One of the biggest forex market events lined up for this week is the U.K. jobs release scheduled for 9:30 am GMT tomorrow. If you’re planning on trading this report, make sure you’ve read this trading guide of mine!

What is this report all about?

The jobs report from the U.K.’s Office of National Statistics is composed of two main components:

1. The claimant count change counts the number of people claiming unemployment-related benefits every month (the lower the number, the better).

2. The unemployment rate measures the number of unemployed workers and is measured once every quarter (the lower the rate, the better).

Market players watch the jobs data closely simply because the Bank of England (BOE) uses this data to help guide their monetary policy decisions.

What’s expected for the upcoming release?

Analysts expect the U.K. economy to have added 27.1K jobs in June, a slightly lower pace of increase compared to the previous month’s 27.4K figure. Still, this just might be enough to bring the country’s jobless rate down from 6.6% in May to 6.5% – five notches below the BOE’s target unemployment level of 7% and enough to spark rate hike expectations once more.

Bear in mind though that weaker than expected data could lead to a bit of pound weakness, as market participants might question whether or not the BOE can afford to tighten monetary policy before the end of the year without hurting the labor sector.

How might GBP/USD react?

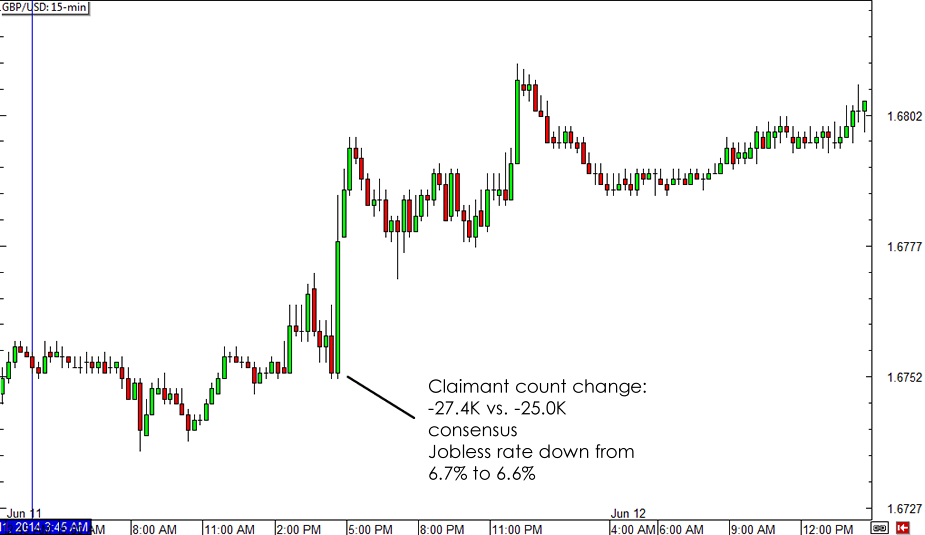

Here’s how the pair reacted to the previous month’s jobs release, when the actual claimant count change and jobless rate came in stronger than expected.

GBP/USD 15-min Forex Chart

Price had been moving mostly sideways during the hours leading up to the release, and it appears that traders were excited to price in their expectations for an upside surprise as GBP/USD started trading higher when European markets opened.

The stronger than expected headline figures boosted GBP/USD by close to 50 pips minutes after the report was released, followed by a few hours of consolidation during the U.S. session. There was still a bit of follow through in the next trading day as Asian session traders came along, but the 1.6800 major psychological level seemed to be a tough barrier to break back then.

If you’re planning on trading the news, then you might need to be quick on your feet and ready to catch the initial price reaction before it fades. Keep in mind that price might start moving as early as the opening bell of the London session and that any straddle orders might get hit due to the increase in volatility.

If volatility ain’t your cup of tea, there ain’t no shame in sitting on the sidelines! Just make sure you’re able to take a look at the actual figures and even the underlying components to guide you in figuring out the longer-term market bias for the pound.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.