Newsflash! The July non-farm payrolls figure fell short of expectations as it showed a mere 209,000 rise in hiring versus the estimated 231,000 gain. Meanwhile the jobless rate ticked up from 6.1% to 6.2% and average hourly earnings stayed flat instead of printing the estimated 0.2% increase.

Judging from the Greenback’s reaction to the report, it appears that market watchers were very disappointed with the U.S. jobs data. The U.S. dollar index slipped from the 82.000 area to a low of 81.654 moments after the release, with USD/JPY dropping by close to 70 pips and EUR/USD popping back above the 1.3400 handle. But was the jobs report really THAT bad?

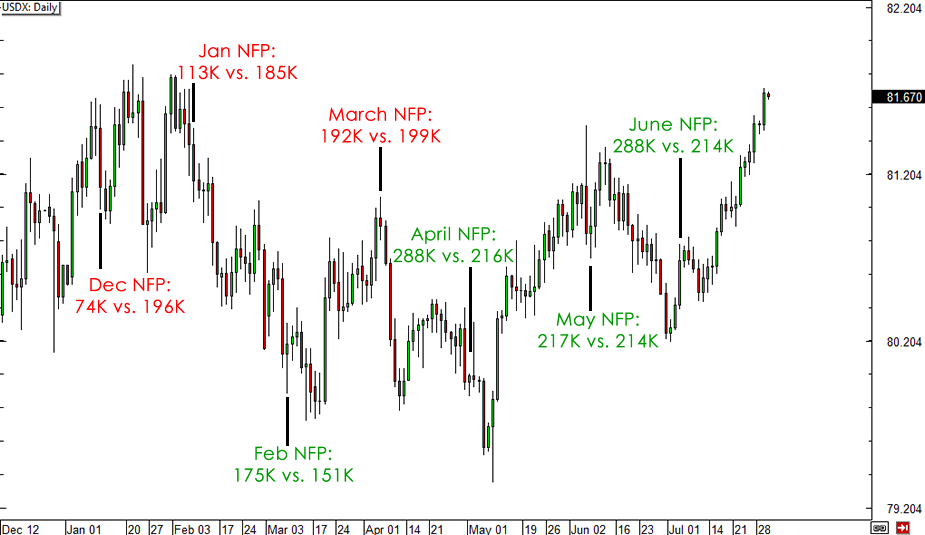

While the headline figures missed expectations, some might argue that a gain is still a gain, as the U.S. economy did add more than 200,000 jobs during the month. Besides, doesn’t Uncle Sam deserve more credit for being able to maintain jobs growth of over 200,000 consistently for the past six months? The last time this happened was in 1997!

Apart from that, the June data was upgraded to show a 298,000 increase in employment from the initially reported 288,000 rise while the May NFP figure was also revised higher from 217,000 to 224,000. A closer look at the components of the report shows that hiring gains were made mostly in the construction industry and in factories.

In addition, the rise in the jobless rate for July was actually spurred by an INCREASE in the participation rate. While the U.S. economy used to be bothered by a falling participation rate, which indicates that Americans are dropping out of the labor force and giving up looking for work, the latest jobs report revealed that people are returning to the jobs market in search for a full-time job.

The lack of wage growth remains a concern though, as this could potentially weigh on consumer spending later on. Personal spending data already came in weaker than expected for the month of June at 0.4% versus the estimated 0.5% increase, even as personal income came in line with expectations at 0.4%. Bear in mind that Fed Chairperson Yellen is also keeping a close eye on wages in evaluating whether the U.S. labor situation is improving or not.

Speaking of Fed policy, the latest NFP release appears to confirm what the FOMC minutes have indicated. While Fed policymakers acknowledged that there were noticeable improvements in the jobs data, there’s still a sufficient amount of slack left to be absorbed and that the upbeat figures are not enough to convince them to switch to a more hawkish stance.

Despite the green shoots in underlying jobs components, market participants also seem to be unimpressed with the data and might not be too keen to buy up the dollar in the near term. A quick review of the chart I showed y’all in my NFP preview article suggests that the Greenback might be in for a few more days of weakness since the headline jobs figure missed the mark:

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.