What are these inflation reports all about?

Inflation figures are a huge deal for central bank officials since monetary policy adjustments are made primarily to maintain price stability. Rising consumer price levels, as indicated by the headline and core CPI, could convince the folks over at Threadneedle Street to move closer to hiking interest rates while falling CPI readings could force them to sit on their hands or consider monetary policy easing.The U.K. typically dumps most of its inflation-related reports in one go, giving forex market watchers a better picture of how overall price levels are faring. The PPI or producer price index shows changes in raw materials and input prices, making it a leading indicator of consumer inflation. The RPI (retail price index) and HPI (house price index) also provide clues on inflation trends.

What happened last time?

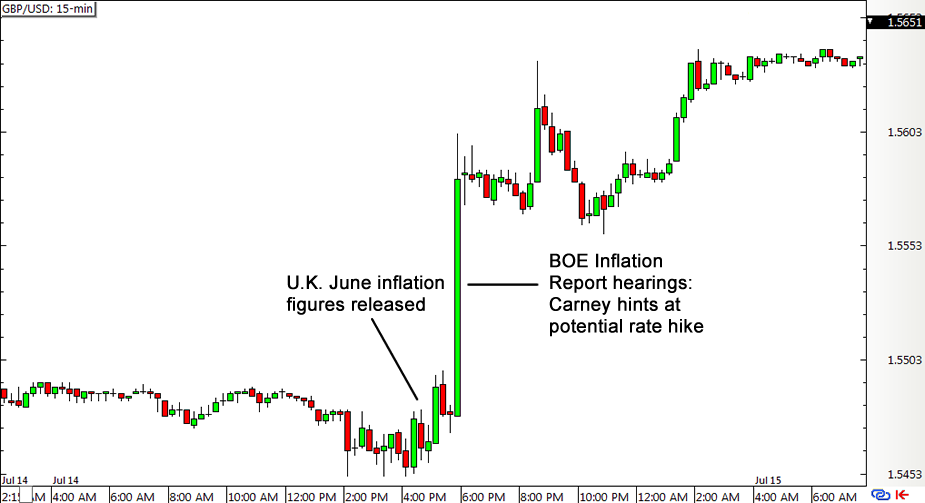

The U.K. June inflation data had a slightly disappointing turnout, as the headline CPI dropped from an annualized 0.1% to show a flat reading while the core CPI fell from 0.9% to 0.8%. Meanwhile, producer prices saw a 1.3% monthly decline, worse than the projected 0.7% decrease.

While the June inflation readings initially generated a bearish reaction from GBP/USD, pound bulls were able to thank their lucky stars when the BOE Inflation Report hearings rolled along and Governor Carney hinted that they’re moving closer to hiking interest rates.

What’s expected this time?

Not much improvements are expected for the July data, as forex analysts predict that headline CPI would show another flat reading that core CPI could stay unchanged at 0.8%. Producer input prices could print another 1.3% drop, probably due to the recent commodity price tumble, while the annualized retail price index could go a notch lower from 1.0% to 0.9%.There are no other U.K. events scheduled right after the inflation figures are printed around 8:30 am GMT tomorrow, which means that pound pairs might have a strong and prolonged reaction to these reports.

How might pound pairs react?

The latest scoop from the BOE revealed that most policymakers aren’t so eager to hike interest rates just yet so another disappointing set of inflation reports could reinforce the view that the U.K. central bank won’t be budging from its stance anytime soon. Weaker than expected results might even lead some market participants to push back their rate hike projections much later, which could spur losses for the pound. On the other hand, strong upside surprises especially for the headline and core CPI could suggest economic resilience, supporting expectations of BOE tightening in early 2016.If you’re planning on trading this economic event, don’t forget to make the necessary adjustments for additional forex volatility. Pound pairs usually consolidate prior to the actual release and might be prone to a few early spikes here and there before moving in a particular direction. If you don’t have a solid game plan for this market catalyst, you might be better off sitting on the sidelines and watching price action unfold instead. Good luck!

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.