Greetings, forex friends! If you’re wondering whether or not oil prices are still weighing-in on the major economies, then look no further since I’ve got a one-stop shop inflation roundup. Does that make sense?

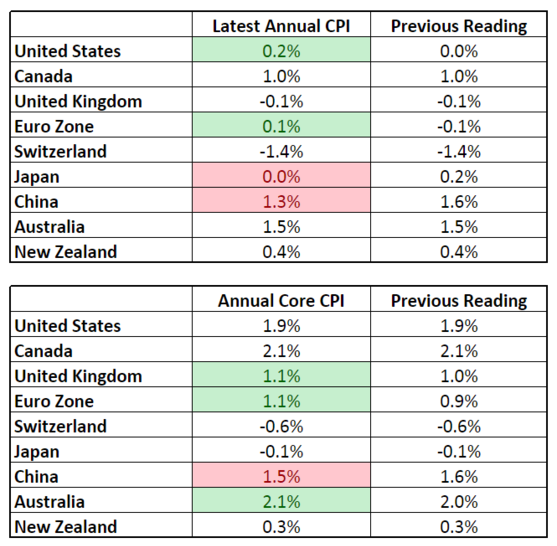

Hmm. The headline readings are mixed since some economies saw increases while other saw declines. The majority remained steady, however. Let’s take a closer look at each economy, shall we?

The U.S.

U.S. annualized headline CPI for the October period climbed back to 0.2% after flattening out in the previous month. The increase was mostly due to the energy component (-17.1% vs. -18.4% previous) having less of a negative impact when compared to the previous reading, with all energy sub-components recovering a bit. Fuel oil, for example, was only down 32.9% from 34.9% previously. Okay, that’s still pretty horrible, but an improvement is still an improvement, right? As for the the annualized core reading, it increased by 1.9%, which is the same rate of increase as last time. The main driver for the continued increase was the services component (+2.8% vs. +2.7% previous), though the commodities component dug slightly deeper into negative territory (-0.7% vs. -0.5% previous).

Canada

The annualized headline reading for Canada’s CPI for the October period showed an increase of 1.0%, the same rate as in the September period. Of the 8 major components being tracked, 7 were able to advance. The one and only drag was 3.2% decline (-3.5% previous) printed by the transportation component due to a 17.1% drop in the gasoline index. However, some components had lower rates of increase. The “household operations, furnishing, and equipment†component, for instance, only increased by 2.1% in October (2.5% previous). But the solid 4.1% increase in the food component (+3.5% previous) was able to offset these since said component contributes 16.41% to the CPI reading.

The U.K.

Annualized headline inflation declined by 0.1% in October, same as back in September, due to negative contributions from the “food and non-alcoholic beverages†(-0.30% vs. -0.25% previous) and “transport†(-0.39% vs. -0.41% previous) components. The BOE already warned that inflation is “likely to remain close to zero in the near term†in their MPC meeting minutes and November Inflation report, however.

Incidentally, the aforementioned components are not included in the core reading, which is why the core reading is still printing a relatively healthy increase, with the current uptick being mainly due to the “clothing and footwear†component contributing +0.07% to CPI after dragging it down by 0.03% last time. With the exception of recreation and culture (-0.05% vs. -0.11% previous), all other components saw rather subdued increases. And the BOE attributed this to the “substantial appreciation†of the pound since mid-2013 continuing “to depress import price growth and so inflation†in the November Inflation Report.

The Euro Zone

The euro zone’s headline CPI reading was able to recover in October after dipping into the red back in September. The uptick was due to a slower rates of decline in oil-related components. The “fuels for transport†component, for example, only decreased by 13.5% (-14.2% previous) thereby having a negative impact on CPI of only -0.68% (-0.71% previous). Of the major euro zone economies, Germany’s annualized headline CPI was +0.2%, and the same goes for France. Italy did a little better with +0.3% while Spain was down in the dumps with -0.9%.

Switzerland

Switzerland’s headline CPI reading declined by 1.4% for the third consecutive month in October. Most components are still in the red, but the transport component only decreased by 5.0% interestingly enough (-5.1% previous). Oh, to the forex newbies (and the technical analysis purists who somehow made their way here), Switzerland is still reeling from the strong Swissy brought about by the Swiss National Bank’s (SNB) surprise decision to remove the floor on EUR/CHF way back in January of this year. Which is why “foreign exchange interventions†(i.e. market manipulation) has been part of the SNB’s monetary policy.

China

China’s headline CPI increased at a decreasing rate for the second consecutive month in October and the core reading followed suit. The main drag to CPI is still the “transportation and communication†component with its 1.9% drop (-2.1% previous). But the lower rate of increase was actually due mainly to the food component since it only increased by 1.9% in October after increasing by 2.7% back in September.

New Zealand

New Zealand’s headline CPI for Q3 2015 rose by 0.4%, which is the same rate of increase as in Q2 2015. The details of their respective report are very different, however, since the transport component had a positive contribution of 0.24% to CPI while the food component had a negative contribution of -0.02% back in Q2 2015. For Q3, it’s the other way around since the transport component is now the greatest drag, having a negative contribution of 0.22%. Meanwhile, the food component had a positive contribution of 0.12%, which is the second highest contribution after the “housing and household utilities†component’s +0.29%.

Australia

The annualized headline reading for Australia’s CPI increased by 1.5% in Q3 2015, same as Q2 2015. The main drags were the transport (-2.2% vs. -2.4% previous), communication (-4.1% vs. -3.4% previous), and clothing & footwear components (-1.0% vs. -0.9% previous). Interestingly enough, the transport component decreased at a slower rate in Q3 due to slower rate of increase in the “automotive fuel†sub-component (-9.8% vs. -10.6% previous). On the other hand, the “food and non-alcoholic beverages†component saw a sudden drop from +1.3% to only +0.2%.

Japan

Japan’s headline CPI reading finally flattened out in September, and energy-related components are still the major drags, with the “fuel, light and water charges†component down by 7.1% (-5.9% previous) and the “transportation and communication†component down by 2.9% (-2.7% previous). The core reading, meanwhile, is still in the red because the “fresh food†sub-component (+3.6% vs. +7.6% previous) is not included.

For the newbie forex traders out there, do note that the sudden drop after March 2015 was due to an artificial boost from the consumption tax. Just subtract 2.0% from the readings for comparison purposes. Also, note that the October reading for Japan’s CPI will be released this coming Thursday (Nov. 26, 11:30 pm GMT), so note that on your forex calendars.

Summary

Overall, oil prices are still weighing-in on all the major economies, but almost all of them reported that the deflationary pressure from the decline in oil prices have somewhat abated. Looking forward, however, there’s a good chance that oil prices will weigh-in hard once again since oil prices started dropping again, starting on the 4th of November.

Brent Crude Oil Daily Chart

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'