It was an interesting week. The Fed with its dovish statement along with the Scottish referendum moved the markets. The “no” given for Scottish independence, saved the Pound. That was the main event of the week but it does not mean that emerging markets focused only on external data. In Poland, the expected but disturbing news was that in August the country experienced deflation (second month in a row). The yearly CPI dropped by 0.3%. According to many, deflation will not increase but can remain for some months. This statement was proved by the PPI decreasing 1.5%. Core CPI though, increased by 0.5% (yearly basis) saving the day. On the other hand, wages increased by only 3.5% (worse than expectations), which for me confirms the MPC should react instantly and cut interest rate so it is not too late (many already complain about the MPC for not acting at all). The industrial sector is not doing much better with industrial production declining by 1.9% in August. Macro data does not sound optimistic to me. To no surprise, the zloty reacted to the negative data by decreasing to the 4.20 level during the week. From a reporting perspective, let me note that the new Prime Minister, Ewa Kopacz, presented the new ministers this Friday. Obviously, markets ignored this event.

The situation on the Zloty market stabilized during the last couple of weeks. The EUR/PLN has been trading in a 4.17 – 4.22 range not being able to break any of these levels. It seemed that a head and shoulders price formation was being formed, but the market was not able to break the neck. From one side, the EUR/PLN seems to be losing power – peaks are at lower levels. On the other hand, the support remains strong not letting for further declines. For short-term traders, the closest resistance is at 4.20 and breaking this level should trigger a move towards 4.22. The support is at 4.18 and if broken, the market will target 4.17. For larger movements, the EUR/PLN needs to break out from the range it has been trading since the beginning of August.

_20140919152322.png)

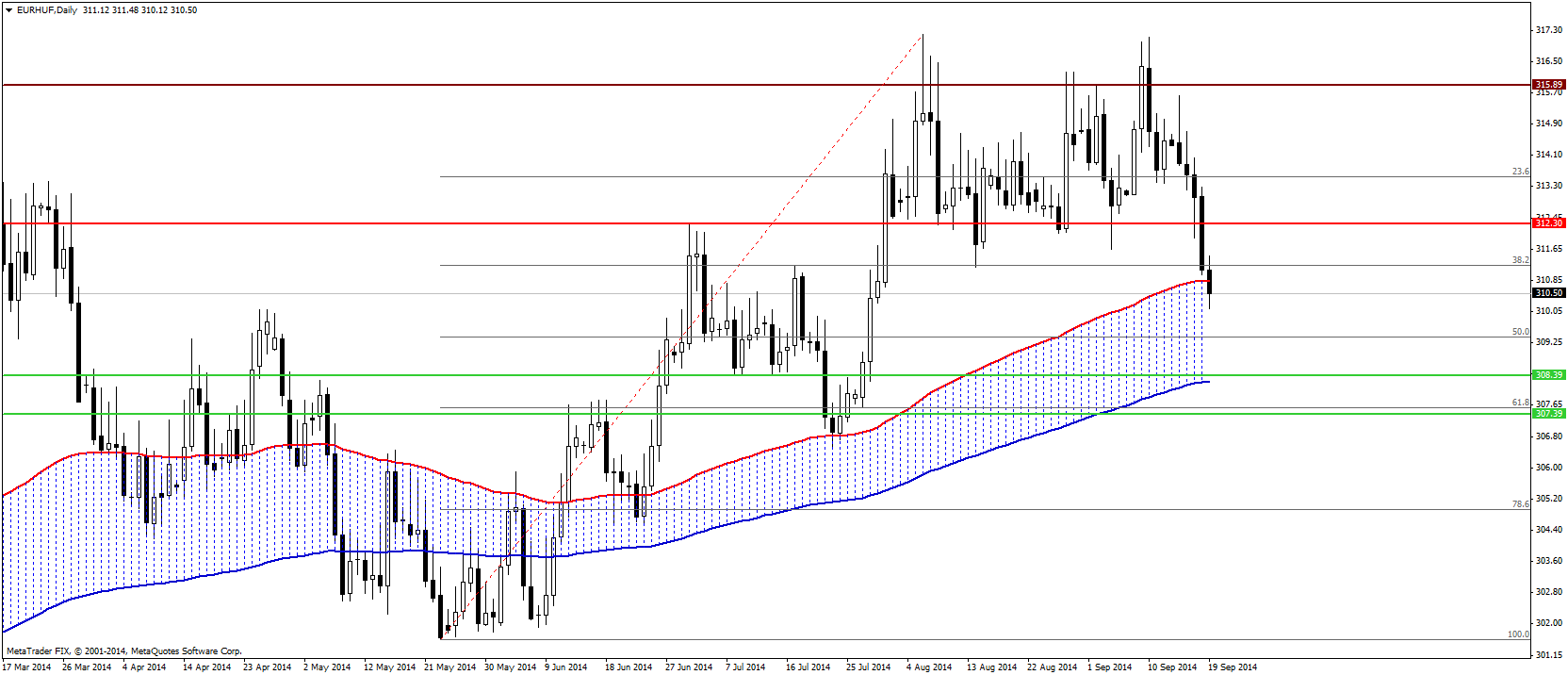

Hungarian Forint (EUR/HUF) – Escape from historical highs

The interest rate decision is coming up next week and the National Bank of Hungary (probably) will leave its key policy rate unchanged. ECB's quantitative easing measures helped emerging markets, especially the Hungarian Forint profited. From internal macro data news, real wages rose 2.9% on a yearly basis in July. The number of people employed in public works has been raising, but the public sector employees even more - people even without fostered workers. The number of employed in public works reached almost 180,000 in July, which is 31,000 more than a year earlier. We are really interested in credit rating agencies’ opinions after better than expected readings of the GDP and the trade balance – there is hope agencies will upgrade Hungary's sovereign rating in the future. Basically, Standard & Poor's keeps the worst sovereign rating. A change to 'BB' could positively impact the Forint. The Central Statistical Office (KSH) will publish the unemployment rate next Friday. Forecasts are optimistic and the market expects the unemployment rate will drop below 8%.

From the technical perspective, the EUR/HUF could touch the 308-307 levels next week at the 61.8% Fibo retracement level. If broken, the next target should be 304. The 312.30 level could be the first front line and resistance in the future. The next resistance could be at 315. Today, the EUR/HUF fell under the 100 daily SMA, which could also keep the Forint in an appreciating move.

Romanian Leu (EUR/RON) – Drifting lower like sand from an hourglass

Without major risks materializing, the market shows signs of relief; after all the RON is in the higher yield, higher risk currencies league. The Fed was seen as less hawkish than some fears – at least the capital markets did not get spooked – and Scottish referendum was concluded with a result pro-status quo. Less data on the macro front did not prevent the RON from gaining and briefly reaching less than 4,4 units/Euro. With local political waters a little more calm, things may last for a while. We view however the National Bank as leaning towards more cuts by the end of the year, which could hurt the Leu over the medium term.

From a technical analysis perspective, the lower bound of the symmetrical triangle is now threatened. Does this mean all is lost for the bulls? Not yet. The chances of a lower breakout are however significantly higher, and let us simply imagine that half of the target takes us below the local low at 4.3820 and can be projected at 4.3523, whereas the full target stands at 4.3150. Resistance around the upper bound at 4.4250 is followed by 4.4525 and the reciprocal of 4.3523 set at 4.4693.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.