1. On the docket for this week

Taking a glance at our calendar, we can notice the more important news events for the week. For the coming week starting July 21st 2014, the main events are:

Monday: GER PPI

Tuesday: US CPI + Existing Home Sales

Wednesday: AUD CPI, UK BOE Minutes, CAD Retail Sales, NZD RBNZ Decision + Trade Balance

Thursday: CNY HSBC Manuf. PMI, GER Markit Manuf./Services/Composite PMI, EU Markit Manuf./Services/Composite PMI, UK Retail Sales, US Markit Manuf. PMI + New Home Sales

Friday: GER IFO, UK GDP, US Durable Goods

2. Strong vs. Weak

Looking at the CME FX futures market, we can see that:

- DXY has closed last week with strong bullish intent.

- NZD has closed last week with a fresh bearish bias.

- EUR still remains with the short bias.

We must be extremely selective during the summer doldrums so the only interesting pairs for the coming week, combining strength vs. weakness, are:

- NzdUsd short bias

- EurUsd short bias

- UsdChf long bias

To understand more about strong vs. weak, come over to Orderflowtrading.com and check out our HeatMaps.

3. Sentiment Analysis on relevant assets

Summer doldrums are here so we need to be more and more selective if we want to remain operational (and mentally sane) in the current environment. Going into the week, unless another plane falls over Russia or Ukraine, or some major development breaks loose, he focus will return to earnings and three key debates in the US economy. Then there was this: in her semi-annual report to Congress, Fed Chairman Janet Yellen said that “The FOMC recognizes that low interest rates may provide incentives for some investors to ‘reach for yield,’ and those actions could increase vulnerabilities in the financial system to adverse events.”. “Bubblewatch” is what we can call this stage...and how much longer can Yellen cheer for new all-time highs in the Dow and S&P before the bubble pops? Fed policy is the primary culprit for rising equity prices, but we're getting another quarterly reminder of how earnings remain the dominant driver of valuations. So far, 80 S&P500 firms have posted average earnings growth of 10% and sales growth of 4% with healthy beats on both. 144 firms listed on the S&P500 report next week. Key names include Apple, Microsoft, Texas Instruments, Whirlpool and Ford. Super Thursday brings out 49 firms on that day alone.

USD: sentiment is bullish. In the US, earnings and a few macro debates will take center stage this week. First of all, investors will watch the CPI data, curious to see whether inflation is still north of 2%. Headline inflation is expected by consensus to come in at about 2.1% y/y. The Fed’s preferred measure is the price deflator on total consumer spending because it changes the spending weights on products and sales channels dynamically as opposed to the periodic rebasing of CPI, and that measure has been a little lighter but also on the rise. Then the focus will be on to the (potential) recovery in housing and after that, on business investment.

Euro: sentiment is negative. Eurozone developments will focus on the blame game in Ukraine, and sentiment data. That includes influential surveys such as PMIs for the manufacturing and services sectors plus German IFO business confidence. Not much of a shift is expected in the mildly expansionary Eurozone manufacturing PMI, while Germany’s IFO reading might decline with an escalation of western sanctions against Russia and the tragic downing of a passenger jet feeding concerns that Germany’s important economic relationship with Russia is poised to deteriorate further. It's becomming more evident that the EU must back the US in sanctioning Russia over the lack of influence/control on their separatist group in Ukraine.

Nzd: sentiment is neutral. The Reserve Bank of New Zealand is expected to hike its cash rate by 25bps to 3.5% on Wednesday. This is overall positive for “the bird”. The recent drop is due to the recent Dairy auction and some downbeat data – but there have also been cross-currents from AudNzd buying. When sentiment is neutral we tend to follow momentum and also keep an eye on headline data for further clues.

For updates on sentiment as it progresses throughout the week, stay active in our Live Trading Floor.

4. To sum up: best looking charts & comments

Source: tradingview.com

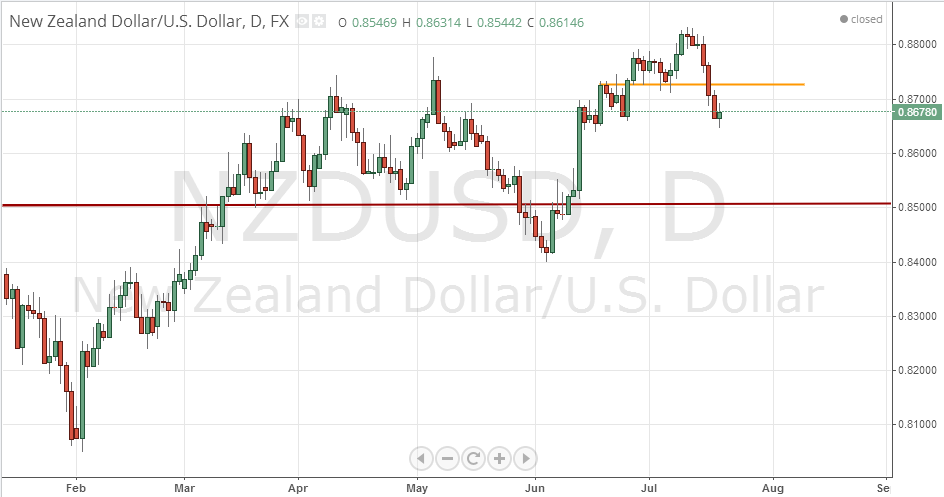

NzdUsd – fresh bearish momentum noted

Source: tradingview.com

EurUsd – shorts have no intention of taking their foot off the pedal for now.

Source: tradingview.com

UsdChf – still bullish momentum in the pipe

It’s a tough challenge to combine sentiment, price action, technical analysis, and fundamental analysis all together to turn these thoughts in to actionable order flow trade ideas. If you still find yourself struggling in that regard, our FREE mindset lessons can help relieve that stress.

As always, good luck out there!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'