Looks like the Fourth of July fireworks started early in the forex market! The U.S. non-farm payrolls report for June contained a few surprises that turned out positive for the Greenback. Here are the main takeaways from the report:

1. Headline data was much stronger than expected.

Analysts were expecting to see a slight slowdown in hiring gains for June but were impressed to see that the U.S. economy actually added 288,000 jobs for the month. To top it off, the previous month’s release was upgraded from the initially reported 217,000 increase in hiring to show a 224,000 rise.

The jobless rate also printed an upside surprise, as it dropped from 6.3% to 6.1%. I guess the Fed was right in predicting that the labor situation could see a lot of improvement this year!

2. Underlying labor components also showed improvement.

Market watchers have been used to taking jobless rate improvements with a grain of salt, as the declines have often been a result of a weakening participation rate or Americans leaving the workforce. A closer look at the components of the latest jobs release reveals that the participation rate actually improved to 66.1%, which means more Americans returned to the labor force to look for full-time work and that the drop in joblessness was pretty legit.

Average hourly earnings showed another 0.2% uptick as expected, which implies that wage growth has been sustained. In fact, wages have picked up by 2% year-over-year, not too far from the U.S. economy’s annual inflation rate. Long-term unemployment, private employment, and the U-6 unemployment – a broader labor indicator which takes those who are underemployed and those not actively looking for employment – all chalked up modest improvements.

3. Rate hike expectations back on the table?

With that, most market participants have started buzzing about a Fed rate hike once more. Although Yellen declined to give a timeline for policy tightening in their latest FOMC rate statement, she did reiterate that policymakers would like to see considerable improvements in a number of data points she's watching. By the looks of it, the U.S. economy has made notable progress in the labor market after the global financial recession.

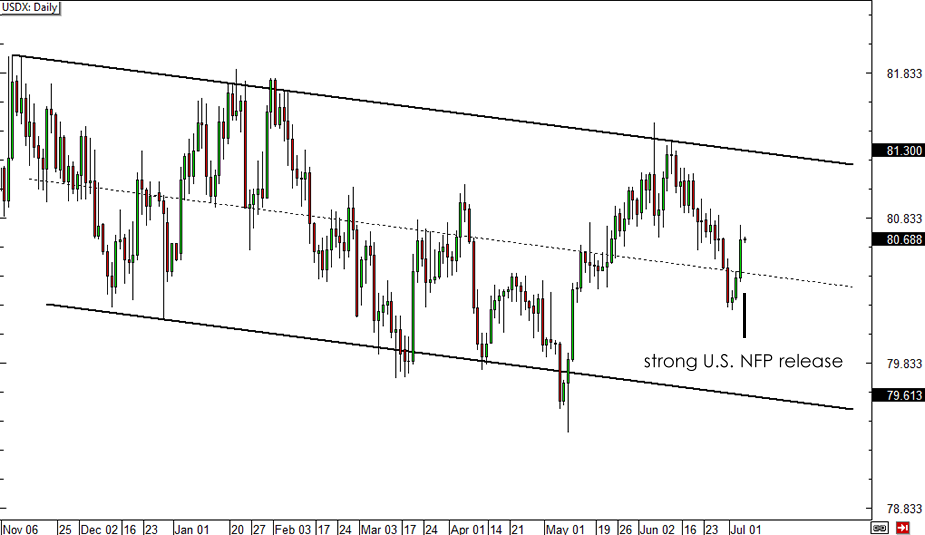

It’s no surprise then that the U.S. dollar jumped after the report was released!

USDX 4-hour Chart

Of course it remains to be seen whether this recovery can carry on or not, and the Fed might be keen to wait for a couple more months of strong jobs data before dropping hints on rate hikes. Do you think the jobs gains can be sustained?

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'