In a speech earlier today, Bank of Japan (BOJ) Governor Haruhiko Kuroda said that he and his gang aren’t contemplating on deepening their recently-implemented negative interest rate policy. Apparently, they’re confident that the quantitative and qualitative easing, as well as the negative interest rates, would be enough to bring inflation to the BOJ’s 2.0% targets.

Are they right to be confident over the economy’s performance? Let’s take a quick look at Japan’s major economic factors and see for ourselves!

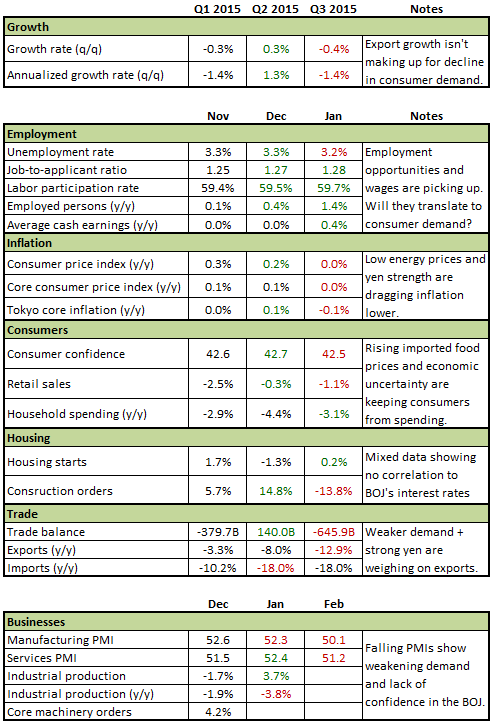

Growth

Q4 2015 growth contracted by 0.4%, worse than Q3 2015’s 0.3% growth.

Annualized figure also missed estimates at -1.4% after rising by 1.3% in Q3 2015.

Private consumption (60% of GDP) fell by 0.8% and shaved off 0.5% from the GDP. Ditto for consumer demand, which fell by 0.5% and shaved off 0.5% from the GDP.

Preliminary estimates are showing a 1.4% contraction for Q4 2015 thanks to a slump in consumer spending and exports.

Growth in exports simply isn’t making up for decline in consumer demand.

Employment

Unemployment rate fell from 3.3% to 3.2% in January, the lowest in three months.

Job-to-applicant ratio improved from 1.27 to 1.28, the highest in 24 years. That’s 128 positions available for every 100 job seekers, yo!

Solid offers in the hotel, restaurant, and medical and welfare sectors keep job demand afloat.

Real wages are rising as employment and earnings pick up while inflation remains subdued.

Inflation

CPI and core CPI remained flat in January after growing by 0.2% and 0.1% in December respectively.

Tokyo’s core inflation, considered a leading indicator, marked a second consecutive decline of 0.1% in February.

Food costs grew at a slower pace while energy and transportation costs dragged. On the flipside, recreation and clothing prices provided small boosts.

The BOJ wants corporate profits to grow to drive up wages and prices but low energy prices and a strong yen are dragging on consumer prices.

CPI and core CPI remained flat in January after growing by 0.2% and 0.1% in December respectively.

The BOJ currently expects inflation to reach 2.0% in H1 2017.

Businesses

Manufacturing PMI fell to the lowest since June 201, as output grew at its weakest pace in 10 months and international demand on new orders declined.

Services PMI fell to its lowest since August 2015, as business activity and new orders slowed down.

Business confidence has been steady at 12 in Q4 and Q3 2015 after falling from 15 in Q2 2015.

Core machinery orders in December boosted by expected demand for Q1 2016.

In 2014 the service industry accounted for 65% of Japan’s GDP while the manufacturing sector contributed 21%.

Start-of-year optimism and front-loading of inventories are starting to fizzle out in February.

Falling PMIs and production show weakening demand and lack of confidence in the BOJ.

Consumers

Retail sales dropped by another 1.1% in January, its third consecutive monthly decline.

Consumer spending dropped by 3.1% in January from a year earlier, and marked a FIFTH consecutive monthly decline.

Household spending in January was dragged by unusually warm weather, which lowered charges for heating, electricity, and water and spending for winter clothing.

Yen’s current weakness is boosting imported food prices and keeping consumers cautious about spending.

Trade and Housing

Japan’s trade went back to a deficit in January after a sharp drop in exports caught up to the declines in imports.

Exports declined for a fourth month in a row, thanks to declines in shipments to trading partners like China, U.S., and South Korea.

Imports fell to a nine-month low, its 13th consecutive decline.

Weaker demand from major economies like China and a strong yen are weighing on Japan’s export industry.

Upside surprise in housing starts contrasted with the abrupt decline in construction orders in January.

Want a real snapshot of all those points above? Here’s a neat chart for ya!

What’s next for Japan?

After looking at the factors above, we can certainly understand why the BOJ would want to step up its efforts in stimulating activity in the economy.

Though employment prospects continue to improve (especially in the services industry), the job opportunities just aren’t translating to economic activity.

The BOJ’s biggest problem right now is fighting a self-fulfilling deflationary mindset where consumers and businesses expect inflation to remain subdued, which prevents businesses from investing and raising wages and consumers from spending their moolah. The yen’s recent strength isn’t helping either, as it’s raising the cost of imported foods and making Japan’s exports more expensive in the global markets.

Do you think the BOJ’s current plans of continuing to buy assets and implementing negative interest rates are enough spur businesses and consumers into spending? The BOJ seems to think so, judging by Kuroda’s recent speech of their current plans being enough to send inflation back to 2.0%. Unfortunately, many market players aren’t convinced and, until we see improvements over the next couple of months, it looks like the BOJ is still on an uphill battle.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.