Nearly a month has passed since the ECB decided to cut interest rates, and now Governor Draghi and his men are gearing up to make another monetary policy decision. What should we expect this time?

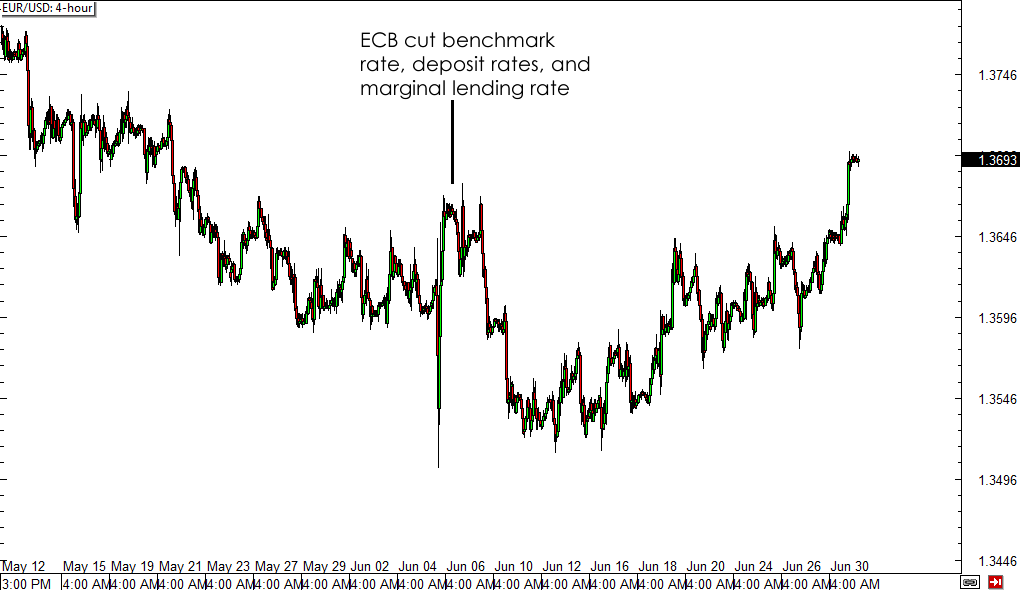

Back in June, ECB policymakers surprised the markets with a set of interest rate cuts instead of just slashing the benchmark rate. Aside from cutting the ECB main interest rate from 0.25% to 0.15%, Draghi also implemented negative deposit rates in order to encourage more lending activity among commercial banks. To top it off, ECB officials also decided to cut the marginal lending rate and introduced new targeted LTRO starting September and December.

At that time, Draghi also emphasized that the ECB is keeping the door open for further easing measures. Other monetary policy adjustments, such as extending the eligibility of collateral assets to prepare for outright purchases of asset-backed securities, confirmed that the central bank is getting ready for potential QE later on. Will they announce these in this month’s policy statement?

A quick look at the recent economic data from the euro zone shows a mixed picture. On one hand, inflation forecasts haven’t been so bad, with the region’s headline CPI flash estimate for June held steady at an annualized 0.5% reading while the core CPI flash estimate for the same month ticked up from 0.7% to 0.8%. On the other hand, PMI readings from Germany and France have been very disappointing while business sentiment, employment, and consumer spending in the region’s largest economy have lagged.

With that, ECB policymakers might decide to sit on their hands for the meantime and wait for the impact of their latest rate cuts to kick in before doling out additional stimulus. Draghi might simply reiterate that rates are likely to remain at record lows for an extended period (Sound familiar?) and that the ECB is still ready to pull the trigger on QE if necessary.

Note that EUR/USD has fallen by roughly 150 pips right after the June ECB statement but has erased those losses throughout the month.

EUR/USD 4-hour Forex Chart

As I mentioned in my review of this event, negative deposit rates have proven to have only a short-term effect on local currencies (ex: USD/DKK and USD/SEK) and that the monetary policy move could eventually translate to stronger lending and currency gains.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.