What is this report all about?

The U.K. retail sales report, which is released by the Office for National Statistics (ONS), indicates the change in the total value of inflation-adjusted sales at the retail level. Say what?!For the newbies out there, this basically means that the folks over at the ONS add up the purchases of tea cups, scones, Royal Family postcards, Harry Potter studio tour tickets, and all other goods and services sold in the U.K. for the month and compare it to previous periods. In doing so, they’re able to get a pretty good picture of consumer spending, which actually accounts for a hefty chunk of overall economic growth.

What happened last time?

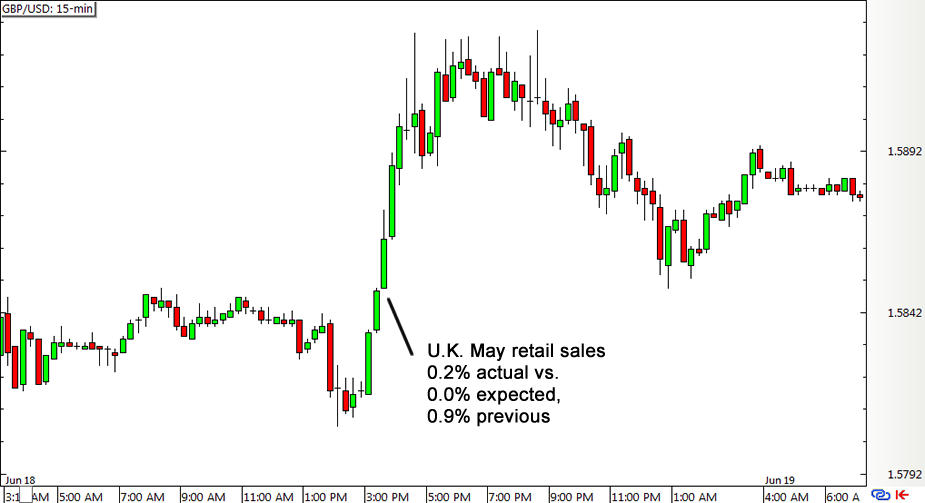

In the previous release, the U.K. printed a stronger-than-expected 0.2% increase in retail sales for May instead of showing the projected flat reading. Prior to this, April retail sales picked up by 0.9%, which reflects a downgrade from the initially reported 1.2% increase.Consumer spending was a tad slower than usual in those months mostly due to a downturn in clothing sales as summertime was approaching. No need to spend on a new trench coat or knee-high boots, I suppose. In contrast, food store sales saw a relatively strong 0.6% gain – its largest increase since December last year.

What’s expected this time?

For the month of June, the U.K. is expected to show a 0.4% increase in retail sales. Several forex analysts might be even bracing themselves for an upside surprise since inflation has remained subdued while wage growth has picked up. The average earnings index has been steadily climbing in the past months and has shown a 3.2% increase for the three-month period ending in May while the headline CPI has indicated a mere 0.1% uptick.Apart from that, the sentiment for the pound has been on the up and up these days, thanks to BOE Governor Carney’s remarks on how they’re moving closer to hiking interest rates. Because of that, expectations are running a bit high this time, which means that there’s also plenty of room for disappointment.

How might GBP/USD react?

Since strong consumer spending readings typically translate to upbeat growth figures, better-than-expected retail sales data tend to spur pound rallies. On the other hand, a disappointing read could suggest that consumers would rather save rather than spend, which might then lead to a pound selloff.

As you can see from GBP/USD’s reaction to the earlier release, the pair zoomed up the charts when the actual reading came in higher than the consensus even though the previous figure suffered a small negative revision.

If you’re looking to trade this pair during the U.K. retail sales release on Thursday, keep in mind that it usually consolidates in a tight range during the Asian trading session. Since some forex traders might be a little too eager to cast their bets for the outcome, GBP/USD might fake out in one direction or another a few minutes before the actual numbers are printed. If you’re gonna use a straddle setup to catch the initial reaction, just make sure to set your orders far enough to avoid getting tripped on a fake out.

The initial reaction to the report lasts by a little over a hundred pips, depending on how much of an upside or downside surprise is seen. In most cases, the reaction is faded right around the start of the U.S. session, especially if there are other catalysts lined up during those hours.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.