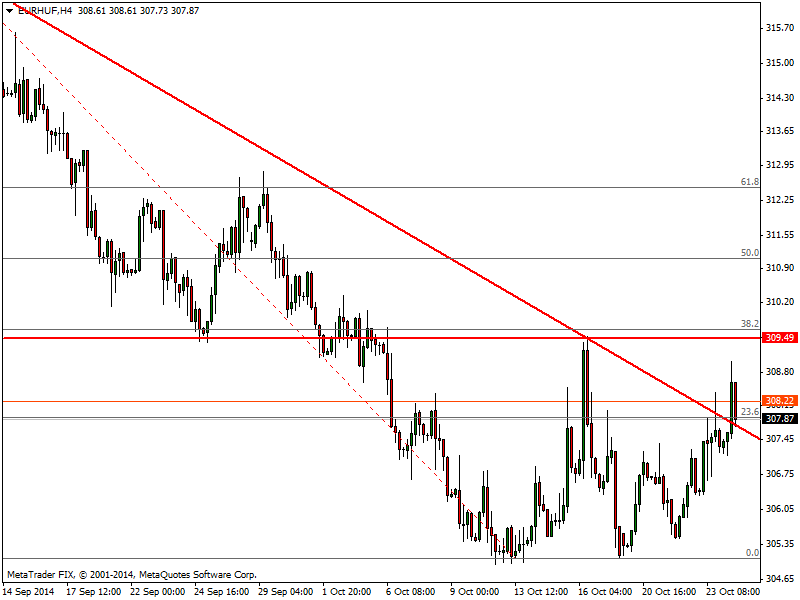

Looking at the EUR/PLN daily chart we see the market was really static this past week. The Zloty moved in a narrow 4.21 – 4.23 range with rather low volume. What can happen next? The resistance of 4.23 has sustained the attacks for a second week in a row so it seems the market could be losing some power. If broken though, it can trigger a quick upward move towards 4.26. On the other hand, if PLN buyers take over, the corrective movement should take the EUR/PLN back to 4.20 and eventually even lower towards 4.17.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – weak interest in the Forint market

Hungary’s Government Debt Management Agency (ÁKK) has witnessed such small demand for its 12-month discount Treasury-bills at its biweekly auction on Thursday that it decided not to allot any of the bills. The only time it had to scrap an auction for lack of demand was at the end of October 2011 after the announcement of the early FX mortgage repayment scheme. Furthermore, the ruling party, Fidesz, said it would propose amendments to be made to a bill on the introduction of a new Internet tax service that providers should pay in proportion to data traffic. After all this cloudy news, the Forint started this week in negative territory against the Euro as we expected last week. What is more important, the NBH interest rate decision is coming up next week so the Euro bulls could bring up the EUR/HUF exchange rate again.

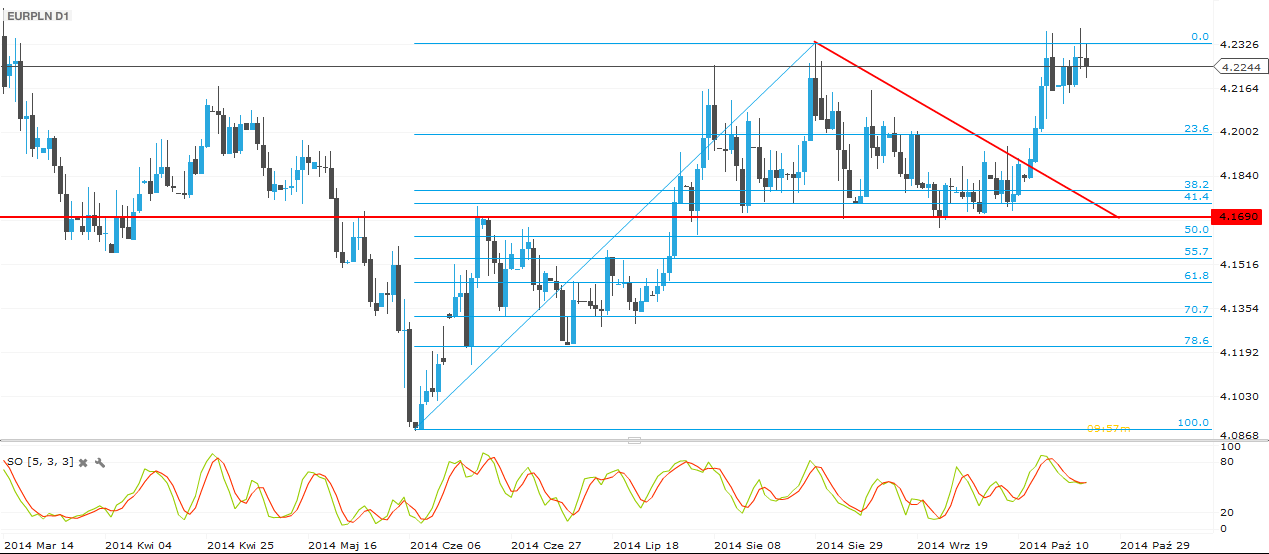

Technically, there is space for the EUR/HUF to trade higher than currently. Only the 309.50 resistance could save the Forint from a larger depreciation. We are expecting a little pull back at the 61.8% Fibo retracement level but a lot depends on the Monetary Policy Council. If the Hungarian Central Bank cuts rates again, the 312 level could be the target for next week.Pic.2 EUR/HUF H4 source: Metatrader

Romanian Leu (EUR/RON) – Realignment silently favored by the NBR

The RON has been (painfully) slowly moving lower versus the Euro, readjusting as the investors felt more uneasy about the shifts in the political scene before and mostly after the presidential elections (on 2nd of November) and some worries over the medium term growth. As the Eurozone, the main commercial partner is feeling the pinch, Romania needs a boost of the currency advantage in order to remain competitive, at least that is what the markets seems to have understood from the NBR’s guidance. There is also the lingering risk of the winter gas crunch” approaching. In case the flow from Russia decreases, the country is forced to be less generous with gas from the internal production towards the local industry. This issue is however less stringent than in most othe CEE countries, as Romania has its own large production.The Leu may be again on the defensive next week, especially if the previous 4.42 ceiling becomes the new floor, with EURRON advancing in small steps.

The technical view provides another uptrend interpretation of the ”original” breakout out of the triangle. We view the market reluctantly moving higher, with an important test at the 4.4315 local high, that once broken may lead up to a push further towards 4.44 and then 4.4525. While this is our baseline scenario, a breach of the uptrend line would change the picture to a sideways move (again), with the novelty of having the new defining lines around 4.40 and 4.43.

Pic.3 EUR/RON D1 source: Metatrader

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.