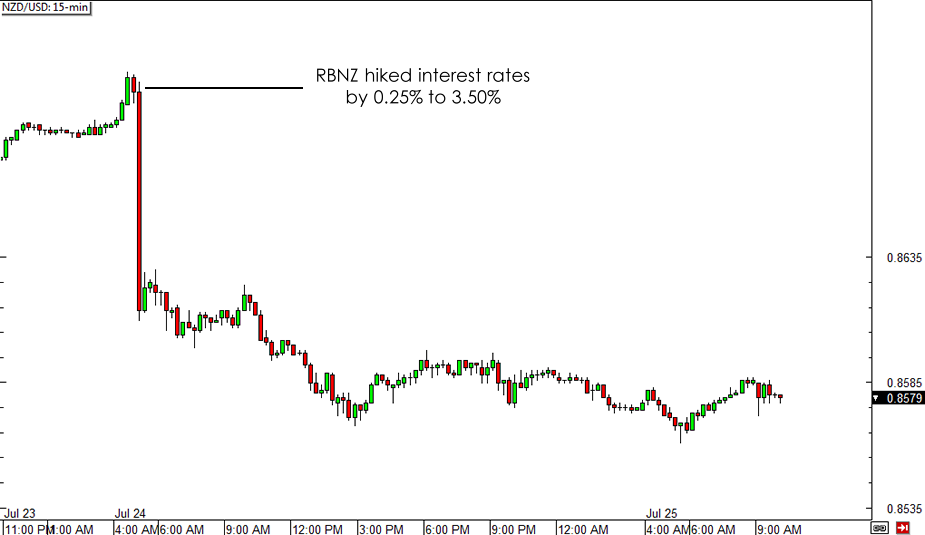

As you can see from the 15-min chart of NZD/USD below, the pair dropped by close to a hundred pips right after the announcement then continued to edge lower for the rest of the trading sessions.

Apparently, RBNZ Governor Graeme Wheeler hinted that this might be their last rate hike for the year, as he mentioned that they would pause from tightening to assess the impact of their latest moves. “It is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level,” he said. “The speed and extent to which the OCR will need to rise will depend on the assessment of the impact of the tightening in monetary policy to date, and the implications of future economic and financial data for inflationary pressures.”

With that, analysts priced in lower odds of seeing another rate hike in the next few months, as some projected that the next increase might not happen until March next year. After all, inflationary pressures have been subdued, particularly among wages and in the dairy sector.

In fact, falling commodity price levels have been such a persistent concern for the RBNZ that they decided it’s time to jawbone their currency again. According to the central bank’s official statement, the trading level of the Kiwi is “unjustified and unsustainable” and there is “potential for a significant fall” as it has to adjust to weakening commodity prices.

This isn’t something new from the RBNZ, as Wheeler has a record of jawboning and has even staged a secret currency intervention last year. At that time, NZD/USD had been trading around the .8700 levels and dropped by roughly 300 pips in a few days.

If the RBNZ is all bark and no bite though, it won’t be long before market participants realize that the New Zealand central bank can’t afford to intervene in the currency market for now. Who knows? Perhaps Wheeler and his men are simply waiting for the Kiwi rallies to retreat before going on another rate hike streak.

For now, the shift in the RBNZ’s stance to a more cautious one could keep any Kiwi gains at bay. It doesn’t help the higher-yielding commodity currency that geopolitical tension has allowed risk aversion to extend its stay in the markets. Sooner or later though, market participants could be drawn back to the positive interest rate differential of buying the Kiwi against lower-yielding currencies and allow the longer-term climb to resume.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.